QuiCQ 20/02/2025

Wise Advise from a friendly Bear

"Don't just do something, sit there"

— Winnie the Pooh

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Today’s Quote refers of course to the Minutes from the last FOMC meeting released yesterday, which showed that the Fed is happy to sit on its hands for now and leave key policy interest rates unchanged.

How did the market react? It didn’t. Or at least hardly so.

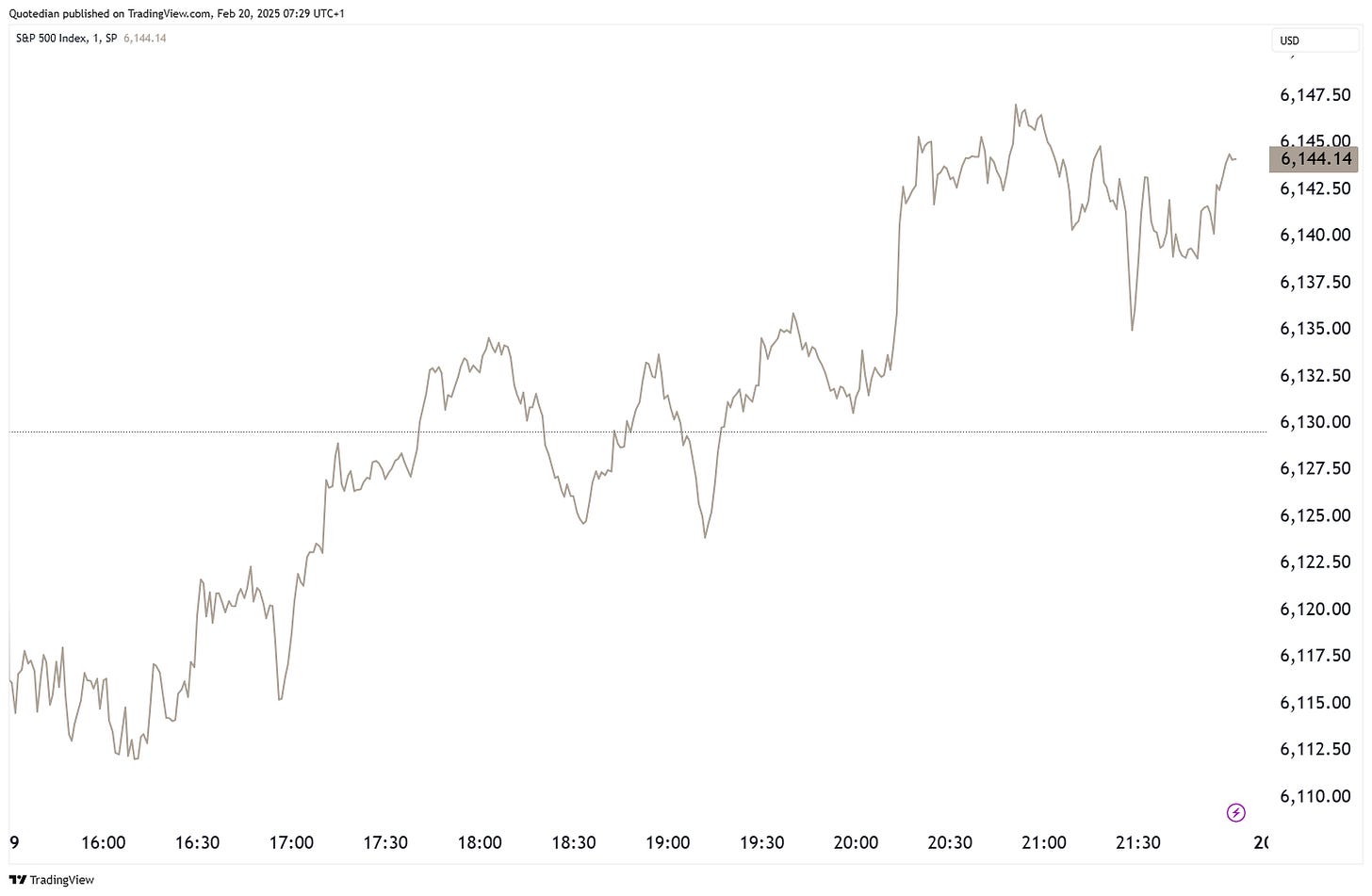

Equities had a fairly quiet session yesterday, spending the first part of the day in negative territory, then oscillating between light and shadow and finally moving higher towards the end of the session to eek out a small gain for another all-time high close. Here’s the S&P 500 intraday chart:

Looking under the hood, market breadth was pretty decent, with 9 out of 11 sectors higher on the day and three stocks advancing for every two declining. Thirty-six stocks in the index hit a new 52-week high, dominated by financials, whilst only eight reached a new 52-week high. Interesting here is that three out of those eight are Homebuilding stocks …

European stocks were in a more corrective mood and mode yesterday, but no wonder, given the steepness of recent advances. Take yesterday’s 1.8% drop in the DAX in context for example:

Not much to observe on the equity side of matters.

In interest rate realm, European bond yields are quietly pushing higher. Here’s the Bund as proxy:

Why? Inflationary pressures via increased defense spending? German elections? A change coming at EU-level? Perhaps a bit all of the above, not sure. But what I am sure of is that this move should be watched very closely.

Swiss and UK bond yields also pushed higher yesterday, with the latter getting additional tailwind from higher than expected inflation readings:

In currency markets, the Dollar/Yen cross should get a special mention, as the next downleg for the currency pair seems to have been initiated:

As you are well aware, we have been calling for a lower USD/JPY rate for a while now. Next support is 149.50 - on a drop below the trend should further accelerate.

And finally, in the commodity space, Gold continues to be the Superstar. After a brief consolidation session yesterday, prices are already pushing higher again:

Stay long.

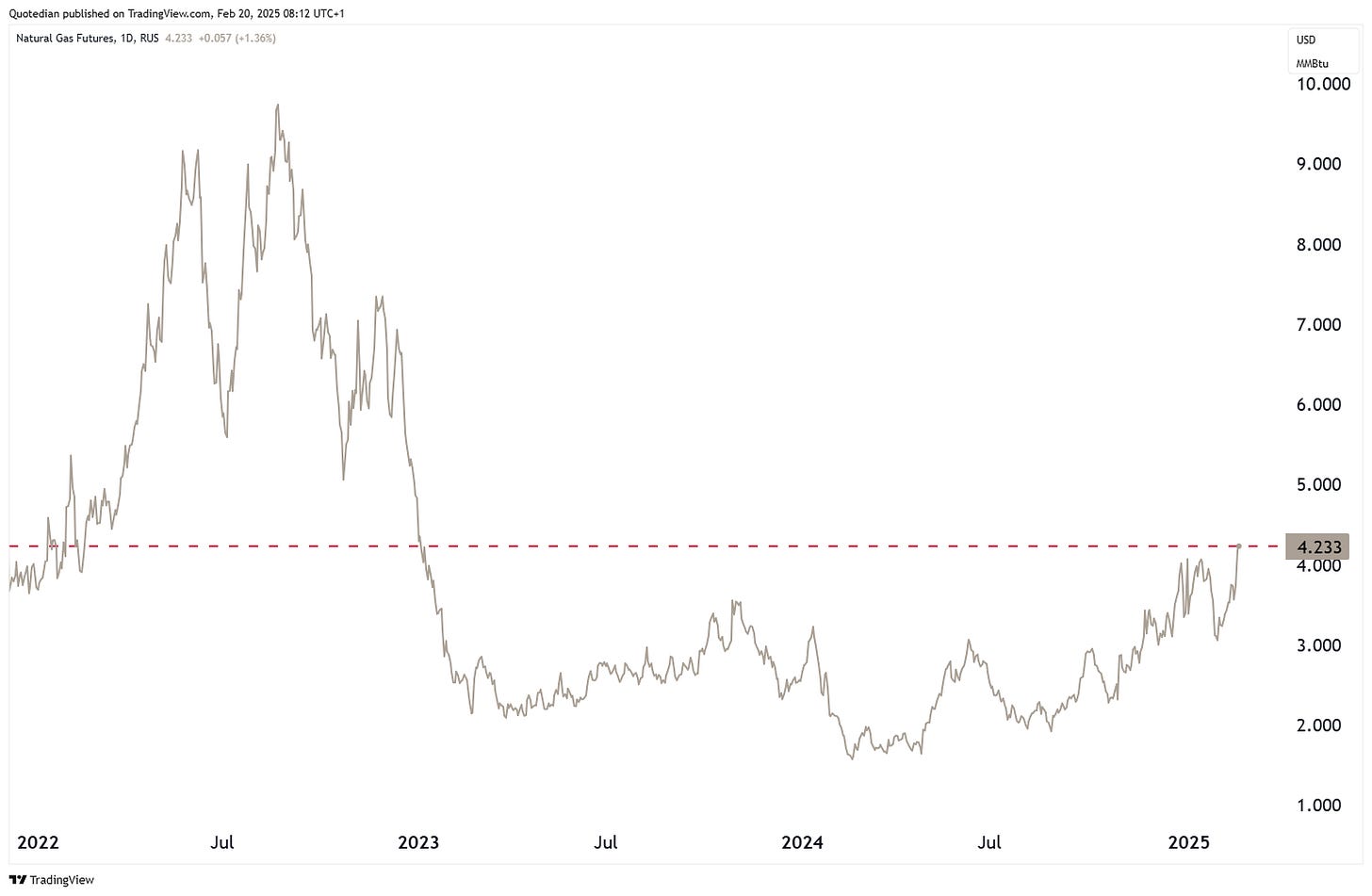

Another commodity that has gotten much less attention, but has quietly pushed to it highest level in over two years is another favourite long of ours - Natural Gas!

Also stay long.

You have been QuiCQed - have a great day!

Yesterday marked the five-year anniversary of the equity market peak before the COVID-induced bear market. Since then, the S&P has achieved 149 record highs and climbed 95% on a total return basis (14.3% p.a.):