QuiCQ 21/08/2024

Barbaric

“In truth, the gold standard is already a barbarous relic.”

-- John Maynard Keynes (1924)

Prefer to read today’s QuiCQ in PDF format? No prob, download it here!

Yesterday I read somewhere that in the past the market (S&P) had never gone up for a nineth consecutive day, after having gone up for eight and moving more up more than 5% during those eight consecutive days. Low and behold that turned out to be true as the S&P 500 'plunged' 11 points (-0.2%) yesterday. The good news is that with this one day 'correction' out of the way now we would be ready for another consecutive eight days up… Indeed, this yesterday's session have little bearish feeling to it, the advance/decline ratio not quiet reaching 1:2 and four out of eleven sectors eking out gains. Energy stocks (-2.6%) took by far the worst hit as the price of crude oil continue to slide. But again, our indicator of new 52-highs and lows showed 29 new highs and 0 new lows.

Bonds rallied as the US 10-year treasury yield slumped from nearly 3.90 to 3.80%. The US Dollar slipped in unison with US yields, pushing the EUR/USD cross above 1.11 for a first time since July of last year on a closing basis.

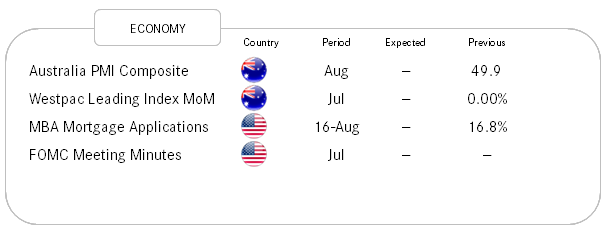

For today, we expect release of the FOMC minutes and the NFP revision. Fade both.

Seems this is turning into the 'Golden Week' for the QuiCQ, with already the second Gold-focused "Chart of the Day".

Based on an article by the always fantastic John Authers at Bloomberg, I found it extremely interesting to learn (again), that the S&P 500 in gold terms, is exactly where it was in … drumroll … 1971! Stunning, isn't it?

And why exactly did we choose the starting date of August 15th, 1971, for our study? That is the date where then US President Nixon abolished the gold standard, decoupling the price of Gold from the US Dollar.

There was a gold bubble in the 80ies, an equity bubble in around the millennium, followed by another gold bubble during the GFC. But all in all, we are where we started.