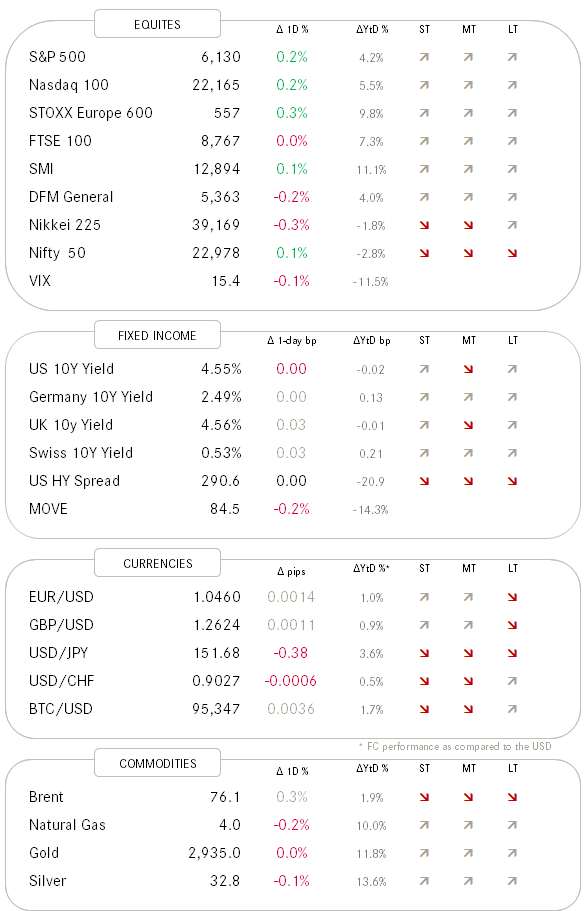

QuiCQ 19/02/2025

The Golden Duracell Bunny

"Not all treasure is silver and gold, mate."

— Jack Sparrow, Pirates of the Caribbean

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Et, voila! There we go … a late rally on the S&P 500

lifted the index to a new all-time high,

after the NASDAQ 100 had achieved that feat already last Friday … and repeated yesterday:

Breadth was pretty positive, with gainers outpacing losers at a ratio of nearly 3:1. And talking about breadth, the European stock market (SXXP) is currently THE party place for new 52-week highs:

Of course, we are coming from a low, undemanding base, but still …

Asian stocks are displaying some weakness this early Wednesday morning, which should be considered a normal breather after several consecutive sessions of higher prices. Bucking the trend are Indian stocks, which finally find a small (and temporary) foothold.

European and US equity futures suggest a flattish opening.

Absent any major economic data yesterday, global yields pushed higher, probably mostly on the back of still rising geopolitical uncertainties.

The US Dollar was weaker over the past few hours versus nearly all other major currencies,

and starts looking a bit toppish on the charts. Here’s the Dollar Index (DXY) version:

But the real star of yesterday’s macro show was of course Gold, which advance nearly one and a half percent or USD 40 to a new all-time high of $2,936 per ounce:

That’s all for today - have a Golden day!

Gold is reaching ATH after ATH, however, it somehow feels that participation (aka positioning) amongst investors is not expanded. Hence, a short squeeze may still take place. How to play?

Given that Gold volatility (GVZ - lower clip) is not at peak levels yet, it may make sense to position for such a squeeze either via a simple long call, or, to save some premium money, a call spread (long call, short call):