QuiCQ 19/12/2025

“If Santa Claus should fail to call, bears may come to Broad and Wall.”

— Yale Hirsch

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

As long-term readers of this publication and our sister-product "The Quotedian” I have ad nauseam insisted that the CPI (Consumer Price Inflation) number should not matter to investors as its composition and large lag-time make it largely unusable for real-world inflation measurement. Now, add a government shutdown to the latest number released yesterday, where some of the data has been literally pulled out of thin air, and CPI now stands for Clown Parody Indicator…

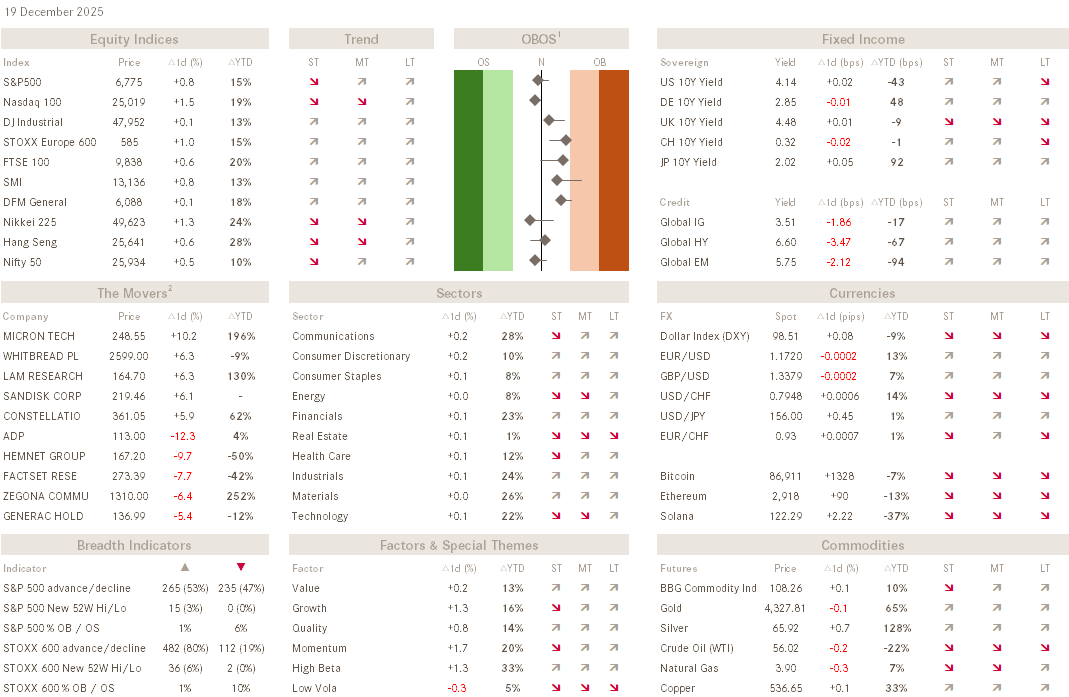

Anyway, here are the numbers in case you care (you shouldn’t),

which were enough to lift the equity market … at least for a while. Here’s the intraday chart of the S&P 500:

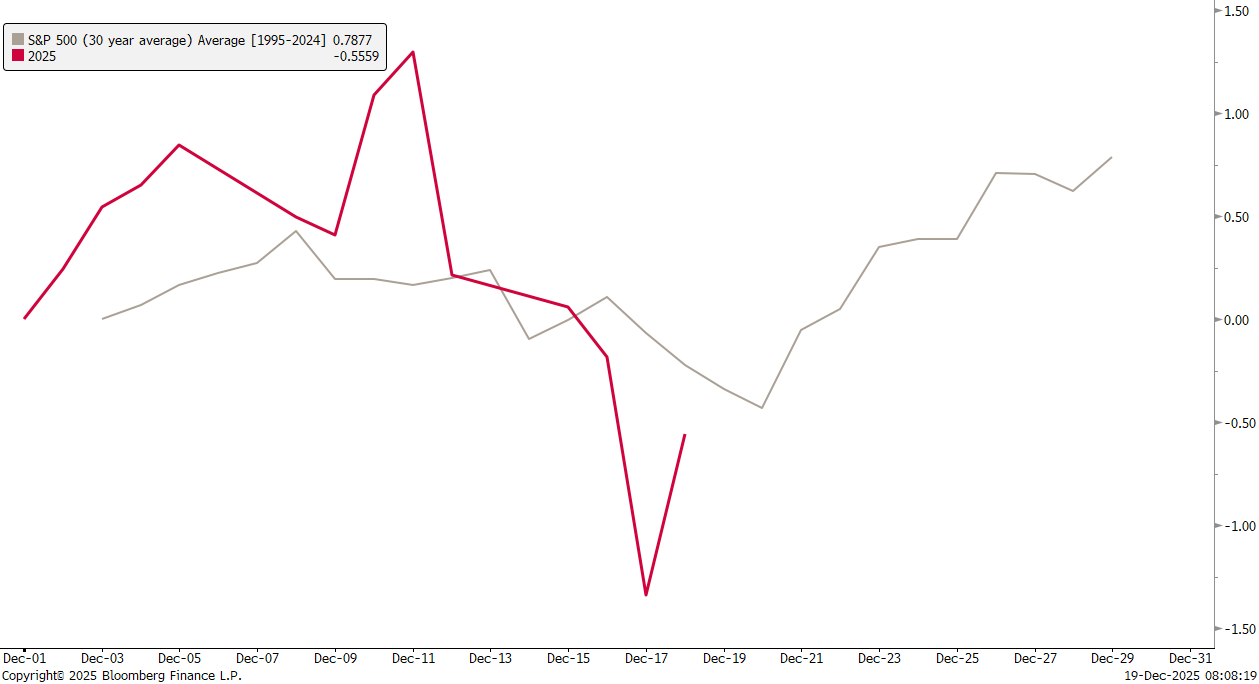

Still, in our Grinch vs. Santa Claus chart the S&P was able to close in the “tie” zone again,

but still, a look at the daily candle chart reveals that it was the fifth consecutive day where the market closed below the previous day’s opening:

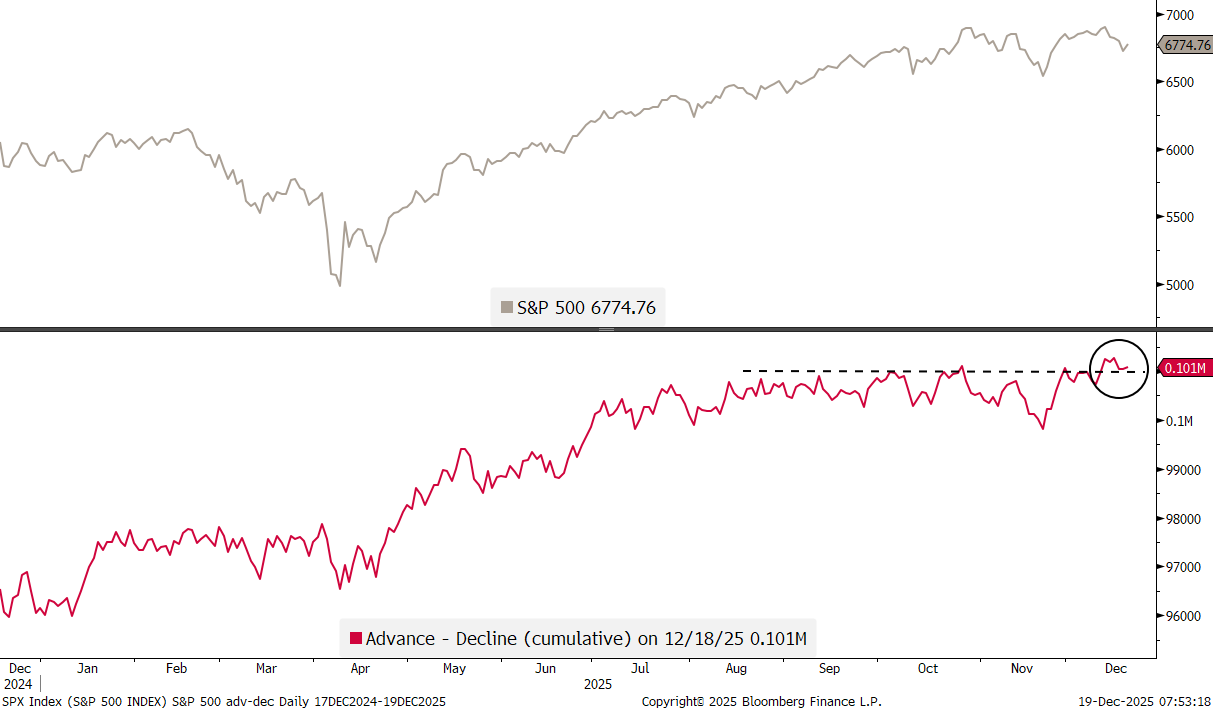

But then again, looking at market internals, breadth has been holding up when looking at the cumulative advance-decline ratio for the S&P 500:

Maybe more importantly, on each of the four negative sessions over the past week, new 52-week highs and beaten new 52-week highs by a wide margin.

And again, the moment of truth from a seasonal point of view is upon us …NOW!

European markets (SXXP) had a much friendlier session, with the STOXX 600 Europe index closing at a new all-time high:

One last point, which goes in favour of the Grinch, is the weakness of cryptocurrencies, where the bellwether Bitcoin is strongly diverging from (tech) stocks:

Correlations come and go and indeed in this case I think it is a crypto-specific issue, yet it is still something we cannot simply ignore.

In rates markets … nothing really.

With one big exception - JGBs.

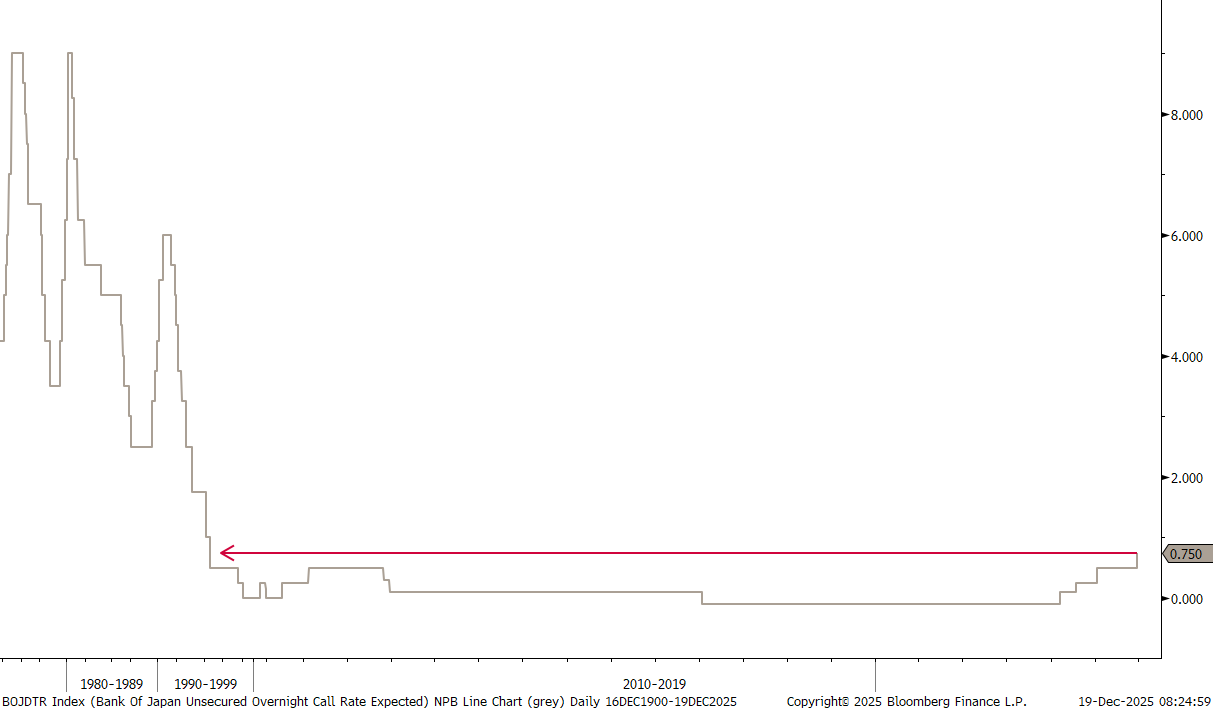

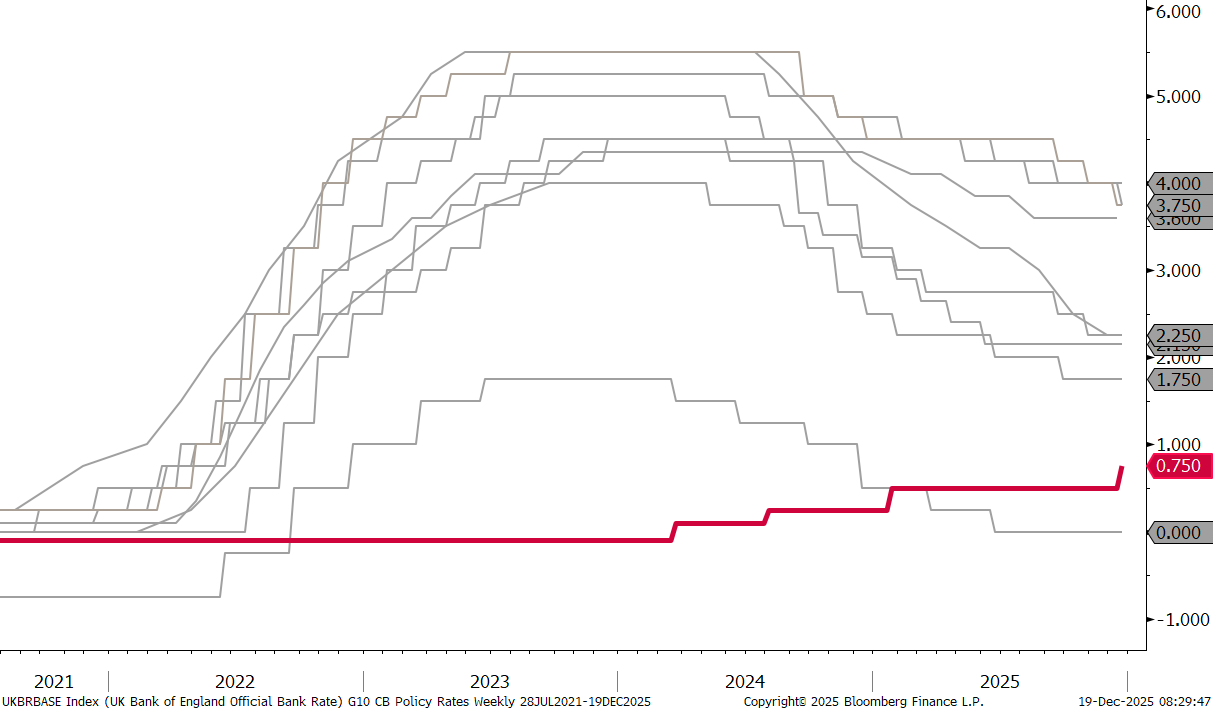

In Japan, the BoJ announced this dawn that they are lifting their key policy rate by a quarter percentage point to 0.75%, its highest level in over 30 years:

Mind you, it is still a very low level, actually the second lowest (SNB, are you asleep) amongst the G10 countries (red line):

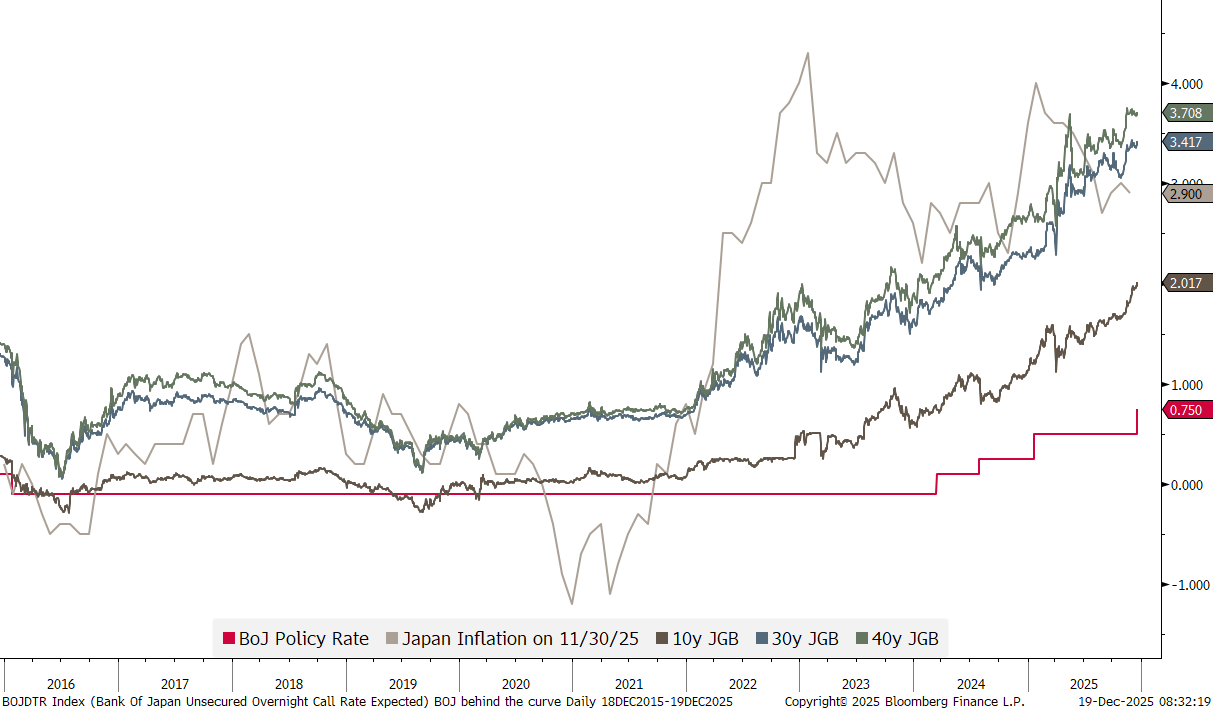

And, arguably, even with the highest policy rate in over 30 years, the BoJ remains waaay behind the curve when comparing market implied rates (dark grey, blue green) and inflation (light grey), with the later running at 3%:

Which brings us the Japanese Yen, which of course, sold off against the USD this morning (inverted scale!):

SAY WHAT?!

Of course I am being sarcastic, as the right move would have been for the Yen to strengthen as the interest rate differential between US and Japan narrows further:

One side (of at least three or four sides) seems to be wrong here. Either the JPY has to increase sharply, or US rates are completely wrong. Or a big carry trader (whale size) will blow up soon. Or a bit of all. This will be ‘fun’ to watch unwinding in 2026.

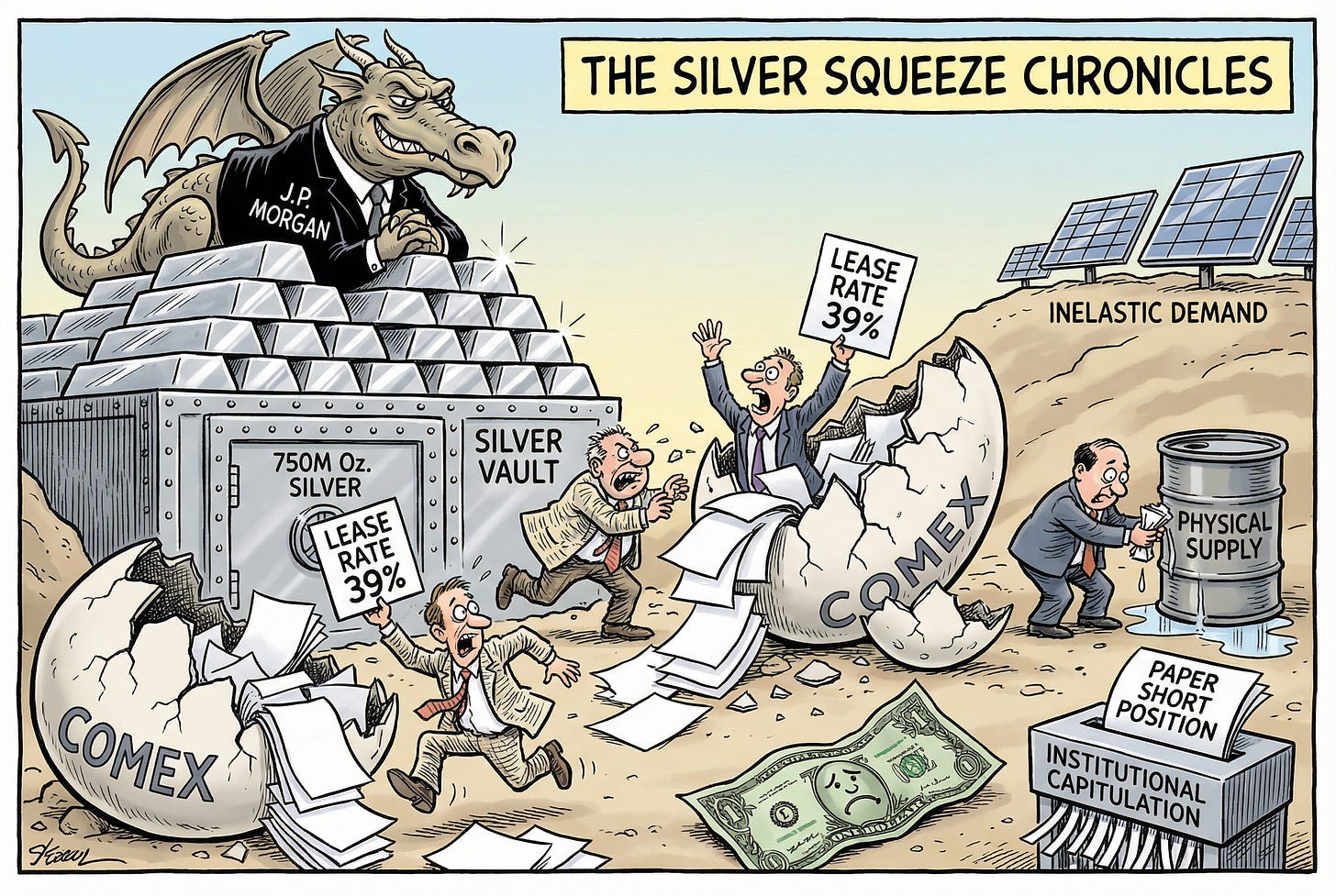

Meanwhile in precious metal land, it seems Silver’s theme song is “The only way is up”:

One market observer tried to explain it via this cartoon:

Joining the party recently has been Platinum, not least thanks to a EU decision relating to the future of automobiles, as discussed in the QuiCQ two days ago:

Well, dear readers, after Monday’s final Quotedian the “end” has now also come to the QuiCQ.

Time for the editor to take a two-week rest and refill the funny and silly but sometimes right out poetic market writing cells and skills. I wish you and your family a wonderful x-mas season and has we say in our swamp: a good slide into the new year!

Merry x-mas from André and his ghost writer