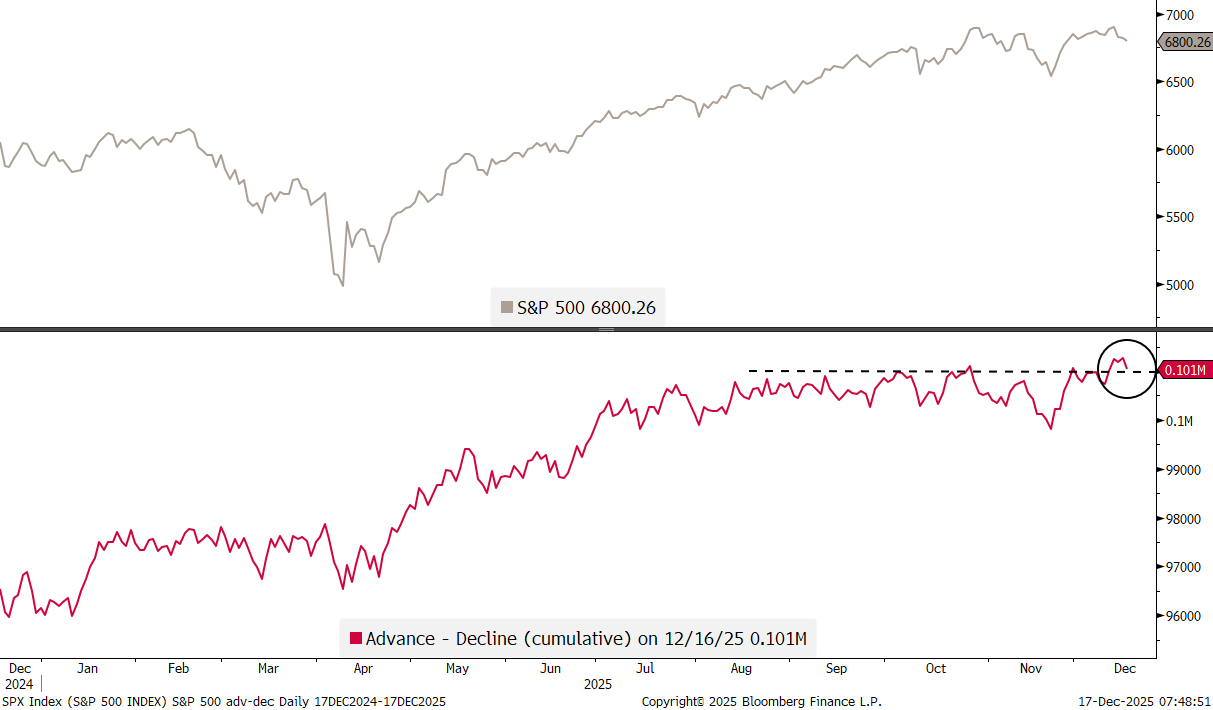

QuiCQ 17/12/2025

Waiting for ... Santa

“Expect the best, plan for the worst, and prepare to be surprised.”

— Denis Waitley

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

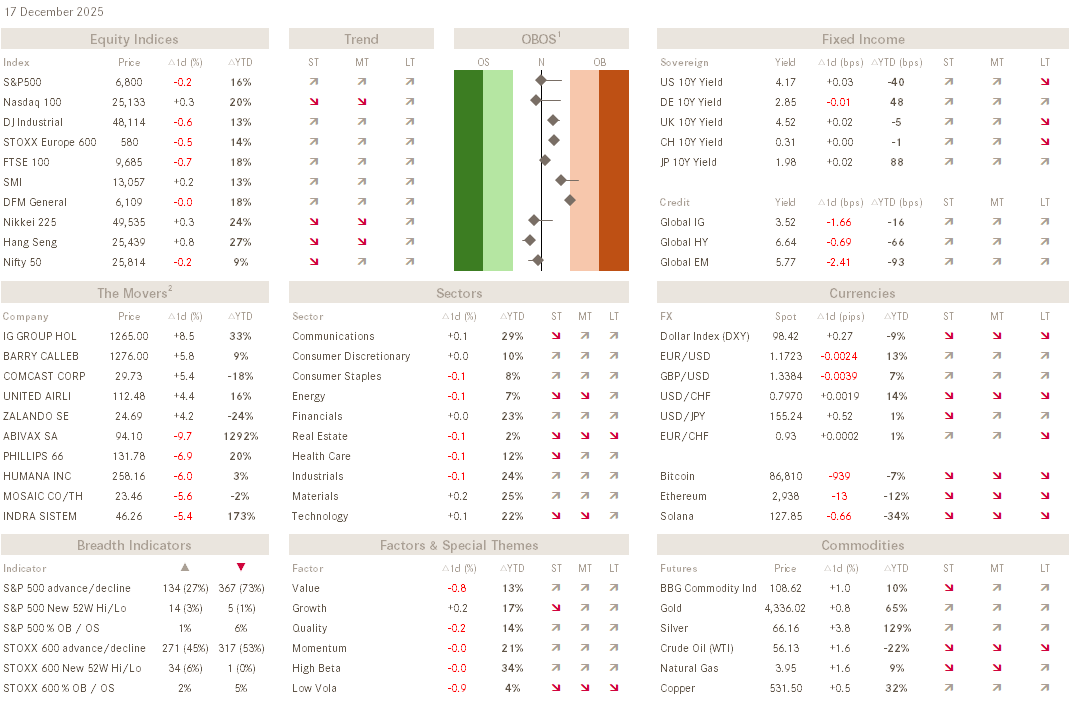

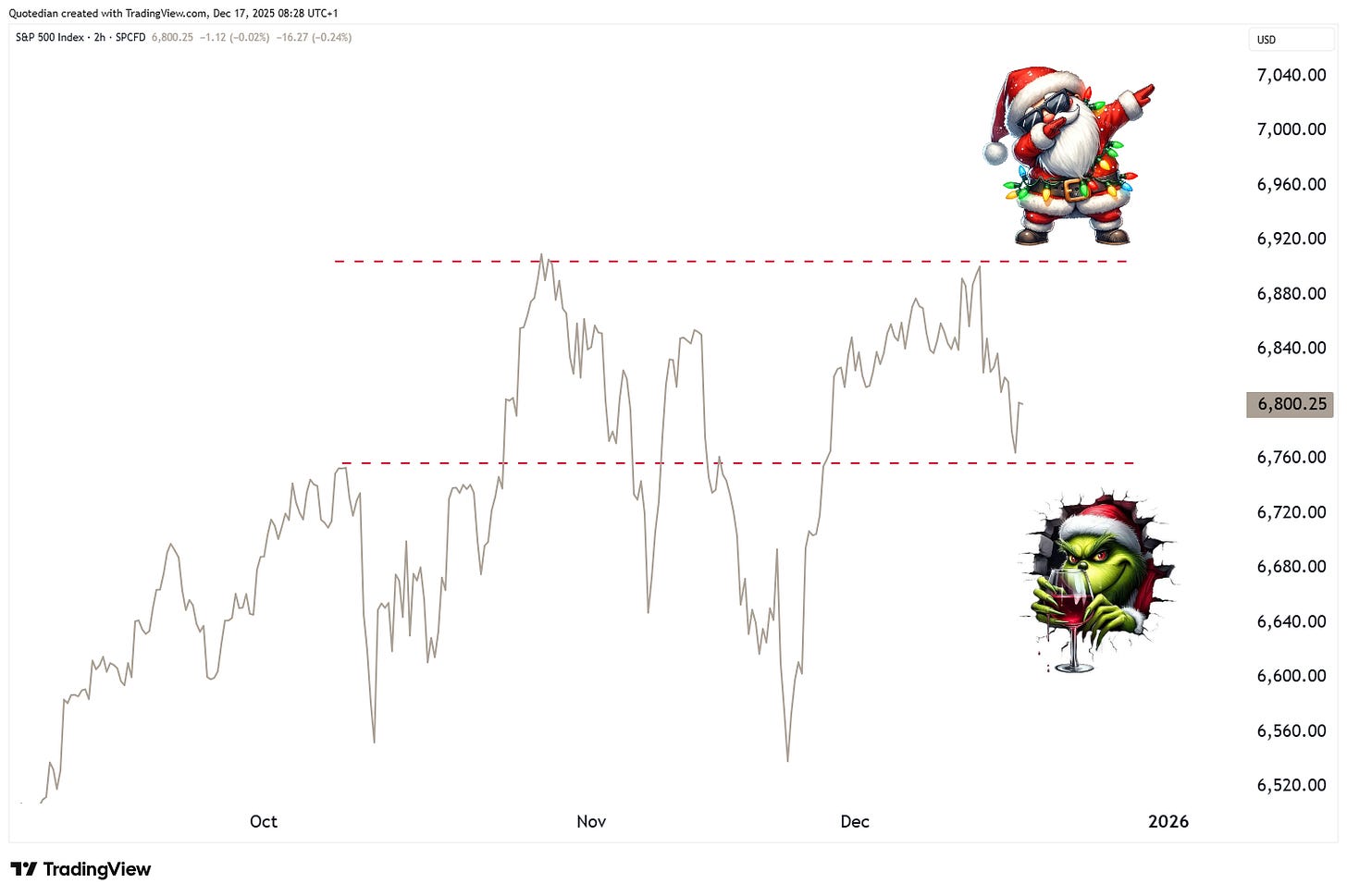

Only a short note today, as equity markets seem to have fallen into their typical x-mas slumber post the one percent last Friday. Here’s the S&P’s mini-future all-session trading this week:

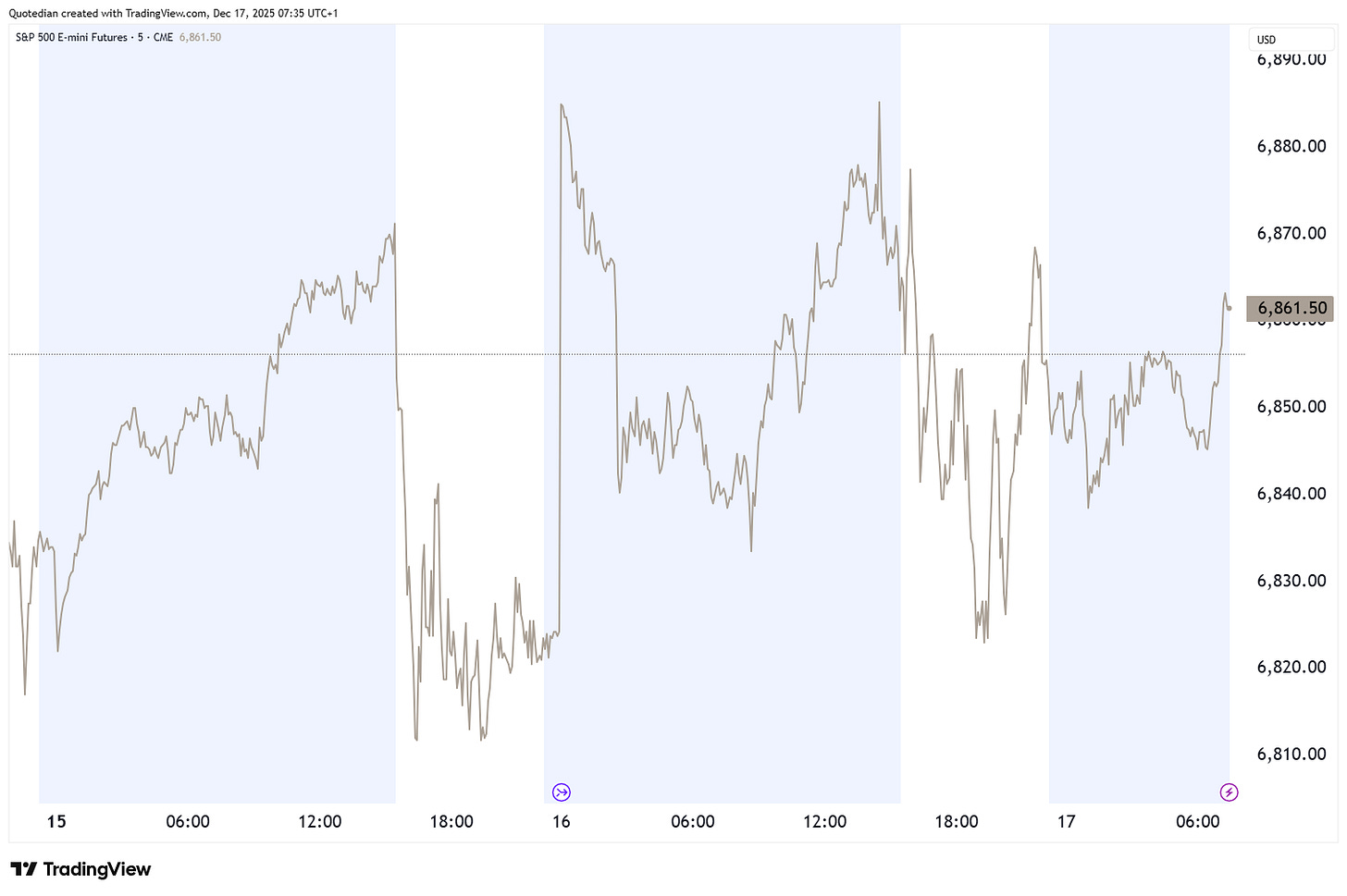

This sideways trading to mild weakness is very typical just before the Santa Claus rally is due to start sometime around this coming weekend and which should last into the first week of January:

However, will Santa also show up this year? There is a huge danger of a double-top in the S&P 500, with both tops strangely enough (or not) coinciding with the last two Fed rate cuts:

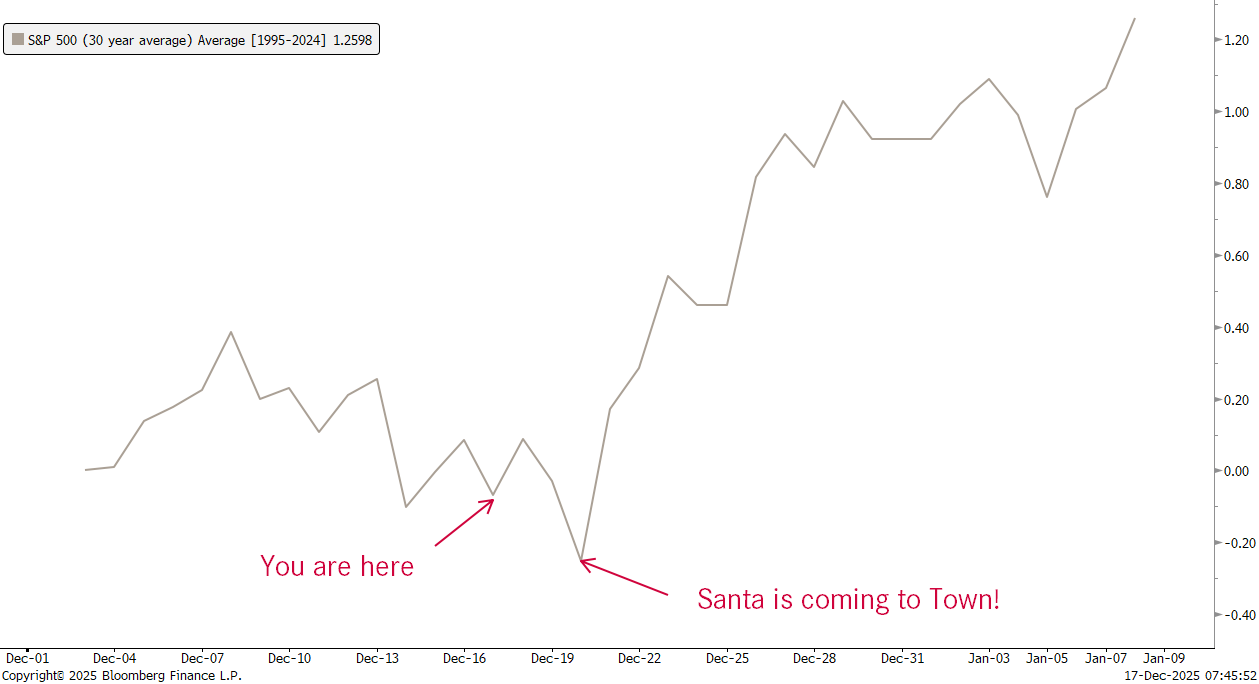

It is then encouraging to see that breadth has been strong, as seen via a new ATH in the S&P’s cumulative advance-decline line,

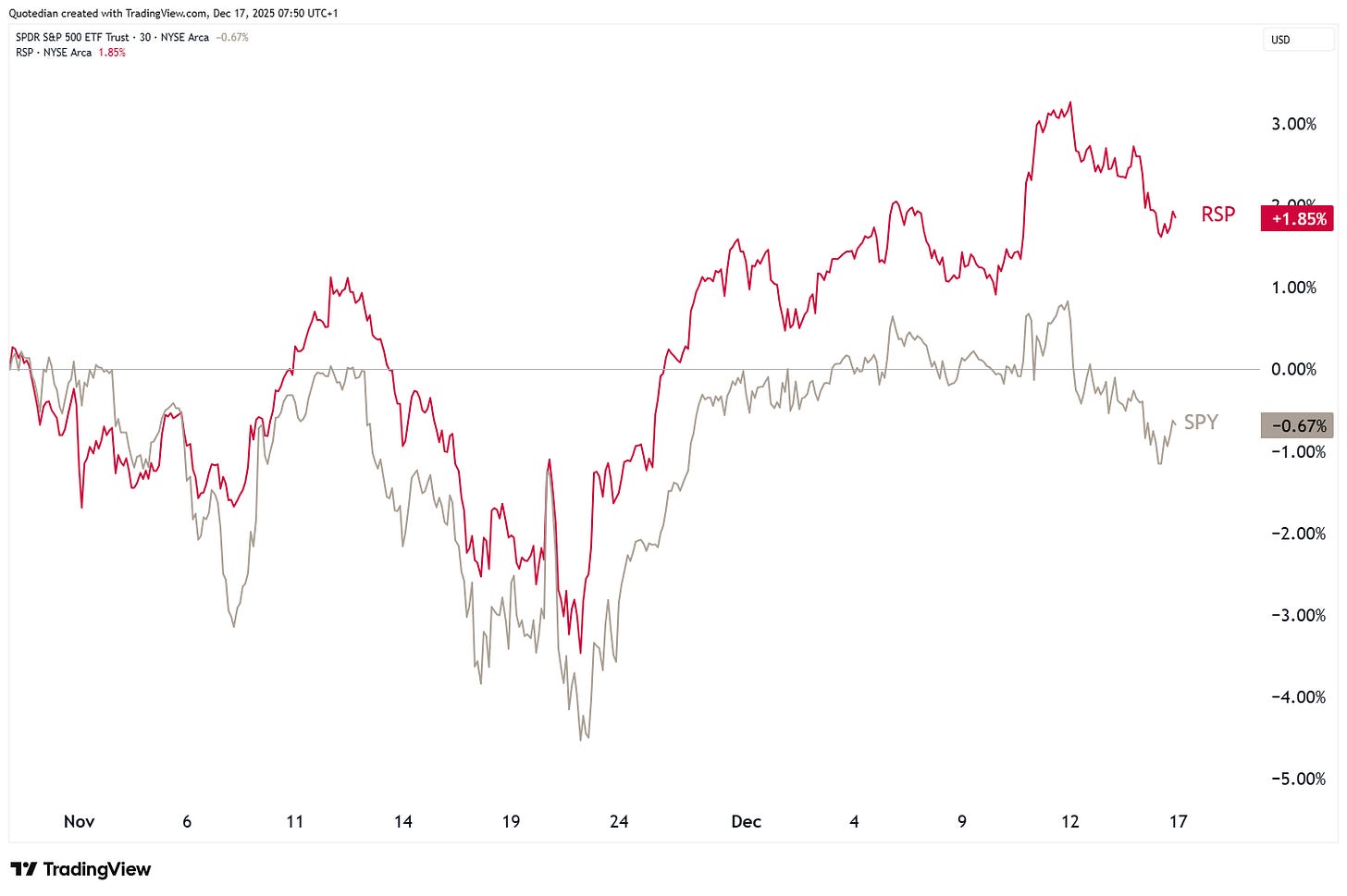

and the S&P 500 equal-weight index outperforming the ‘normal’ market-cap version since the October 30 top:

Remember this Ralph Acampora quote:

“Rotation is the lifeblood of a bull market”

So, as we move into 2026, we stand at the crossroad (I do hate that word) of a possible top OR an healthy rotation away from the AI thematic into a broader market rally. Which will it be? Probably the latter, but just in case scroll back to the top now and read that Quote of the Day again.

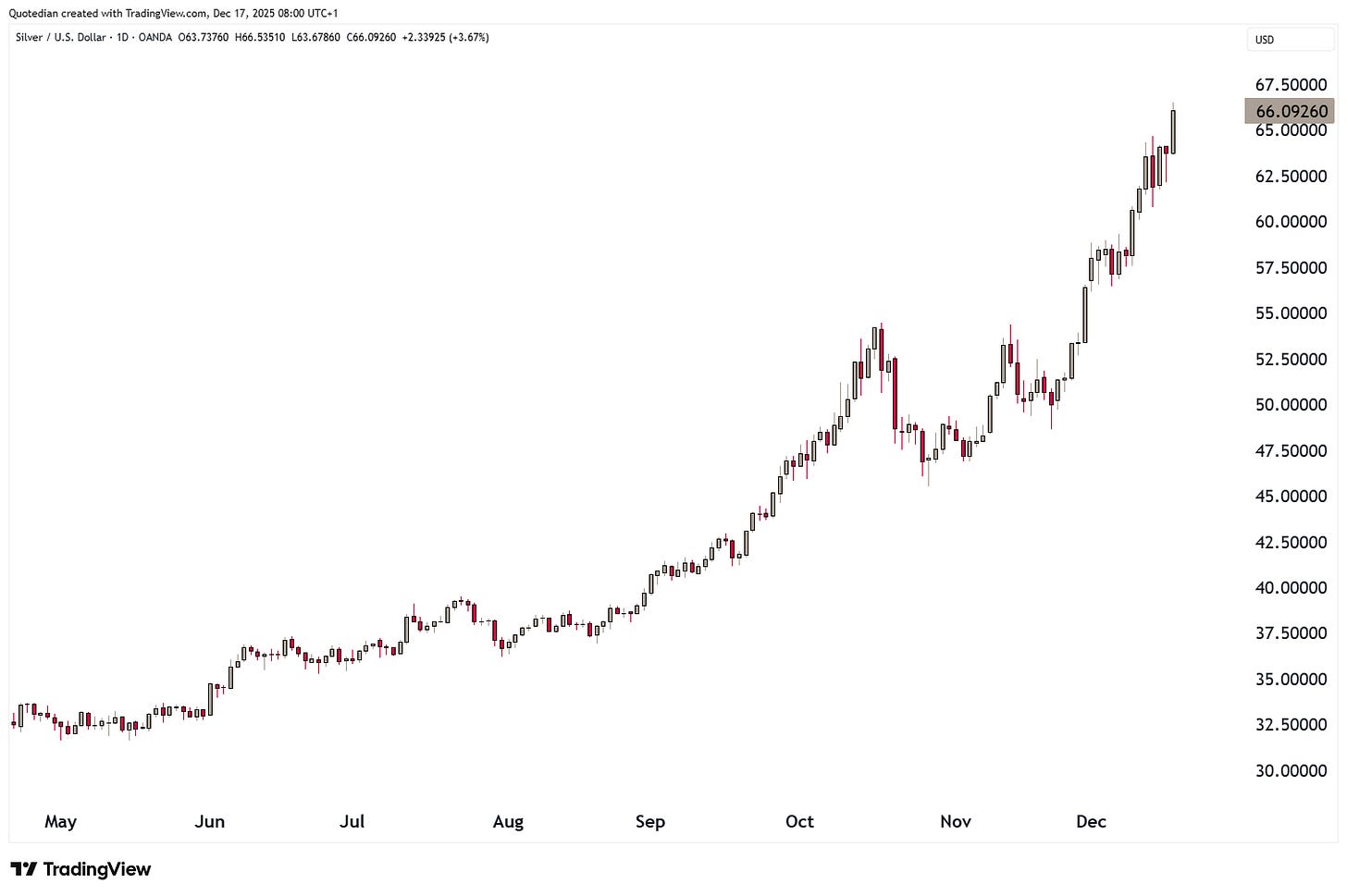

Now, A LOT of action is happening again in the precious metals space, which has been flying yesterday and overnight in the Asian trading session. Gold maybe the least, up half a percentage point only:

But Silver (+3.7%),

and Platinum (+4.1%) are skyrocketing higher:

Why? Worse-than-expected job numbers in the US increases odds for further rate cuts and hence USD-weakness + inflation? Perhaps. U-turn by EU on EV motorised cars yesterday increases the chances of hybrids (which need more Platinum than EVs) being used in the future? Perhaps. Precious metals are still an under invested theme? Perhaps.

All of the above? You bet!

At the same time another commodity, crude oil, is being washed out, maybe on the back of President Trump now recognising his true intentions (oil) regarding Venezuela:

I am truly not a specialist here, or for that matter, anywhere else, but my understanding is that it would not be enough to … uuhhmmm… seize Venezuela to get more oil to the Western world, but rather it would take years to ramp up the infrastructure in a meaningful manner. As I said, don’t take my word for it.

Well, that’s all for today, have a great day!

Above we discussed the two different setups currently at hand for equity markets (S&P 500).

Double-top

Healthy rotation and resolution higher

Which will it be? Santa or the Grinch?