QuiCQ 17/06/2025

Ignorance is Bliss

“Nothing sedates rationality like large doses of effortless money.”

— Warren Buffett

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Yesterday's session was under the sign of unwinding (mean-reversing) Friday’s risk-off trade, as investors got pretty complacent about the ongoing kinetic conflict between Israel and Iran. John Templeton famously quipped that “The four most dangerous words in investing are: 'This time it's different.'“ and hence also this particular rise in geopolitical tension should be faded as nearly all the other ones before and risky asset should be continued to be loaded into portfolios. The 50% drawdown risk here lies obviously in the world ‘nearly’…

But, let’s not start the ranting and just assume that ignorance is bliss.

Stocks rallied around the globe yesterday, especially once the US session got underway. The S&P 500 ended up nearly a percent higher, whilst the Nasdaq just about missed the one and a half percent mark.

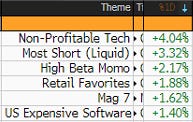

But it were really the riskier corners of the market that had a field day:

The S&P 500 itself saw a healthy expansion with broad participation as winners outpaced losers by a ratio of nearly three-to-one. Defensive sectors plus Energy underperformed, with the latter of course seeing that mean reversion trade from Friday:

Bond yields also completely unwound Friday’s slump and then some, sending bond prices sharply lower yesterday. Here’s the 10-year US treasury yield chart:

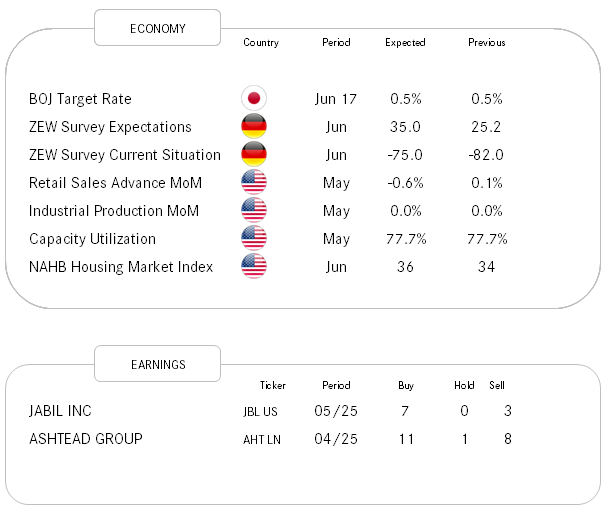

Staying with the rates market for a moment, the Bank of Japan (BoJ) decided to leave their key policy interest rate unchanged at 0.5% this early Tuesday morning. As this non-move was widely expected the market reaction was muted, though the long-end of the JGB curve did pick up a little, leading to a steepening of the curve:

Another risk-off trade being unwound yesterday was Friday’s very brief Dollar rally. As a matter of fact, and as we highlighted in yesterday’s Quotedian dubbed ‘The Wall’ (click here), the Dollar safe-haven “rally” was so miniscule that it highlights the structural weakness in the Greenback. Here’s an updated EUR/USD chart for reference:

Gold slumped nearly one-and-a-half percent yesterday and just from about the right level, respecting the resistance from the ascending triangle … for now:

But most attention has of course gone to the price of oil over the past few session, which has seen its volatility spike to the highest level since the Russian invasion of Ukraine:

The intraday chart of crude (WTI) is accordingly messy:

This morning equity futures are a tad lower, maybe because Trump abandoned the G7 meeting calling for the evacuation of Tehran, in comments that contrasted with earlier optimism regarding a resolve of the situation. FOMC day tomorrow.

Have a great day - May the trend be with you!

A picture is worth more than a thousand words, but let me leave you with five: “Something is going on here”