QuiCQ 19/11/2025

The Nest*

“Humans, it seemed, were like cockroaches. Determined enough, they could thrive anywhere.”

— Christopher Golden

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

I will admit that I am a tad less well-know (and substantially less rich) than JPMorgan’s Jamie Dimon, but I will pride myself in having talked about possible problems spreading in the private credit sector in The Quotedian title “Pirate Credit” (click here) several weeks before Mr Dimon flagged similar cockroach problems:

Initially baby cockroaches, named Tricolor and First Brand, were sighted - now suddenly their bigger brother “Blue Owl” is appearing on the kitchen sink too. The following two headlines go hand-in-hand:

Stocks of Blue Owl (OWL), the private lending ‘specialist’, dropped 6% on Monday and rebounded one percent yesterday, but the real story (and warning sign) has been observable since the beginning of the year:

Expect the already ‘respectful’ year-to-date losses in some of the VanEck BDC Income ETF to ‘grow’ further:

But the real question is - where will it stop? What will be the true mother of all cockroaches, or the big whale-cockroach so to say?

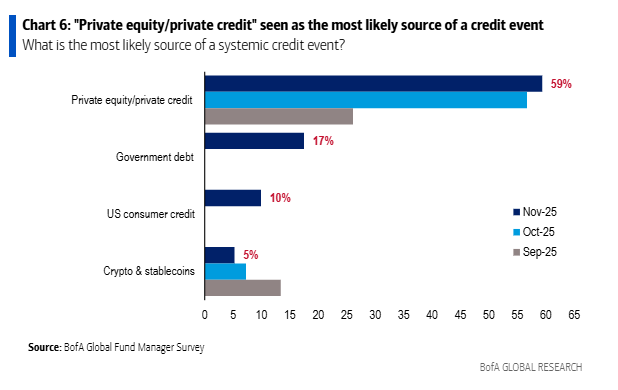

Enough ranting, except for one more comment, coming via John Authers this morning:

The latest Bank of America survey of global fund managers, released Tuesday but carried out last week, shows that many investors have come to believe that the exterminator can no longer be averted. More than half flagged private credit as the most likely source of a credit event:

The broader market again suffered somewhat yesterday, but generally feels a bit like a headless chicken ahead of tonight’s (after market close) Nvidia Q3 earnings release (blue line),

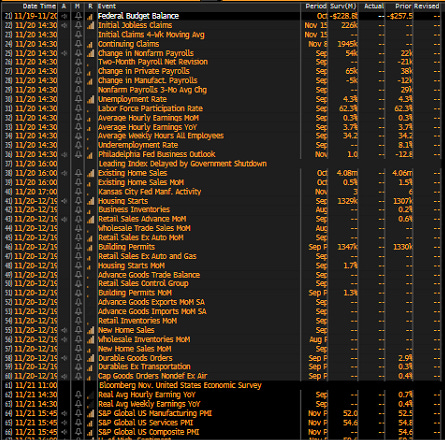

and a whole sway of ‘accumulated’ US governement economic data due Thursday and Friday:

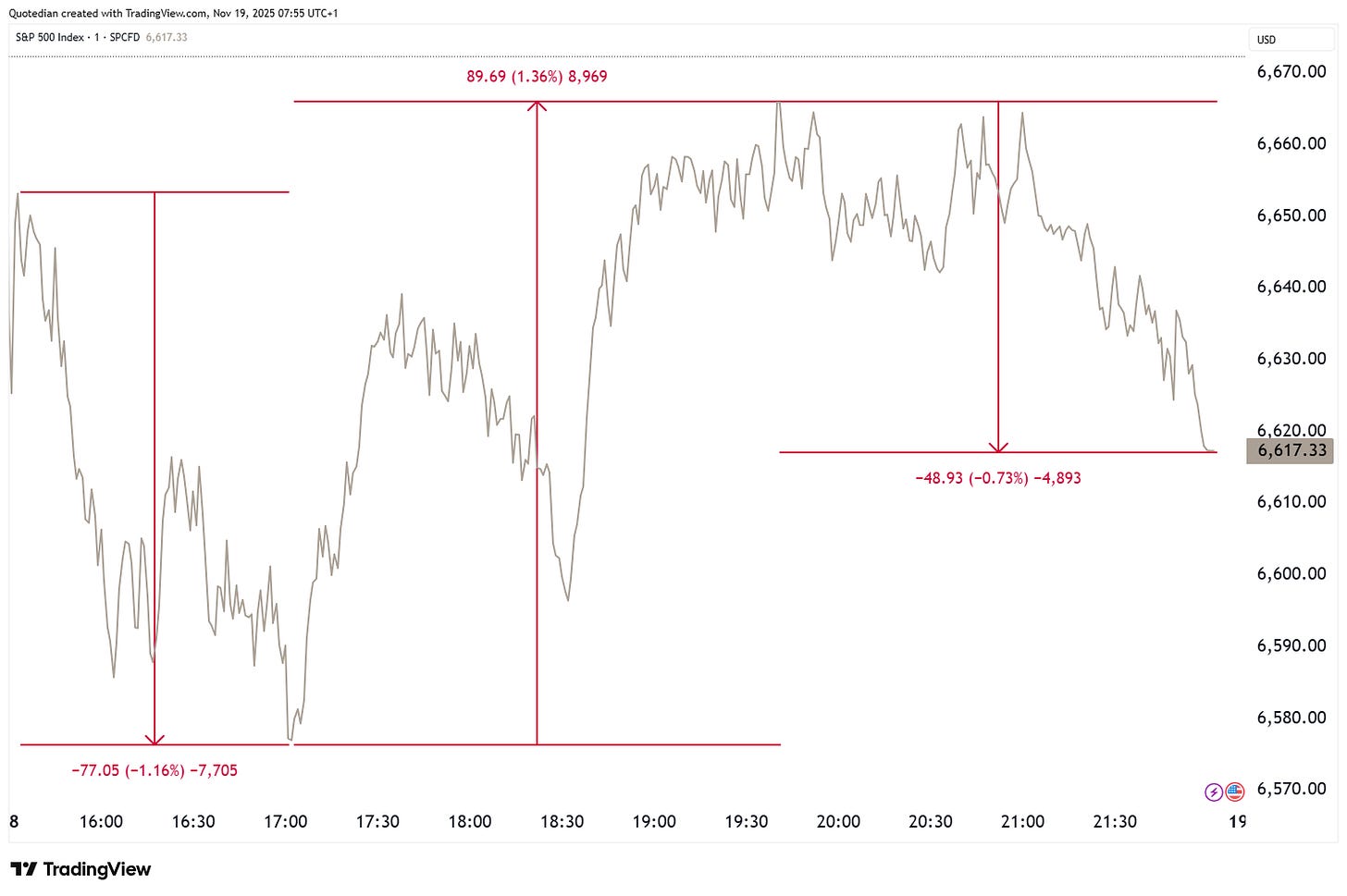

The following graph of the S&P 500’s intraday movements depicts that indecisiveness:

Technically, 6,550 is the make-or-break spot (dashed line) for the short-term fortunes of the stock market:

A break would probably mean another 5-6% drawdown to the 200-day moving average (dark grey line at 6,154.74).

Some more items to watch…. for example, FT’s Alphaville ran following ‘amusing’ headline:

The FT’s conclusion was based on substracting the market cap loss of Oracle since the announcement of the deal from that $300bn. It is actually bit less dramatic right now, but still underwater:

Another theme to watch is the announcment of a new Fed Chair, maybe before x-mas (which is actually only about a month away, for those of you who have not started their shopping yet).

With regards to that new Fed Chair, Rabobank’s always excellent “Global Daily” letter asks the following:

Does anybody think it’s going to be a strong, independent, gnostic, hawk deliberately ignorant of geopolitics, who will focus on 2% CPI and clash with the White House and Treasury? I thought not.

Lastly, as if the NVDA results tonight and the flood of US economic data tomorrow and Friday where not enough, we may also get President Trump signing off the release of the Epstein-files. One might think this has nothing to do with markets for Fed Chairs or Geopolitics, until one sees an already-released Epstein email forced former Treasury Secretary and nearly-Fed Chair and former Harvard President Larry Summers to step away from public life because it revealed he asked Epstein for advice on how to seduce a Chinese economist mentee - who was the daughter of a senior CCP official, a former Vice Minister of Finance, and at that time chairing the World Bank-rival Asian Infrastructure Investment Bank HQ-ed in Beijing.

Have a great day,

André

* BTW, if case you wondered about the strange subtitle of today’s QuiCQ, it stems from the 1988 movie “The Nest”, which is all about mutant coakroaches invading a New England fishing village. Aaaaahhhh! you will say, it all makes sense now (kinda’)

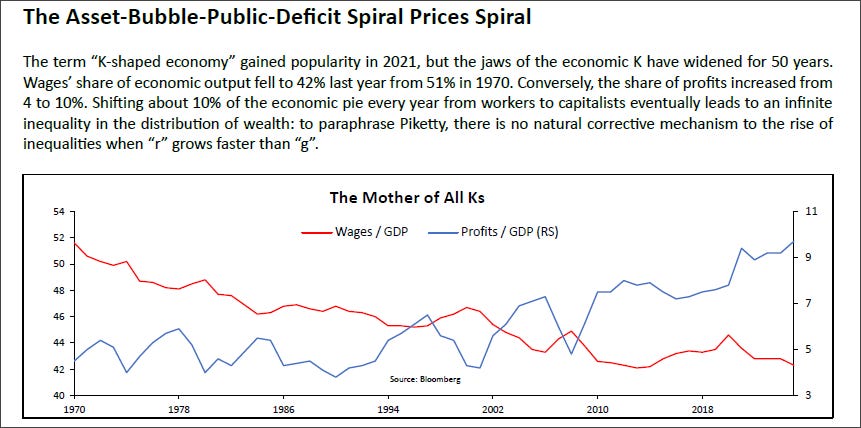

The latest Quotedian released earlier this week and titled “K-POP” (click here) discussed the increasing K-shaped economy, especially in the US. Several good charts argue this increasing difference between the rich and the poor is for real.

However, the ultimate graph has reached me this morning by Kevin Muir from the “Macro Tourist” and was originally drafted by the always excellent Vincent Deluard at StoneX. No further commentary than Vincent’s needed: