QuiCQ 18/03/2025

Tesla Chainsaw Massacre

"You just have to laugh at the horror."

— Sally Hardesty (1974)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Time's up, more tomorrow - May the trend be with you!

Markets continued to climb for a second consecutive day after a preceding more jittery period. Is the worst over now?

We have a more in-depth look at that question in yesterday’s Quotedian titled “Good Buy or Goodbye” (click here) which you should make sure not to miss.

Spoiler Alert: Of course, nobody can know if the bottom is or how much downside remains (and if they DO say they know, they’re lying), but we try in the newsletter our best to lay out a battleplan with clearly defined lines in the sand.

But I digress … back to today’s QuiCQ, which has the purpose of looking at only the most recent market moves and hopefully entertain you along the way.

US stocks started off their session in a very shy manner, then started to find self-confidence shortly after the European closing bell rang, only to give back about one third of gains made by market close:

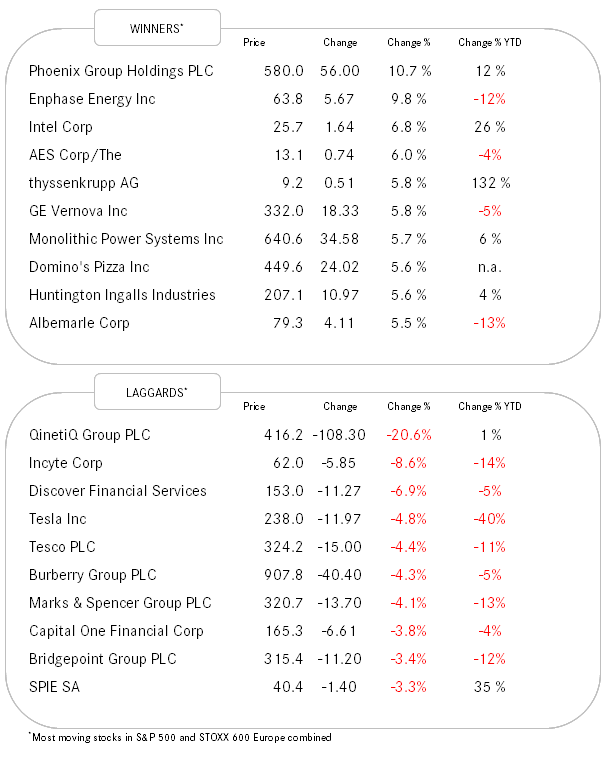

Despite the late profit-taking which left a bit of stale taste in investors’ collective mouth, the session was constructive with over 90% of the S&P 500’s constituents up on the day, leaving us following market heat map:

10 out of 11 sectors closed up on the day, if you have a closer look at the table above you may see the signs of which one was not.

Exactly! Consumer Discretionary. Which is down thanks to one stocks, which is TSLA. The shares of the carmaker high-stakes bet on the future of technology dropped close to five percent on a combination of broker downgrade and rumours that BYD was about to introduce a new battery technology allowing cars to be recharged in five minutes. Read more on TSLA in the Chart-of-the-Day section below.

In real of (interest) rates, global duration found a bid yesterday, but probably mostly pronounced so in European rates, where the German Bund yield as proxy dropped eight basis points before recovering slightly again:

All eyes on Germany of course today, where lawmakers will vote on a bill to unlock hundreds of billions of euros in debt-financed defense and infrastructure spending. Don’t underestimate the historic importance of this vote - for either outcome…

If accepted, this is for Europe about 5x as important as Mario Draghi’s “Whatever it takes” speech in 2012.

In currencies, the US Dollar has been a tad stronger over the past few hours, with the exception versus the Euro & Swissy (and less important the NZD), but most pronounced versus the JPY:

The USD/JPY should not move above 150.75ish, otherwise our theory of the continuation of the ($) downtrend is at danger:

EUR/USD is clearly waiting for the German vote:

One ‘currency’ that is not waiting is Gold, now firmly trading above the $3,000 level:

With Silver closely on its heels:

This early Tuesday Asian equity markets are firmly higher, led once again by the Hang Seng, up over two percent. European equity futures are firmer one hour before cash trading opens, whilst US futures trade a tad lower.

Time's up, more tomorrow - May the trend be with you!

Tesla share price is now down 50% since its December highs and has gone nowhere for the better part of the past five years, leading to today’s snatchy subtitle: