QuiCQ 21/11/2024

Gib gas! (Let her Rip)

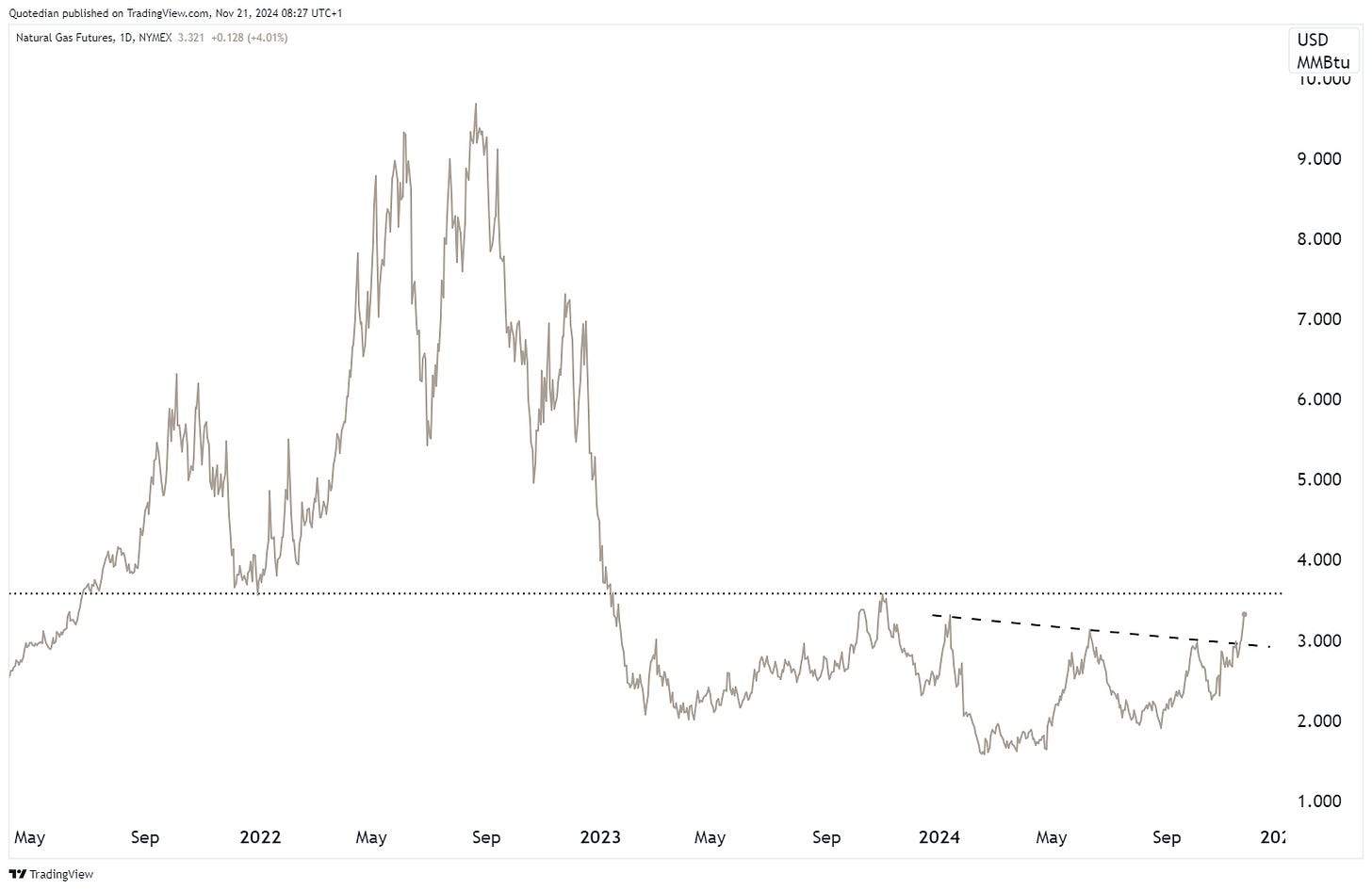

“The longer the base, the higher the space”

— Wall Street Adage

Quiet the few micro moving news over the past few hours:

NVDA came, saw and reported … another set of astonishing results. However, they still kind of failed to live up to apparently even more astonishing expectations, with the stock (small) down after-hours.

The US Department of Justice is increasing pressure on Alphabet to sell Google Chrome in order to curb the companies monopoly.

Tycoon Adani Charged by US Over Alleged $250 Million Bribe Plot

NVDA trades about 2.5% lower, GOOGL is flat and Adani Enterprise (ADE) is down 20% as I type …

Taking a broader perspective, US market closed flattish yet again yesterday, as the market was probably waiting for the NVDA numbers. Asian markets are broadly lower this early Thursday, but Western equity market futures, especially in Europe point to a not too shabby start when cash markets open.

Global yields pushed higher in yesterday’s session, as European wage numbers pressured to the upside and the UK inflation (CPI) also surprised with a higher-than-expected reading.

Gold pushed higher too in yesterday’s session and already again today, despite a stronger Dollar, now having recovered nearly half of the losses since early November.

One of the most important macro movers yesterday, IMHO, is the breakout in natural gas prices higher. We had discussed this already in Monday’s Quotedian (click here), with the break now all but confirmed:

Of course, there are always argument for some further resistances (dotted lines) just ahead,

but, to circle back to our QOFT at the beginning of today’s post, the “the longer the base, the higher in space”: