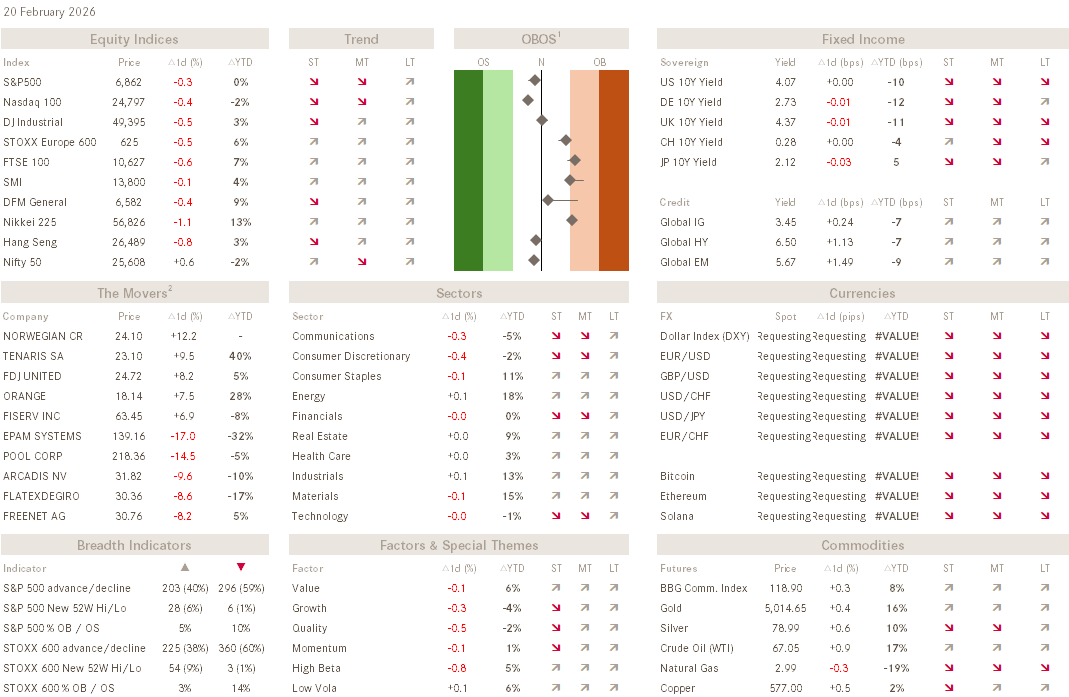

QuiCQ 20/02/2026

T-10

“Successful investing is about having people agree with you ... later.”

— James Grant

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Nothing beats the irony that US president Donald J. Trump yesterday at the conveniently after him renamed US Institute of Peace in Washington said:

“So now we may have to take it a step further, or we may not. Maybe we’re going to make a deal [with Tehran]. You’re going to be finding out over the next, probably 10 days.”

So, here we are at t-minus-10, or less. Or not. Confusing. But then what has been not over the past 14 months or so …

In any case, if in doubt, listen to the market.

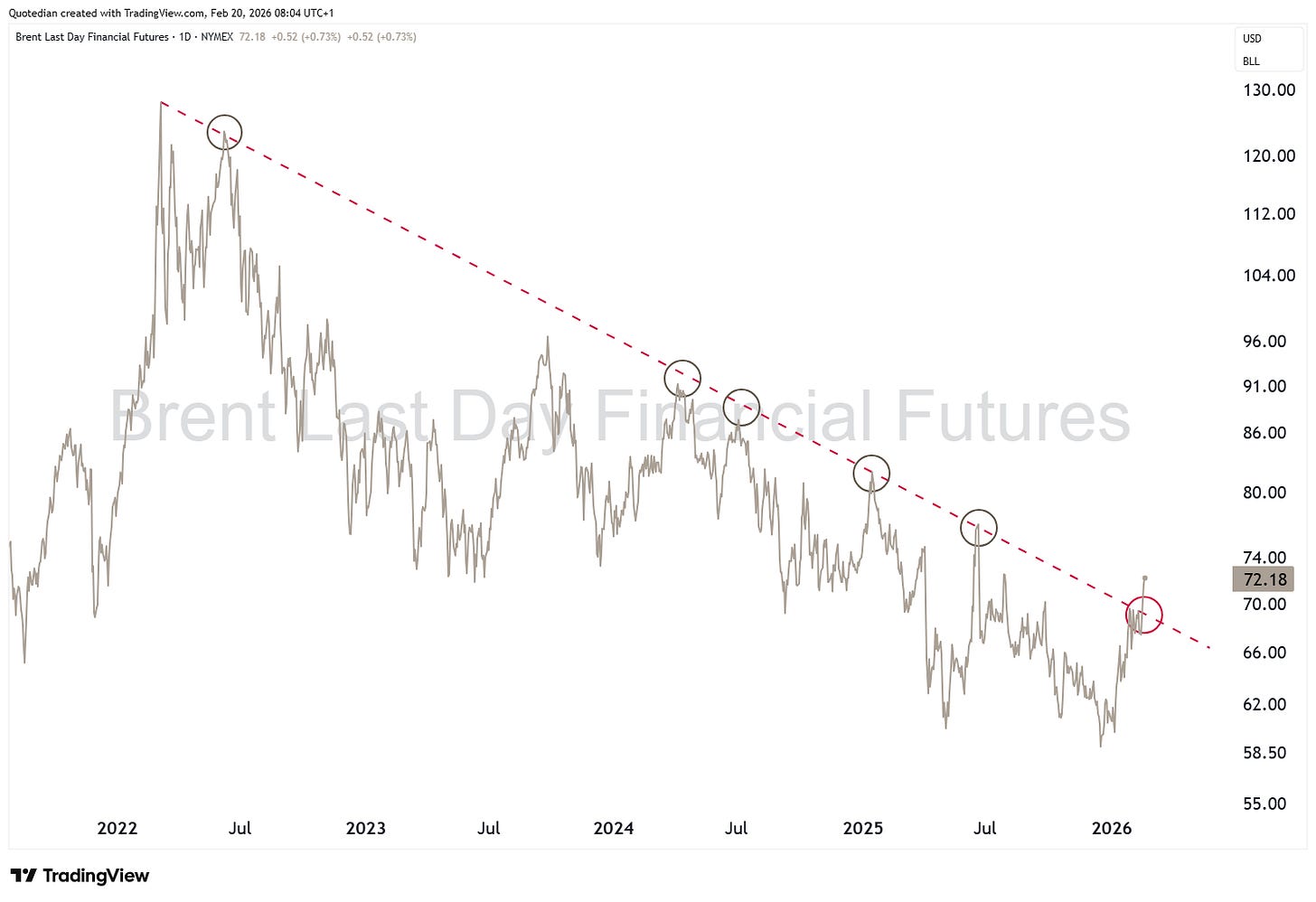

Oil is starting to vote with its feet that an US attack on Iran is coming. Here’s the short-term chart:

And here’s putting that into the longer-term (five years) context:

Stocks on the other than continue to say kind of “Meh”. Here’s the mighty S&P 500 (via the SPY ETF), which has gone nowhere since last November and has been range-trading since the beginning of this year:

Though, we may not forget that the equal-weight version of the same index (via the RSP ETF) looks substantially more constructive:

Hence, if you think that the situation around Iran is about to escalate, and equities have been to complacent about it, then maybe buy some puts on the RSP i.o. the SPY, with the former being only 0.2% away from a new ATH closing high and just about a percent from a all-time intraday high …

And as we discussed in the QuiCQ two days ago, volatility (VIX) is somewhat elevated, but far from triggering a max panic signal, usually indicated by a curve inversion:

What is surprising is how quickly retail investors (via the AAII bull/bear survey) have given up on their bullishness:

This could be a (contrarian) sign that retail has turned too bearish too soon and equity downside may be limited. HOWEVER, retail investors have NOT been putting their money where their mouth is, and continue to hold a record high exposure to equity:

Recent ‘strength’ in the Greenback may also suggest a US attack on Iran is likely,

but the true safe haven currencies to watch are probably the Swiss Franc and the Singapore Dollar.

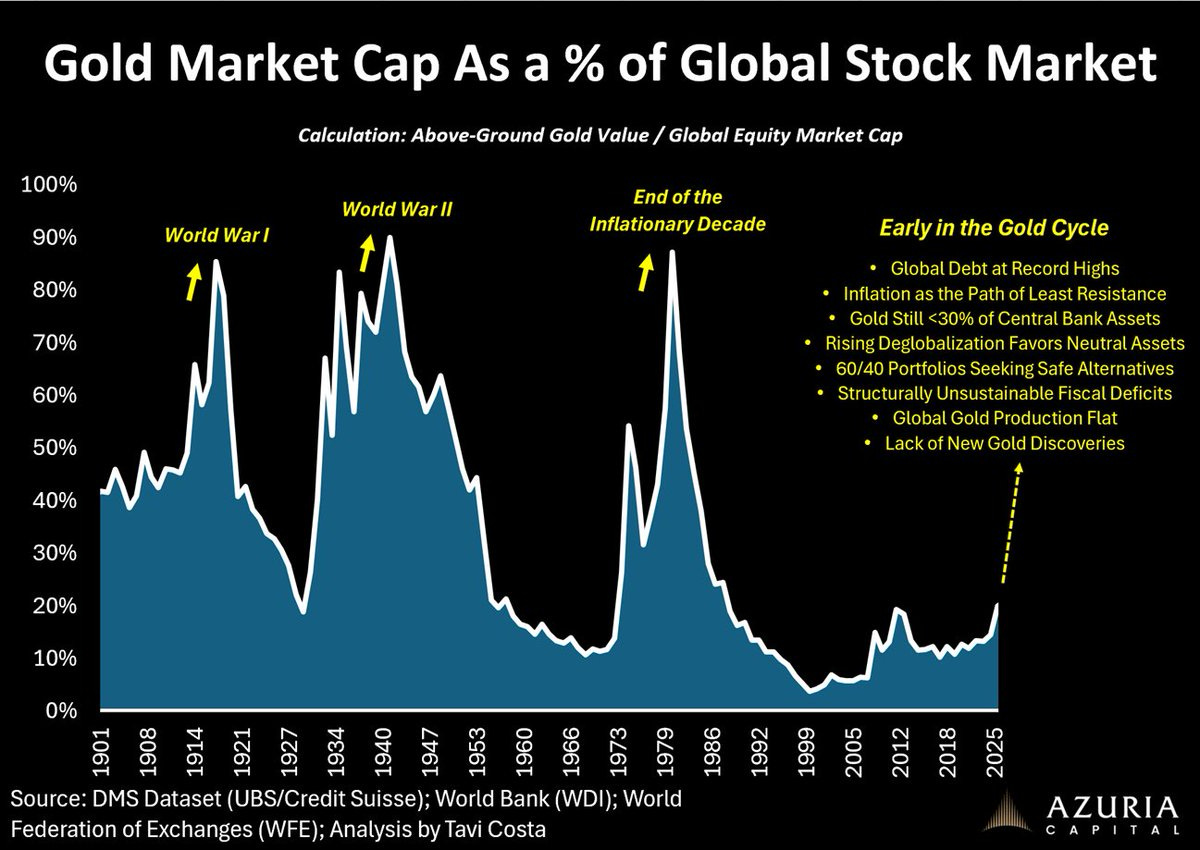

Another hedge for any kinetic escalation in the Middle East could be Gold, though I must say I am not sure how much of that is the price already:

But, in any case, who am I to oppose any further gold upside → go and check out the Chart of the Day below.

That’s all for today - have a great weekend - and - may the trend be with you!!

André

Gold bulls need no further comments here.

Gold bears need to get their act together.