QuiCQ 19/12/2024

Santa Claus 0 - Grinch 1

"This can't happen. It shouldn't, it couldn't, it mustn't, it wouldn't!"

— The Grinch

As the subtitle of today’s QuiCQ already suggests, Fed Chair Powell decided to dress up us Grinch rather than Santa Claus yesterday.

The Fed cut their key policy rate as expected by 25 basis points, but also, as feared, reduced their projected number of cuts for next year. This cartoon sums it up:

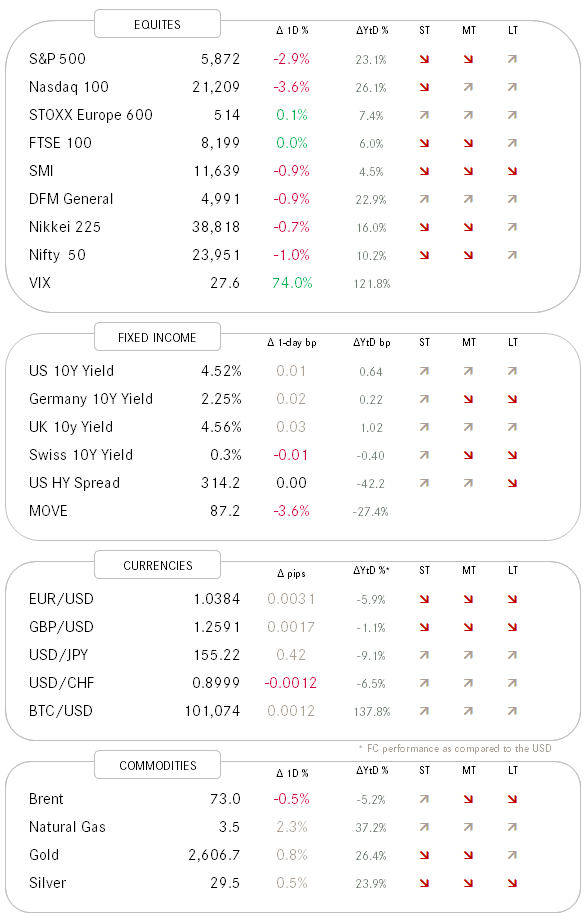

Here’s a summary of market reactions, which were not for the faint-at-heart, to put it mildly.

Major indices saw, well, major reversals. That 1,100-points candle on the Papa Dow (DJI) looks absolutely impressive (I use the word impressive to keep a positive tone):

Consider that November 6th election gap closed…

Small-cap investors even got briefly the opportunity to invest at pre-election levels:

The 3%-plus drop on the Nasdaq was also impressive, though the trend channel is holding for now and to close the election gap the index would have to drop another 5%:

In risk-adjusted terms, the rise in bond yields (drop in bond prices) may have been even more painful impressive. Here’s the 10-year UST yield:

The iShares 20+ Treasury ETF, a proxy for long-duration investments, is now suddenly down 6% over the past two weeks and down 12% from the intrayear highs:

For equity-focused investors that may not sound like a lot, but believe, for bonds, it’s pretty, yes you guessed it, impressive:

Another source of pain came out of the FX realm, where the US Dollar rallied impressively against all other G10 currencies:

On the EUR/USD cross this translates into the glittering wonder that is the Euro having broken key support (dashed line). The EUR should be quickly (as in one or two sessions, max) recover above that dashed line again and in no case break the dotted support line:

Failure to hold will open price targets well below parity. Impressive, isn’t it.

Overnight, major Asian markets, with the notable exception of China’s CSI300, traded lower, albeit mostly only moderately so, which makes a lot of sense.

European index futures suggest that the Grinch may have taken the overnight flight from NYSE to Euroland and wreak some havoc there too. Albeit, seeing that US index futures are flattish at the moment leaves some hope that further downside may be contained.

And if not, do not forget that the Santa Claus rally does start on the 24th this year and ends on Friday, 3rd January.

To finish today’s brief, here’s some chicken soup for the chartist…

The VIX spiked 74% yesterday. Even though spikes of this extent are not too common, it was the second spike of more than 60% this year (before that, you have to look back to 2021 to find spikes of similar size.

The other spike in volatility (lower chart) on August 5th was 65% and served as an excellent buy-signal for the S&P 500 (upper chart):

What will it be this time? Worth a dabble perhaps? Perhaps.