QuiCQ 20/03/2025

Bird Watching 🦅🕊️

"And those who were seen dancing were thought to be insane by those who could not hear the music."

— Friederich Nietzsche

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Bloomberg’s John Authers opened his daily newsletter today with “Never be embarrassed to admit ignorance”, which was apparently what he first was told when starting his distinguished career as a journalist.

In that context it was very gratifying (and probably also satisfying) to see that Jerome Powell during his presser last night seemed to admit to have the same f**k-all clue as everybody else with regards to tariffs and how it is going to affect the economy. After all, he used the word "uncertainty" 16 times in his press conference today. Go figure.

As is well-known by now, the Fed left policy rates untouched in yesterday’s meeting, so for now we had the September 50 bp jumbo cut, a 25 bp cut in November followed by another 25 bp cut in December, and then a pause in January and now March.

There are still two cuts priced in for this year, but with less than a 20% chance for a cut at the next (May) meeting, some voices are getting loud already that the Fed may be done:

My view? Perhaps, but never underestimate the randomness of Trump! Plus, Liberation Day (April 2) could throw the world into economic mayhem … or not …

Uff, all so confusing, let’s stick to do what we do best, which is observe market movements and continue with our mantra that “price leads narrative”, or as I said to my asset management partner-in-crime Tim yesterday:

“We believe in price, not words”

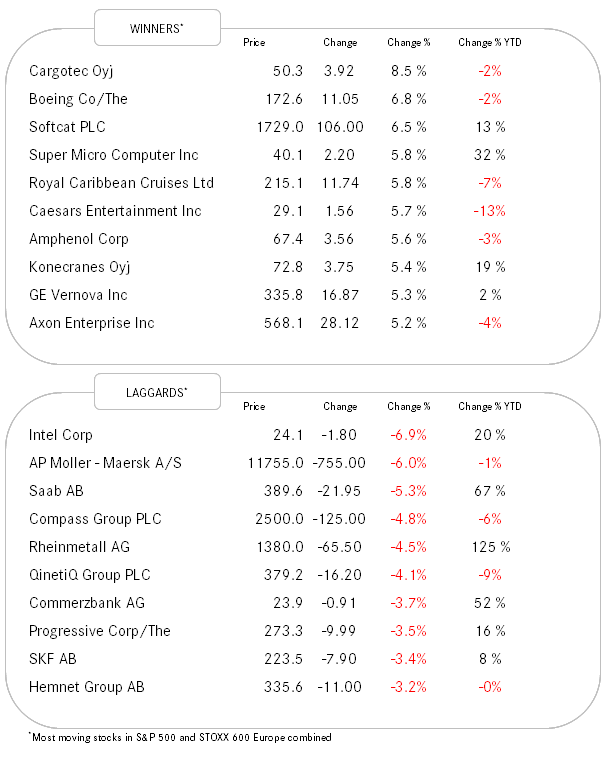

Wall Street closed higher on the day, though stocks had showed upside momentum already pre-meeting but got an extra ex-post boost. Here’s the intraday chart of the S&P 500:

Participation in the rally was relatively broad, with all eleven economic sectors printing green and roughly three quarters of the stocks in the index up on the day:

The key level to watch on the S&P 500 is 5,700 and hence close by - a close above would somewhat improve the short-term outlook.

Treasury bonds rallied post the FOMC decision, as witness on the US 10-year Treasury yield chart:

I guess the (yield) weakness came as market focused on the economic slowdown part of Powell’s overall stagflationary message, rather than on the inflationary part.

In currency markets, let’s take for the fun of it another perspective than the usual Dollar view today, focusing a moment on the Japanese Yen. Because that currency strengthened versus the other G-10 currencies over the past 24 hours, pretty meaningfully:

This despite the BoJ having left their key policy rate unchanged, but probably market participants are focusing on the continued rise JGB yields across the term structure,

and hence the dwindling spread between Japanese yields and its G10 counterparts. Here’s the US-Japan 30-year version of that spread contraction:

With all this uncertainty, to which even the mighty Fed had to admit last night, does anybody really wonder why Gold is trading now at $3,050, up nearly 90% since late 2022 and up another 20% alone since Trump’s election?

Asian stocks carry as region a negative sign in front of their performance today, though dispersion is quite broad. Hong Kong’s Hang Seng index is taking a two percent breather from their recent rally, whilst Taiwanese stocks for example are up to the nearly same extent.

European index futures are a tad negative some 40 minutes before market opening, whilst US index futures suggest a higher opening to the tune of about half a percentage point.

There will be no QuiCQ tomorrow and I am not sure yet if I will find the time for writing The Quotedian this weekend due to a heavy travel schedule. Hence, back latest next Tuesday, everything else may be a (positive?) surprise :-)

May the trend be with you!

William Shakespeare’s wrote in Act II, Scene 7 of The Merchant of Venice (1596):

"All that glisters is not gold."

Wasn’t he write, that little Nostradamus!

Nor is it necessarily silver …

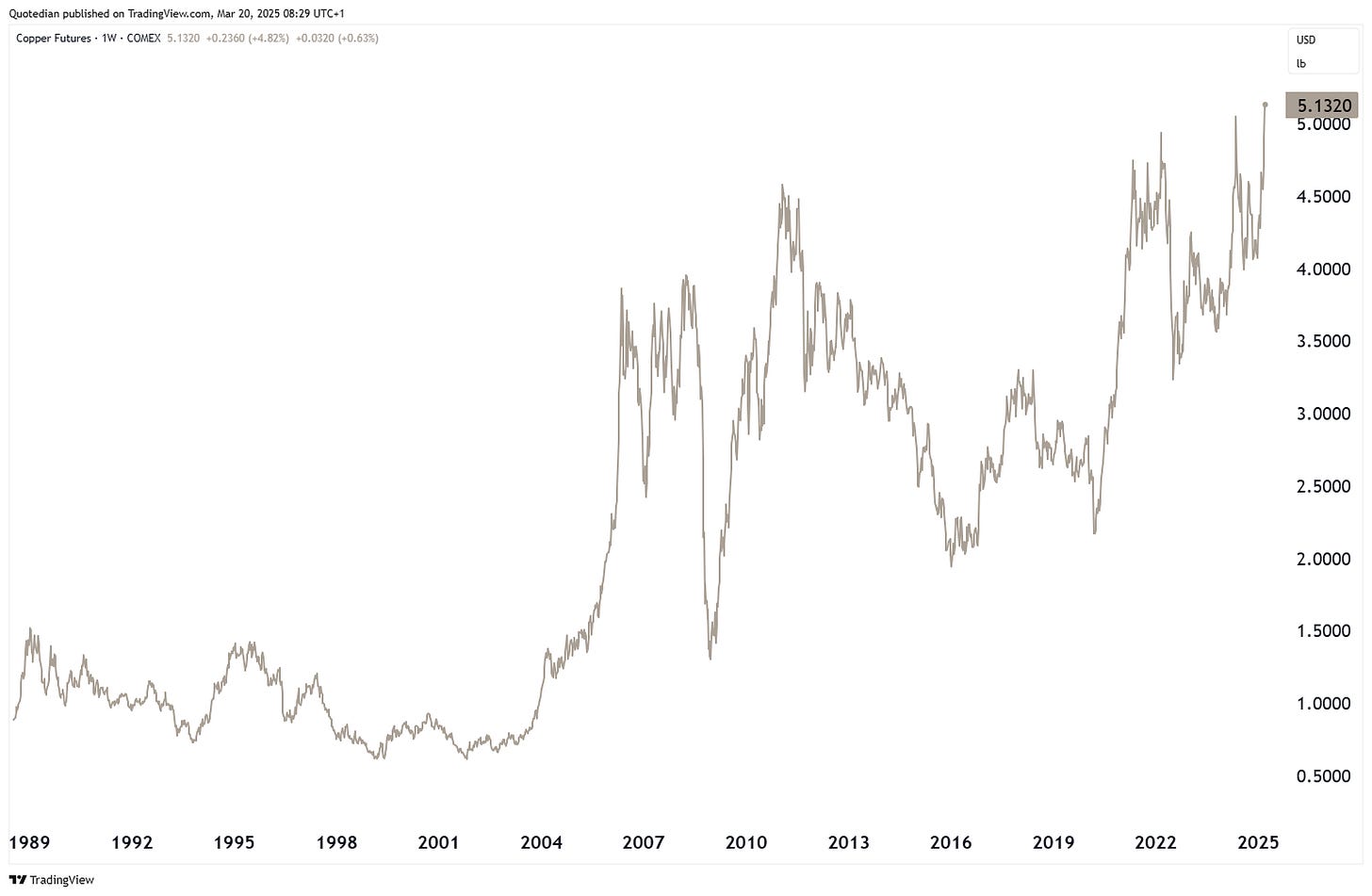

But COPPER for example is shining like made these days too, trading at an all-time high this week: