QuiCQ 20/05/2025

Snap Back

“It lasted about as long as a politician’s promise.”

— Anonymous

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Initial worries post Friday’s US debt downgrade by Moody’s commented extensively in our weekly Quotedian (click here), abated quickly in Monday’s session and were nearly completely gone by the time the US market opened for trading.

Stocks (S&P 500) opened about a percentage point lower, already off their lows reached when looking at the futures prices (ES1), and then gradually recovered into positive territory by session end:

Though admittedly the rally was a tug-of-war between bulls and bears, with roughly the same number of stocks advancing (258) on the day as those declining (242). Seven sectors rose yesterday led by health care, whilst four ended lower, with energy stocks making up the tail:

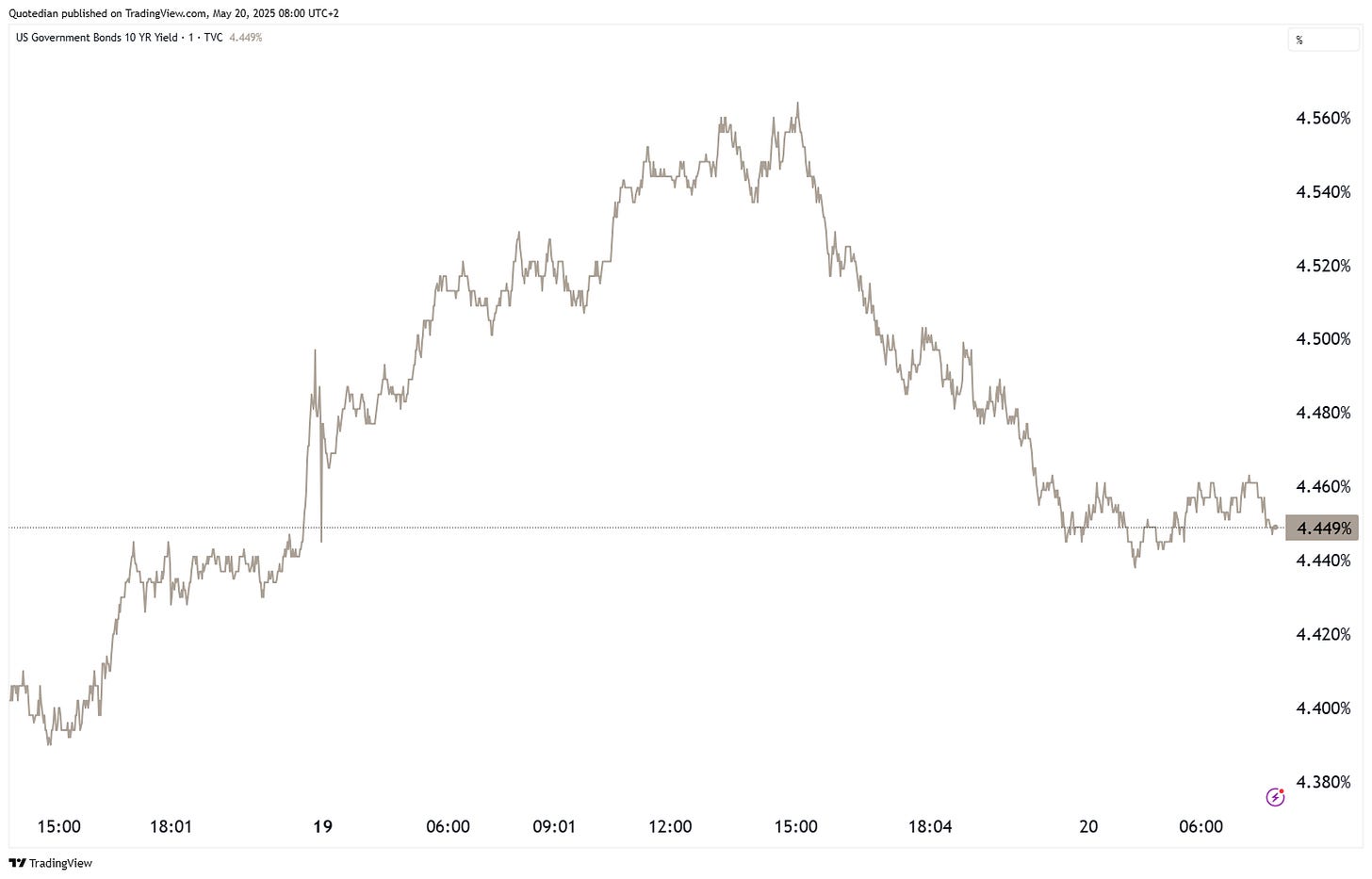

Bond yields had a similar reaction function as stocks, though the opposite up-then-down move, of course.

The US 10-year treasury yield shot up as high as 4.56% post the Moody’s decision, to now trade more or less at the same level it had finished on Friday evening:

Similarly, the 30-year yield had shot up above 5% yesterday, but now trades even lower than it had on Friday pre-debt rating cut:

The only ‘victim’ that continues to be beleaguered is the US Dollar, which unsurprisingly softened over the weekend and has stayed down on Monday. Here’s the US Dollar index (DXY) as proxy for all crosses:

Asian markets are firmer this morning, led by a very decent 1.3% rally in Hong Kong. European index futures also hint to a positive start, whilst US futures are trading currently in negative territory.

Time's up, more tomorrow - May the trend be with you!

The S&P 500 is still about 3% shy of reaching a new, post ‘Liberation Day’ all-time high. However, industrial stocks, below proxied via the SPDR Industrial ETF (XLI) have already achieved such a new ATH, on an absolute (top clip) AND on a relative (bottom clip) basis:

Not tech, not communications, not consumer discretionary … industrials are the new leadership and are hence where investors should be overweight.