QuiCQ 18/11/2025

Winter is coming ...

“Winter is coming, but you can light the torches and drink the wine and gather around the fire and continue to fight the good fight.”

— George R.R. Martin.

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

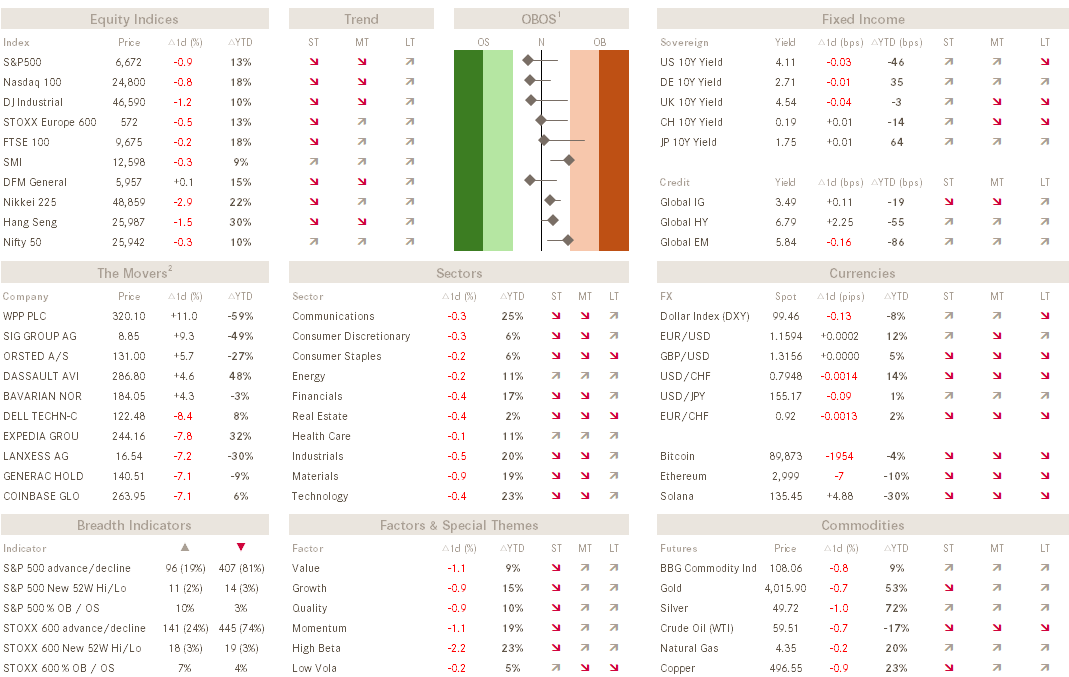

Another frosty session for stocks yesterday, though losses were capped at about half of what they had been during the three worst days over the past two weeks.

Yet, the S&P’s 90 basis points drop yesterday made the index close below its 50-day moving average (MA), a source of good support over the past seven months, for the first time since early March of this year:

Not all is lost if the index can reclaim that MA quickly again, though the index’s futures drop of an additional half percentage point this early Tuesday is not helping:

Hence, if the S&P 500, and the Nasdaq, which also closed below its 50d MA for a first time in a long time, fail to quickly (1-2 session) reclaim that support (now resistance) zone, chances increase for a deeper pull-back to the 200-day MA. This is how this would look like on the NDX:

Quite precisely a ten percent pull-back from current levels and a 15% correction top-to-bottom.

But let’s take this step by step. As we wrote in yesterday’s Quotedian titled “K-Pop” (click here), we are currently in one of most favourably seasons for stocks.

Yet, we have to closely observe whether breadth continues to deteriorate further, as evidenced in a falling cumulative advance-decline ratios,

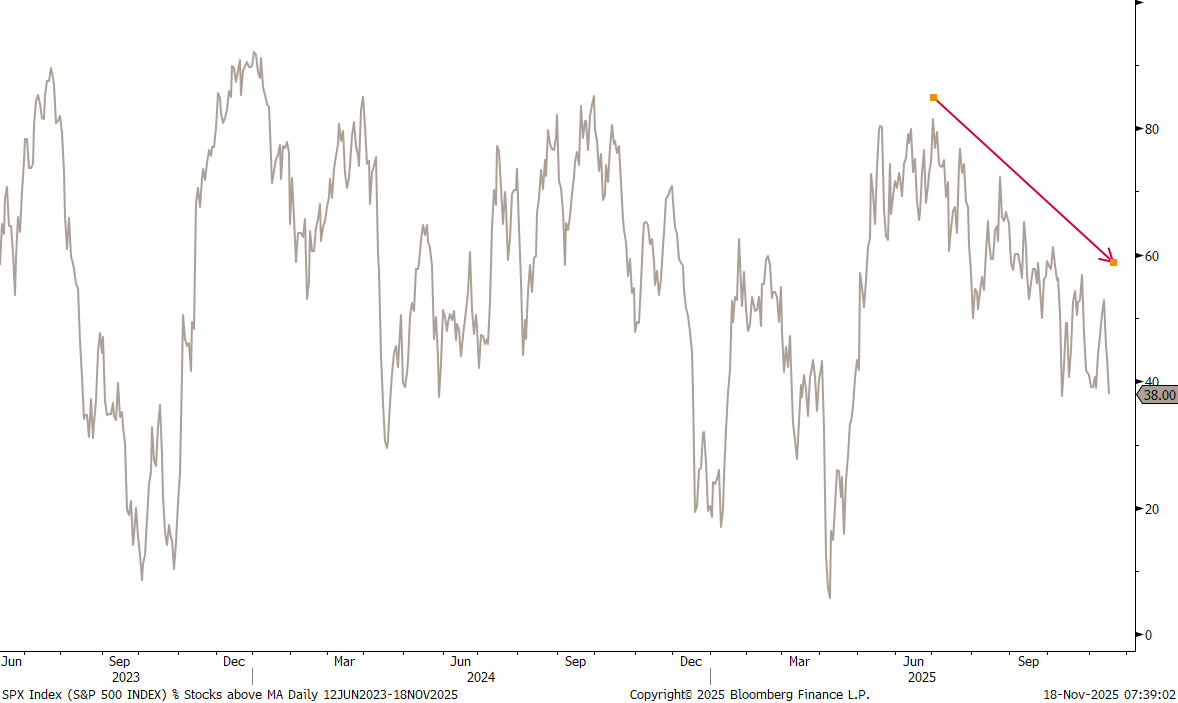

Or a dwindling number of stocks trading above their 50-day MA:

One additional concern we have been observing recently, has been the divergence between Bitcoin, a global risk on/off indicator, and stock prices:

Now, since Bitcoin broke its 100k support level we have been calling for a price target anywhere between 80k and 75k. This seems to be rapidly manifesting itself, as Bitcoin trades below 90,000 for a first time since May:

Another theme we need to talk about are Japanese yields. A massive stimulus package planned by the government has raised question marks about the already heavy >250% debt/gdp burden, pushing up yields along the curve.

The 20-year JGB yield for example is now at 2.78%, its highest in 25-plus years!

The US 20-year Treasury yield is about 2% higher, but given that hedging cost are probably more than that additional yield, the danger is that this huge JPY —> USD carry trade could unwind, with some potential massive implications for the financial plumbing system. Stay tuned on this one!

Anyway, the stock market is not liking it either, with the Nikkei 225 retreating three percent this morning, setting the tone for a chilly Asian session this Tuesday:

That’s all for today - make sure to hit that like button before closing your browser window 🙏😉

André

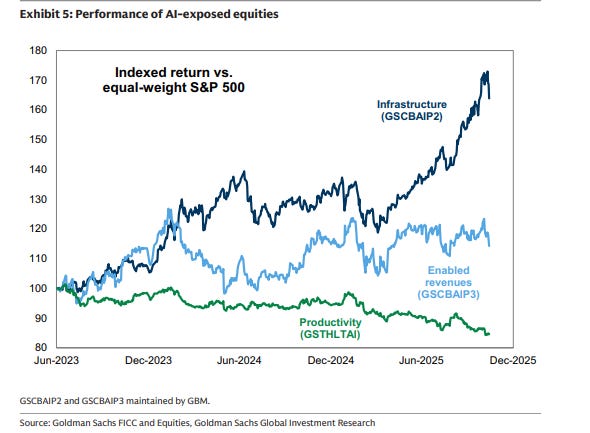

Goldman’s David Kostin drew up three baskets of AI-related stocks: those building infrastructure (data centres), those standing to gain revenue from AI applications, and those with productivity problems that stand to benefit most from it.

Infrastructure groups are hogging returns.