QuiCQ 16/08/2024

"If all the economists in the world were laid end to end they still wouldn't reach a conclusion."

— George Bernard Shaw

Prefer to read today’s QuiCQ in PDF format? No prob, download it here!

Panic seems to be ruling markets again this week. Upside panic that is. AKA FOMO. US markets closed sharply higher yesterday, with the S&P up more than one and a half percent and the Nasdaq 100 up nearly 2.5%. Breadth was tilted tremendously to the positive side, with the advance-decline ratio close to 5-to-1. Trigger for the rally seemed to have been stronger-than-expected retail sales in the US, but the sad reality is that if we were not on the very tip of our toes last week, we (once again) missed a great buying opportunity. Point in case? Japan's Nikkei for example. Up another nearly four percent this early Friday morning, that benchmark for Japanese stocks has now recovered two third of the losses since the July 11th top. Little movement on the rates and FX side of things. In conclusion, the Santa Claus rally seems to have come a tad early this year …

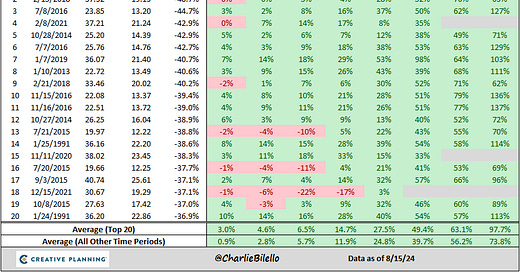

Last week we highlighted in a QuiCQ (click here), that the CBOE Volatility Index (aka VIX) had reached the intraday level of 65, which was inline with levels previously reached during the heights of the GFC and the COVID panic, with no similar 'trigger' apparent. The VIX closed substantially lower (37.6) that very same day, but since then has continued to collapse. The table below, courtesy of the always fantastic Charlie Bilello at Creative Planning, shows what happened to S&P 500 Total Returns following such "Volatility Crashes". Not bearish …