QuiCQ 17/07/2025

Powell Cut

“There's nothing the people love more than a Federal Reserve joke.”

— Adam McKay

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

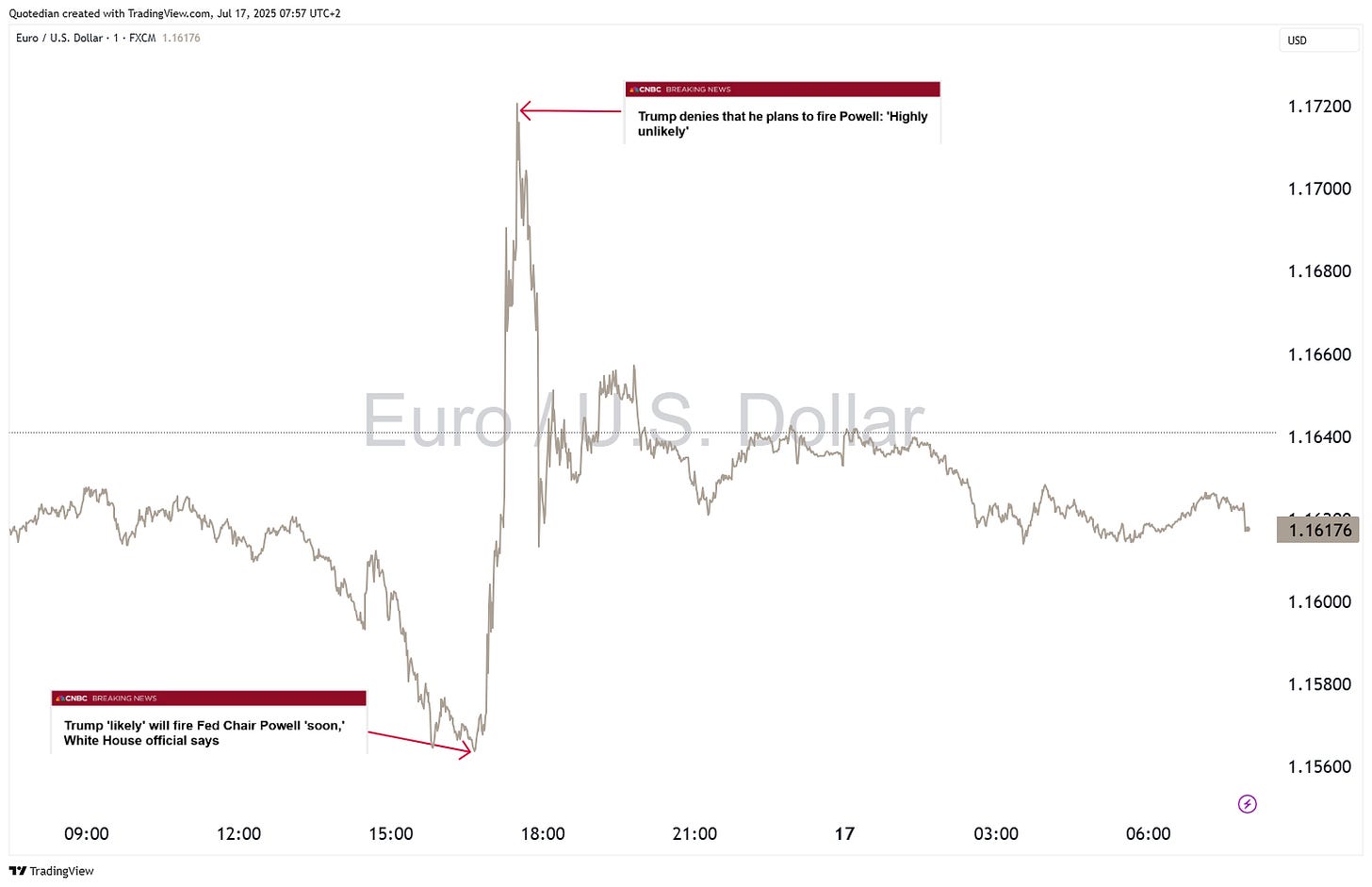

Like a sudden, rare rain shower on a hot summer day (actually not so sudden or rare where we write from), a dull market welcomed some price action seemingly coming out of the nowhere.

But that “out of nowhere” was once again the US administration, as it seemed that Trump floated a trial balloon that he might fire Powell. Within less than an hour we got this headline:

And then this one:

It is widely assumed that if Powell was to be replaced it would be someone substantially more ‘dovish’, likely to push policy rates in Trump’s desired 1% direction. Markets reacted accordingly as would have to be expected:

10-year Treasury bond yields jumped by nearly five basis points:

The curve (10y-2y) steepened dramatically:

Stocks (S&P 500 below) plummeted:

as did the Dollar, giving up nearly two big figures versus the Euro:

And finally, Gold rallied over fifty Dollars in a matter of minutes:

As all the dust settled and Trump called the trial balloon back in, stocks managed to eke out some modest gains, but with some decent breadth number. More than two stocks rose for every stock lower and eight out of eleven sectors closed higher on the day:

NVIDIA had another up day, and has ‘only’ about one trillion Euros to go to have the same market cap as the 50 most valuable companies in Europe:

PPI was also reported in the US and came in a tad cooler than expected in comparison to Tuesday’s CPI which had been a wee bit hotter than expected. Important to note here is that PPI does not account for imports (simplified) and hence inflationary tariff fallout should show up in CPI first.

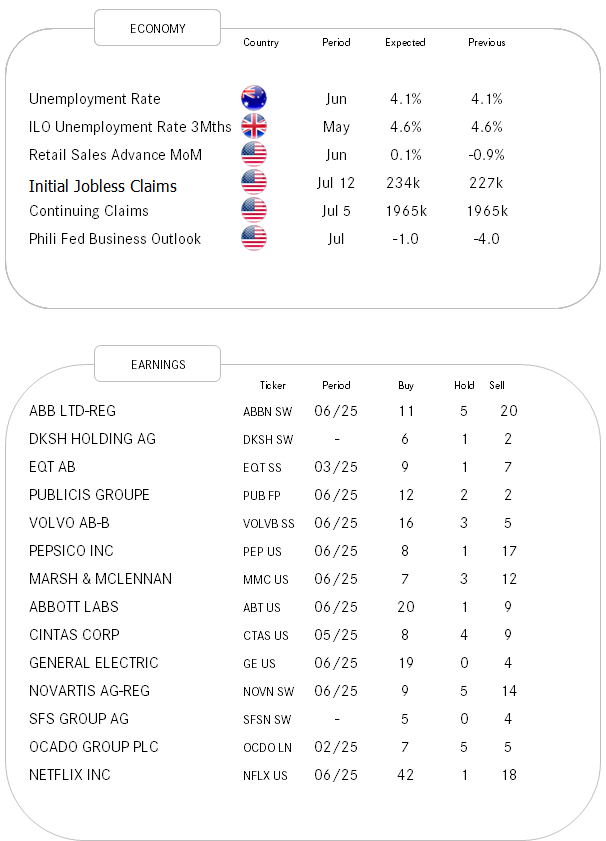

Today, the economic agenda is thin, whilst earnings season continues, with one of the possible highlights the Netflix numbers after market close. Asian markets are printing largely positive and index futures also point to a friendly start to our cash trading session here.

Our chart of the day from the always interesting Torsten Slok at Apollo suggests that today’s AI bubble is bigger than the Dotcom bubble 25-years ago:

Time's up, more tomorrow - May the trend be with you!