QuiCQ 16/07/20225

Sticky Stuff

“Inflation is like toothpaste. Once it's out, you can hardly get it back in again.”

— Karl Otto Pöhl

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

US inflation numbers came in at the upper end of expectations yesterday, however, given the absence of any major immediate market reaction in stocks, bonds or currencies it is safe to assume that the number was widely expected by investors.

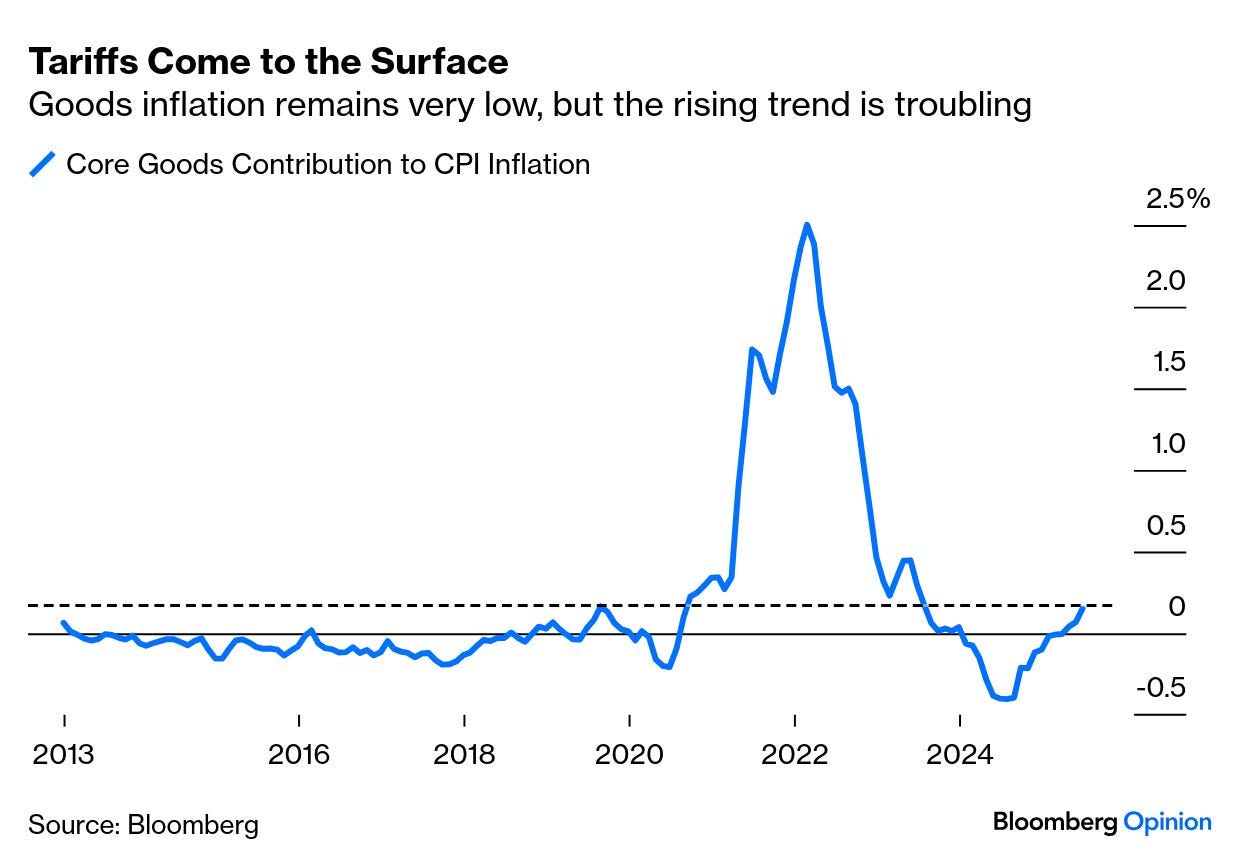

Nevertheless, a closer look under the (inflation) hood reveals, that different components of inflation measures are starting to turn the wrong way:

As John Authers of Bloomberg fame correctly put it this morning, “The direction of travel matters, and it’s going the wrong way” …

Does this then mean that another major spike in inflation is coming? Not necessarily, but it does suggest that progress on inflation has ended, with ever getting back tot he Fed’s target.

Accordingly, a July FOMC rate cut is now off the table and even a September cut is only a 50/50 chance now:

Is inflation coming from Trump’s Tariff Tantrum (TTT) then? If so, it would show up in the contribution of Core Goods to CPI (rather than services, food, etc.):

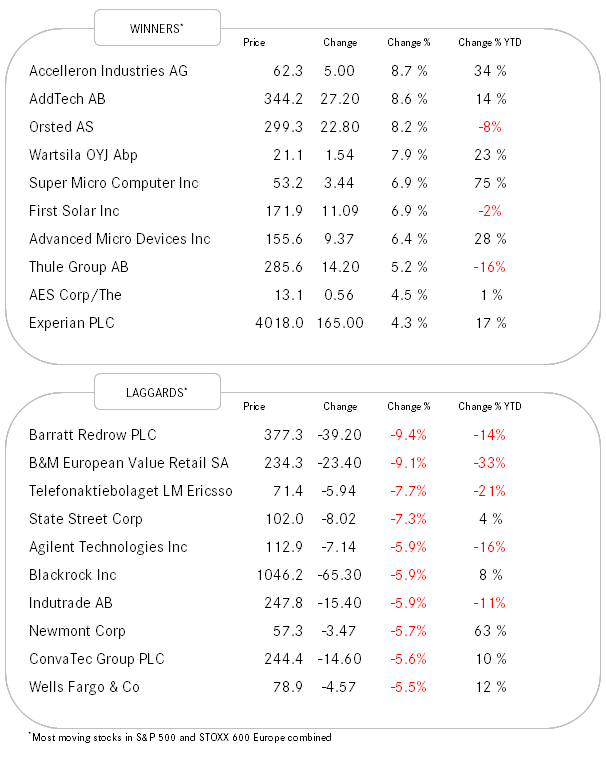

Ok, enough on that … onwards with markets review … which is nearly done before we start, as it was another eerily quiet session.

Most indices in Europe and the US closed lower on the day, with only the Nasdaq bucking the trend, mostly thanks to a four percent up day for heavy-weight NVIDIA, after news broke that the US government was relaxing its restrictions regarding chip sales to China.

Other Mag 7 stocks also helped to keep the Nasdaq in positive territory and the S&P 500 from losing too much, however, it was not enough to avoid a nearly one percent drop on the Dow Jones Industrial index, which saw 26 out of its 30 components decline on the day:

Earnings season opened yesterday, with some solid results from JPMorgan and BlackRock for example, albeit those stocks still retreated on the day, probably due to some profit taking.

By the way, breadth on the S&P 500 was horrid too, as the following sea of red of attest:

In the (interest) rates realm, we already highlighted the advance JGB yields yesterday. Well, the US 30-year Treasury yield just exceeded the 5% mark yesterday again:

Watch this space, as it is forming up to a repeat of last year’s “Yen Carry Trade Unwind” summer hole …

And are high yield bonds (HYG - grey line) acting as the canary in the coal mine for the broader stock market (SPY - red line)?

The US Dollar in the meantime is getting some upside traction:

If 99.00 can be cleared, a move until 101.50 could indeed be possible, however, our mantra laid out in our Q3 outlook of “sell the rallies” remains in tact.

Onwards to our chart of the day …

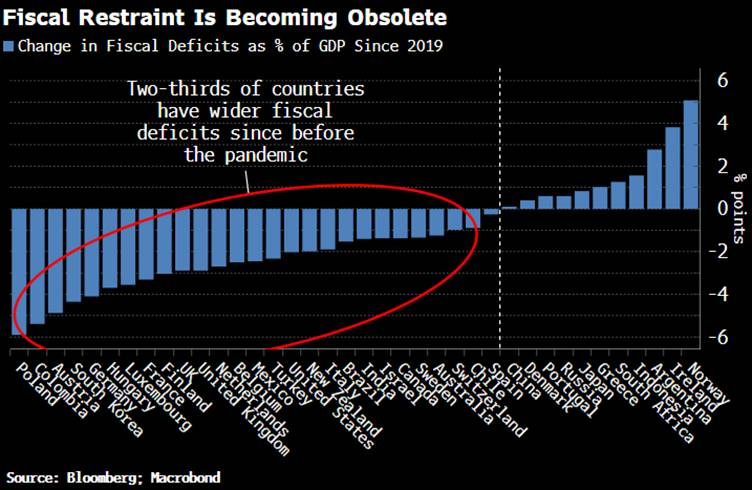

Our chart of the day asks: “Where has all the fiscal discipline gone?” Mostly down the drain, as the following chart would suggest:

That’s all for today - have a great Wednesday!!