QuiCQ 19/06/2025

Juneteenth

"Not everything that is faced can be changed, but nothing can be changed until it is faced."

— James Baldwin

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

The Fed told us yesterday that they see a pick-up in employment, a slowdown in growth and a rising inflation in 2026 and accordingly - did nothing to interest rates! Even more so, whilst the median expectation remains for two cuts this year, there are now seven FOMC members expecting no cuts in 2025, as compared to the previous Dot Plot when only four expected no cuts:

The equity session around the Fed decision yesterday was a forgetable one, even though the movements at the time of the non-decision communication and the presser (red box) seem like a lot, it is in not in percentage terms:

Under the hood the number of stocks up or down on the day was quite precisely balanced and four out of the eleven economic sectors managed to close in the green, lead by tech stocks and energy stocks making up the tail-end.

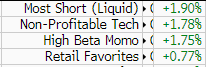

Even so, the more speculative corners of the market ended up the sessions meaningfully,

hinting to retail investors still being very active (and bullish).

And if you thought the stock session was boring you haven’t seen the rates market yet. US Treasuries (10-year version below) ended the day where they had started, with hardly any notable reaction post Fed Meeting:

One asset that was and is on the move is the US Dollar, showing some ‘unexpected’ strength post the FOMC meeting. Here’s the intraday chart of the Dollar Index (DXY):

Is this sudden refound strength a function of the Fed not cutting and interest rate differentials working in favour of the Greenback. Very likely. Or is it because “short USD” has become a very crowded trad? Also very likely. Or a combination of both? BINGO!

Dollar up means probably commodities down and looking at the precious metal space in general and gold in particular … indeed!

After menacing with a break out of the triangle to the upside, we now face quite the opposite.

It is of not that Silver also corrected, but the previous laggards Platinum and Palladium continued to show strength.

That’s all to yesterday’s observations… UP NEXT:

SNB rate decision at 9.30 CET (expected 0.25% cut; whisper 0.5% cut)

BOE rate decision at 13.00 CET (no move expected)

REMEMBER: US Bond AND Equity markets closed today in observation of Juneteenth public holiday

Time's up, more tomorrow - May the trend be with you!

They say that if a butterfly flaps its wings in the Amazonian rain forest, it can change the weather half a world away. Chaos theory.

Well, a butterfly is flapping its wings in Thailand at the moment, with the SET index about to break out to new lows:

And here’s the long-term aspect of this:

Stay tuned (on in on that butterfly).

The red bar for soft commodities was also conspicuous..