QuiCQ 20/01/2026

Peak Trump?

“Darkness cannot drive out darkness; only light can do that. Hate cannot drive out hate; only love can do that.”

— Martin Luther King Jr.

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

As usual, with US markets closed for a public holiday (MLK day), the rest of global markets lag guidance.

Having said that, US President’s continued aggressive stance towards the Greenland question, has set some of the larger macro wheels in motion. No doubt there will be much more to write about as the week progresses and the world’s global political and corporate ‘elite’ (yes, I put that word ‘elite’ on purpose into sarcastic high commas …) meet in Davos.

But here a very brief sneak preview on which snowballs have started rolling down those Swiss mountains.

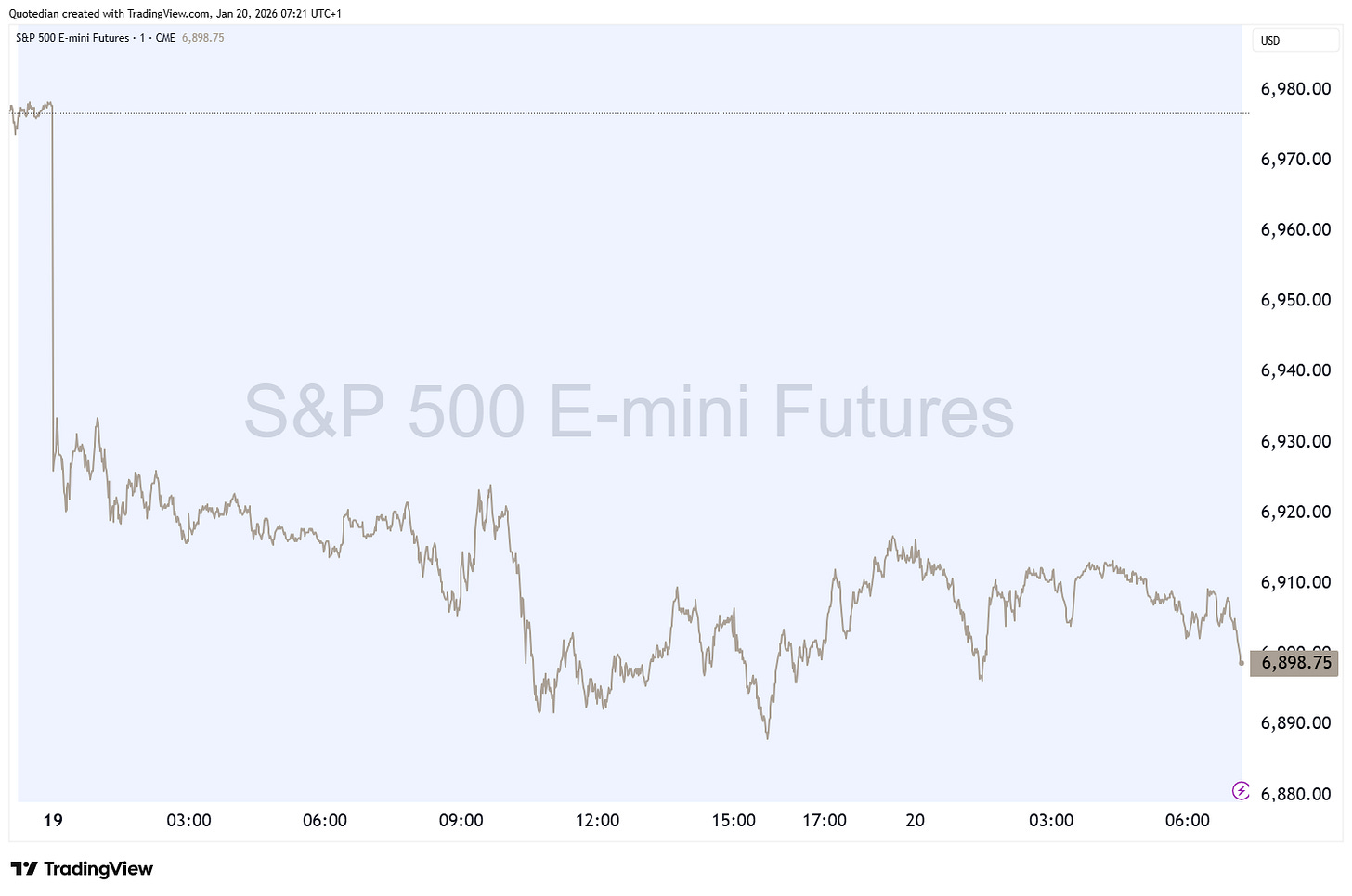

Equity futures (S&P 500 mini) have been trading lower (-1.2%) since opening on early Monday night:

European equity markets felt the (tariff) heat yesterday:

But probably more important (and dangerous) is the sudden move higher on US yields. Here’s the 10-year version:

Watch this space VERY closely …

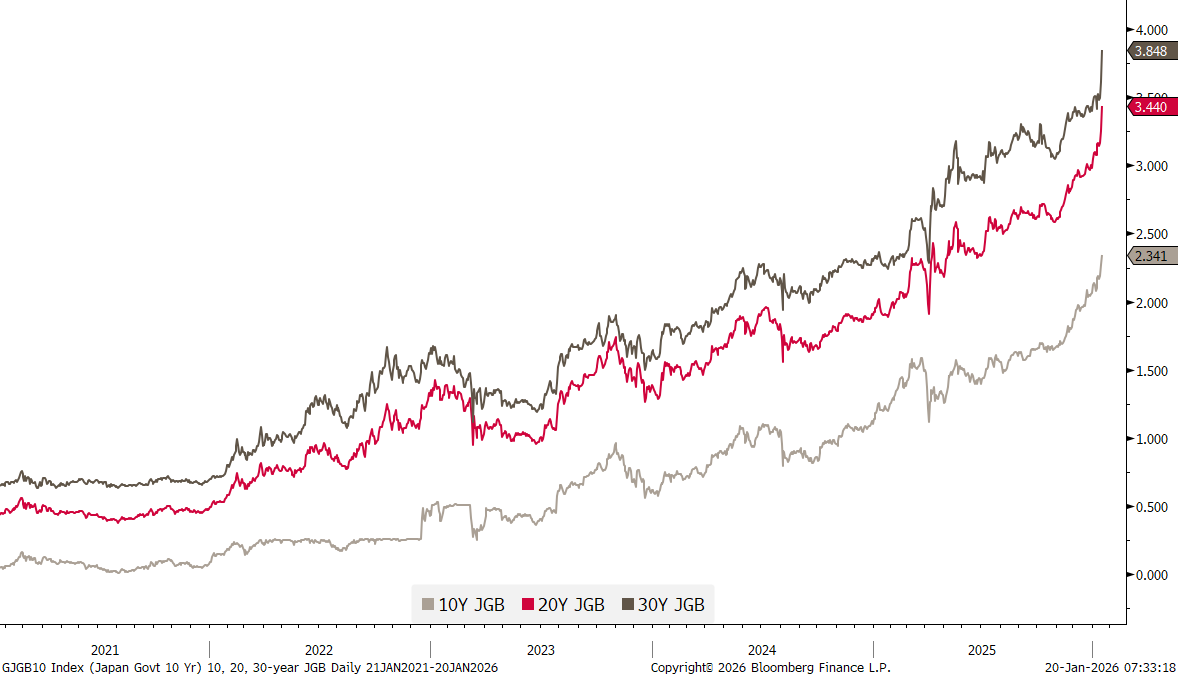

Yields in on JGB’s have been shooting higher again too, but for other reasons. Japan’s PM Sanae Takaichi is pushing through on her plan and has called on a snap election on February 8th, with the idea to use her high popularity to bolster/re-initiate her LDPs previous power-glory. Here’s one headline on Bloomberg this morning:

And here’s a selection of long-dated JGBs:

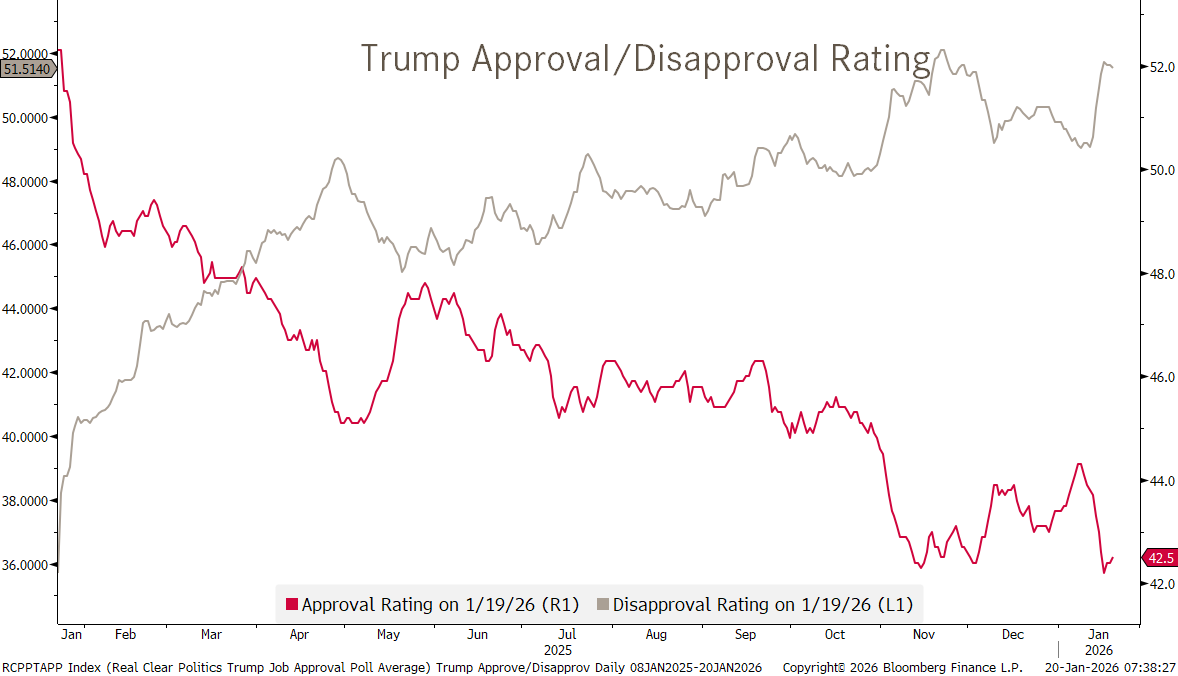

And talking about popularity:

Further on the move, Gold:

As mentioned in yesterday’s Quotedian “Typhoon Brewing” (click here), it does not seem long before the yellow metal will hit the 5,000-mark.

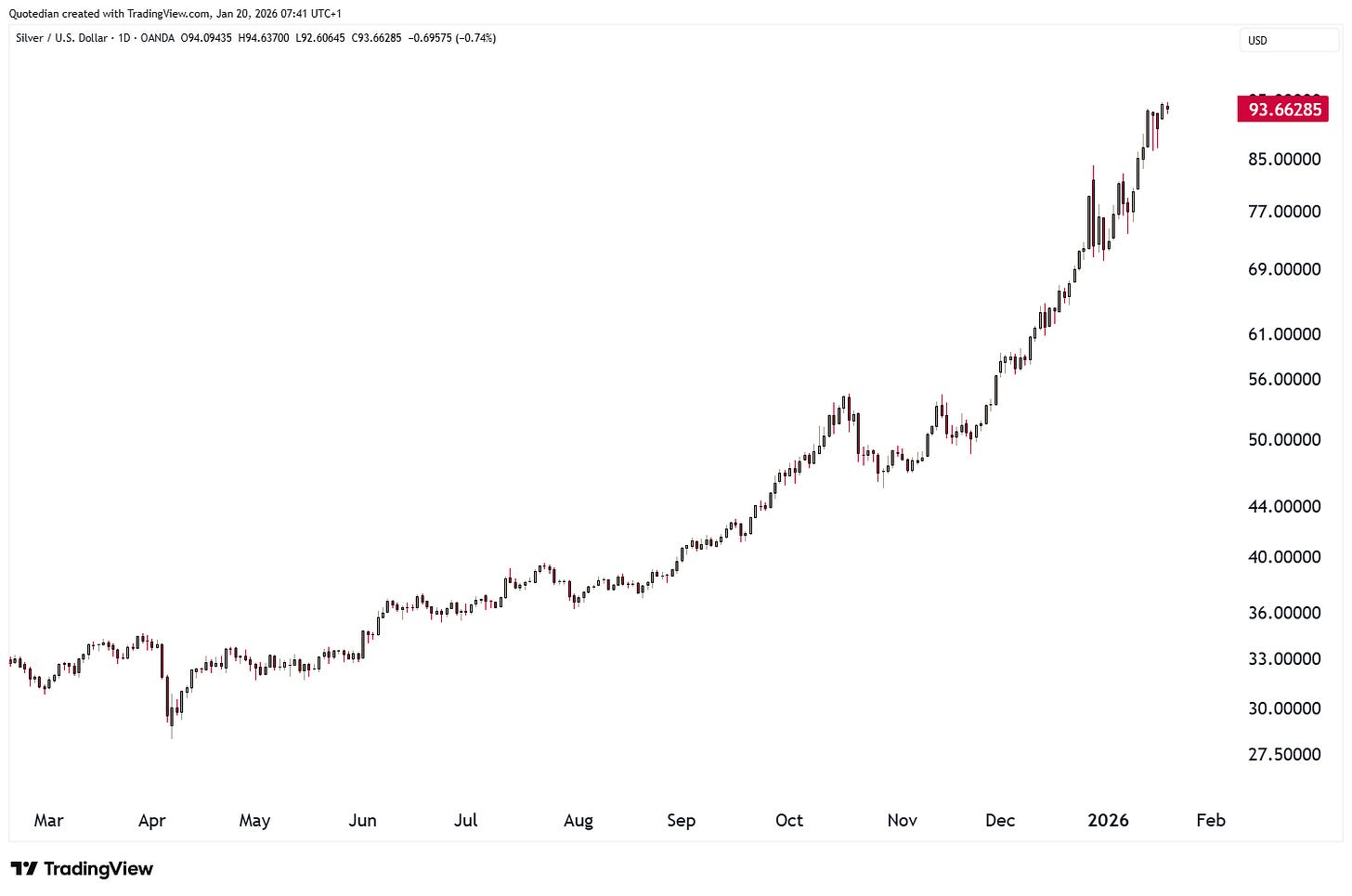

Also subject in this week’s Quotedian, was Silver and how COMEX prices are lagging the physical price in Shanghai, which is already well above $100:

Finally, one last observation, before I leave you to it. The futures price of crude oil is barely unchanged today, however, Natural Gas is nearly 20% higher this morning as I type:

Have a great day!

André

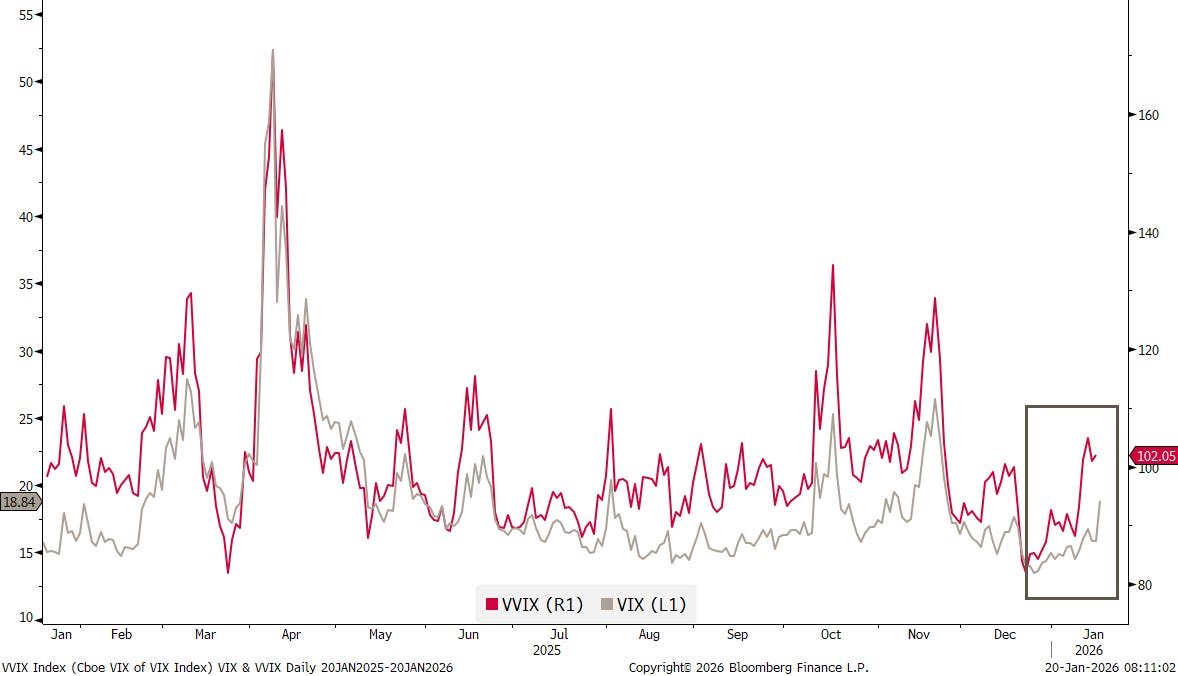

Equity volatility, measured by the famed VIX index (grey line), is sharply higher this morning. As so often, volatility of volatility (aka VVIX - red line) warned investors that this may happen: