QuiCQ 16/04/2025

Next Round?

“Don’t let yesterday take up too much of today.”

— Will Rogers

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Running behind schedule and seeing that this Wednesday morning’s price action is substantially more interesting than what happened yesterday, let’s focus on just that.

An early rally on Wall Street fizzled out during the session, leaving major indices barely in the green by the time the closing bell ran. However, in after-hour trading (futures) stocks continued to decline at an increasingly accelerating pace. Here’s the Nasdaq 100 as a proxy for the rest of the market (white = regular trading hours; blue = after hours trading):

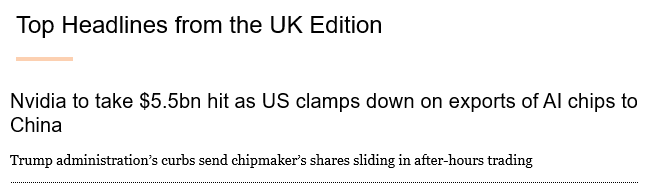

The drop off in the Nasdaq is probably explained via Nvidia’s warning;

And then this morning we got some additional ‘icing on the cake’:

However, neither headline explains the cross-asset volatility pick up we have seen in the past few hours. Or maybe they do, in combination with yet another headline (don’t you think I am becoming a noise-investor now!):

Now add in that an European trade delegation left Washington yesterday with, probably mildly put, ‘no additional clarity’.

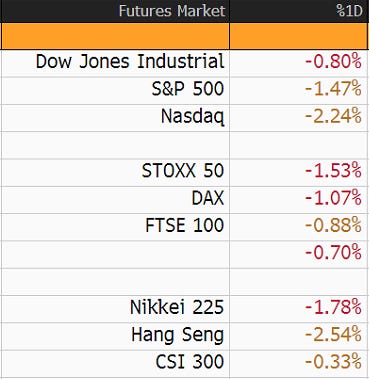

All this probably to investors enough nervous to hit the “risk-off” button again this morning.

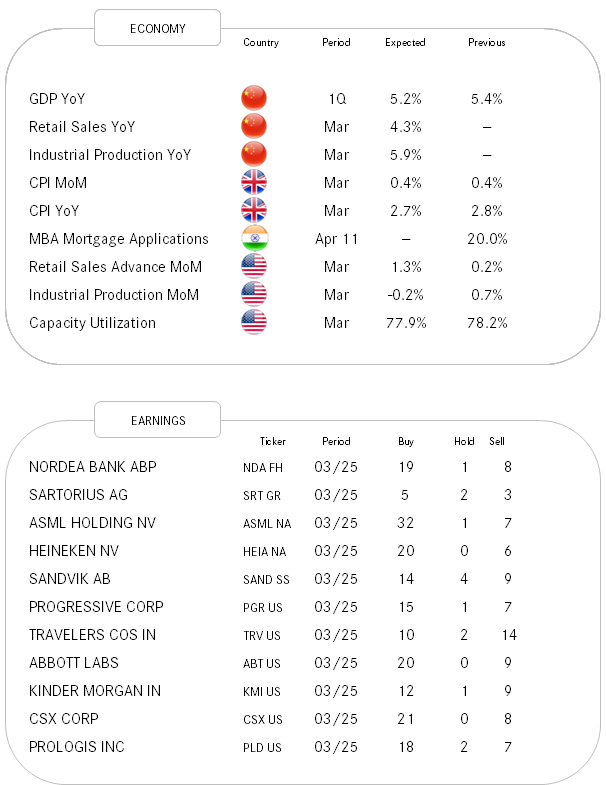

Some highlights …

Equity futures clearly in the red around the Globe:

The US Dollar bashing trade (aka exodUS) is on again:

The USD/CHF cross

and the USD/JPY stand out to me:

We are not (yet) seeing distress as we saw last week in the US Treasury (4.32%),

HOWEVER

the Japanese 30-year JGB yield is down 20 basis points in two sessions - something that not happens just because:

Time's up, more tomorrow - May the trend be with you!

And now to the shocker-chart of the decade:

Grey = S&P 500 High Beta ETF

Red = S&P 500 Low Volatility EFT

Conclusion = No compensation for worse-quality sleep