“Always forgive your enemies; nothing annoys them so much.”

— Oscar Wilde

Prefer to read today’s QuiCQ in PDF? Download here:

Technical issues made us miss yesterday’s QuiCQ … apologies!

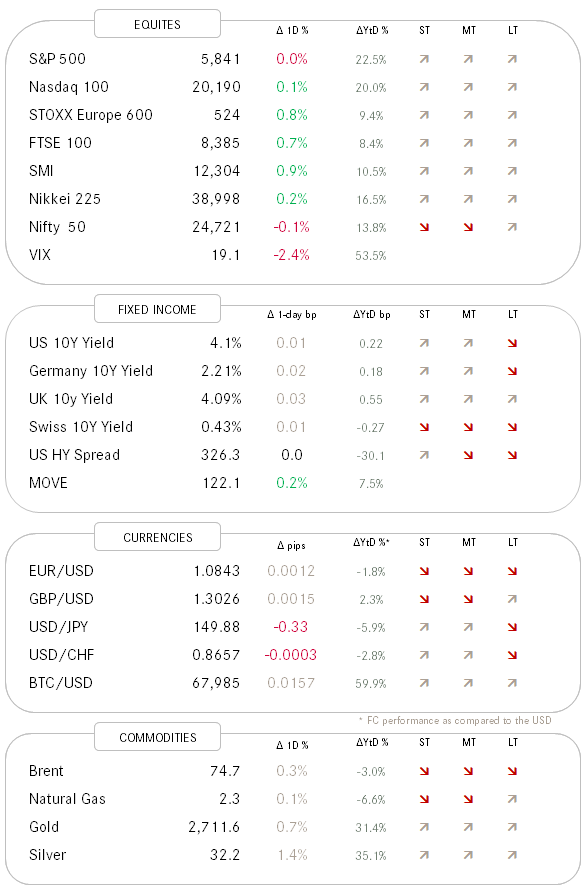

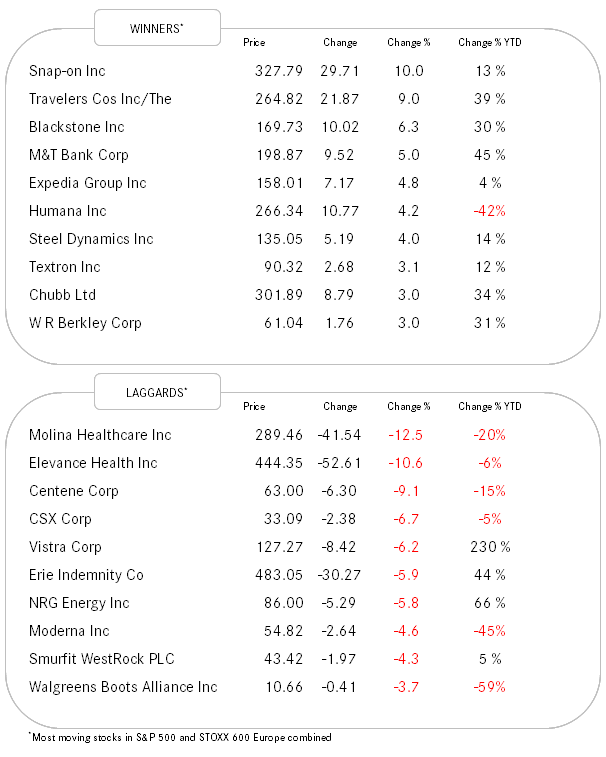

Yesterday the major indices on Wall Street closed flat, with only the DJ Industrial showing a minor advance of not quite half a percentage point. Yet, that was enough to have that index close at a new all-time highs.

A lot of focus away from macro to earnings now, which at a superficial glance seem to be coming in on the right side of surprises. Nokia was one of the few disappointers yesterday, with companies such as Blackstone, Intuitive Surgical, Netflix or Taiwan Semiconductors all reporting earning beats.

Jobless claims came in less than expected, however, we probably should not heed to much attention, as the number may be volatile for a few weeks given the impact of hurricanes over the past few weeks.

US retail sales came in above expectations, pushing the entire yield curve, but especially the long-end higher, which led to a curve steepening. The Tens are right back above 4.10 and expectations for future FOMC rate cuts slipped a bit further, albeit remain at nearly two for this year.

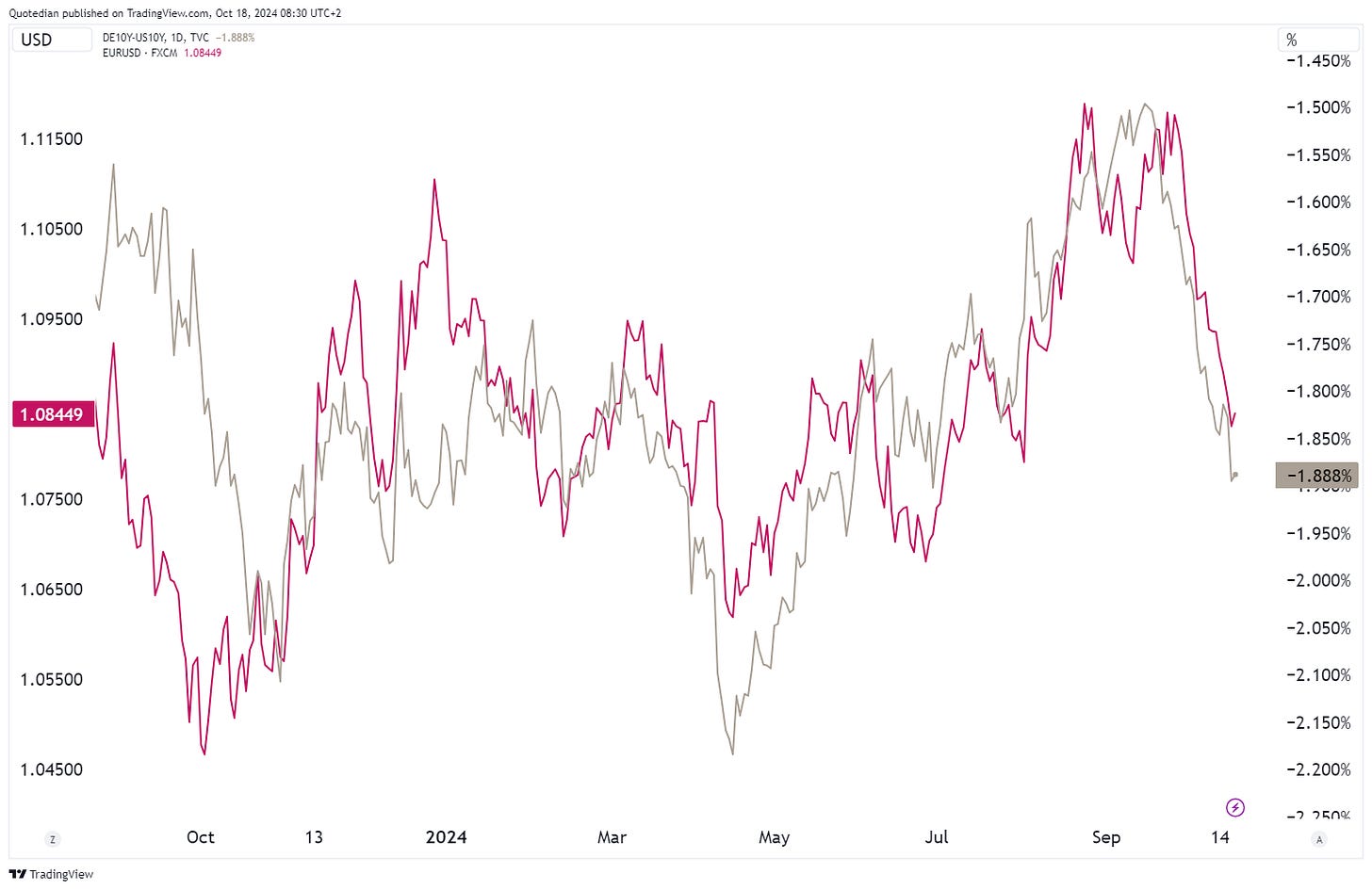

In Europe, the ECB cut rates as expected and all but confirmed another rate cut at their December meeting. The EUR/USD has been under pressure accordingly (check out the COTD below).

Asian equity markets are higher nearly across the board this early Friday morning, led by the Chinese equity complex (CSI 300 +4.25%), after the PBOC signalled further stimulus may lay ahead.

Enjoy your Friday, but above all, enjoy your weekend!

As mentioned above, the ECB decided to cut their key policy rates by 25 basis points yesterday and signalled another rate cut of the same magnitude to be likely at their last meeting of this year (12/12/24 - nice date). Despite yields moving a tad higher after the announcement, the interest rate differential (grey line - rhs) between German 10-year yields and their US counterparts has been growing. This is, as it should, exhibiting downside pressure on the EUR or upside pressure on the USD, depends on how you want to put it. In conclusion, the EUR/USD (red line - lhs) cross is falling and given the paths of the two economies, that trend could continue for now: