QuiCQ 18/02/2025

Tuesday

"The great tragedy of science—the slaying of a beautiful hypothesis by an ugly fact."

— Aldous Huxley

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

* SXXP stocks only today

With the US stock and bond market both closed in observance of Presidents’ Day in the US yesterday, most other markets decided to take it easy too.

European equity markets closed uniformly higher, lead by another 1%-plus jump in Germany’s DAX index.

Defence stocks, hidden under industrial in the table below, were the big driver of the session as European leaders gathered in Paris to discuss Ukraine and the future of the European army:

The DAX may have been given an additional boost over optimism that next year’s general election may bring much longed for change - in whatever form, just change. I will repeat what I wrote in The Quotedian (Golden Age) a week ago:

"The most money is made when things go from terrible to just bad, rather than from good to excellent.”

— Howard Marks

With all the war-mongering going on these days in Europe (don’t shoot the messenger, it is what it is), bond yields are pushing somewhat higher again too. The German Bund (10y) closed in on the 2.50% level yesterday - nothing catastrophic so far, but keep an eye:

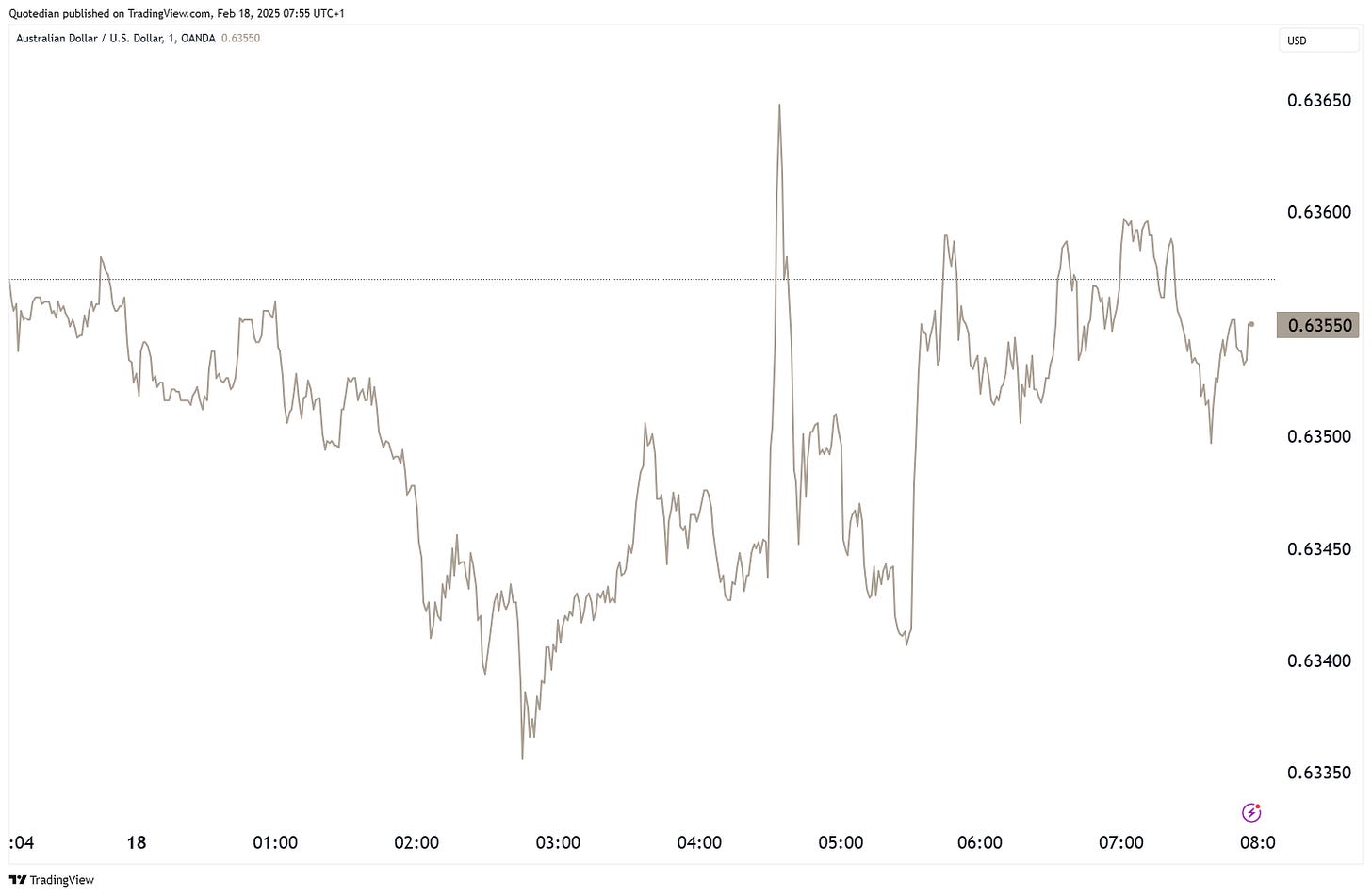

Staying on interest rates for a moment longer, but then immediately using it as a segue into FX, the Reserve Bank of Australia (RBA) today cut their key policy interest for a first time in more than four years:

The immediate impact on the Australian Dollar was … none. Here’s the intraday chart of the AUD/USD cross:

Asian markets this morning are showing a mixed picture, with an overall index over the region printing a small red number. However, gains in the Hang Seng (+0.7%), but not on mainland stocks, continue to accumulate and Japanese stocks are also up a quarter of a percentage point.

On the other hand, Indian stocks continue to suffer a thousand a little cuts, with the BSE500 down another 0.7%

European and US index futures suggest a friendly opening to our session today.

Think China is uninvestable? Think again.

Below, the most popular ETF on the S&P 500 (SPY - grey) versus the most popular ETF on China Large Cap stocks (FXI - red) over the past 12 months: