QuiCQ 22/01/2025

An Apple a day keeps the ... gains away

“Every age has its peculiar folly: Some scheme, project, or fantasy into which it plunges, spurred on by the love of gain, the necessity of excitement, or the force of imitation.”

— Charles Mackay (1841)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

With the presidential inauguration final and out of the way and a light economic agenda, focus in yesterday’s session was mostly micro-factor, i.e. company-level driven.

Probably on the back of a bit less rapid tariff announcements (never though I’ll have to write an intro as this), the S&P 500 closed up about nine tenth of a percentage point, with ten out eleven sectors printing green, leaving us with following heatmap:

49 stocks hit a new 52-week high, versus only one hovering at a new 52-week low, a testimony to a much improved breadth in the market compared to only a few weeks ago. On Europe’s STOXX 600 index, which was up a bit less than half a percent, that ratio was a similar positive tilted 70 to 2.

But going back to my initial remark that it was a company-level driven session, and rechecking the heatmap above, one sore thumb sticks out immediately. Apples stock slide (another) three percent after downgrade from a couple of research houses over concerns of their iPhone sales. The ‘good’ news was that the share price was able to rebound intraday by about one percent of a key support (dashed line):

One of the other big movers yesterday, albeit after-hours, was Netflix, which report a stellar number of new subscribers, bringing the overall number to over 300 million addicts viewers. The stock powered 14% ahead in after-hours trading and trades just shy of $1,000.

Bond yields around the globe had a quiet session, with European yields a tad lower and US yields climbing back from Monday’s lows from around 4.53 to 4.60 to finally settle in around the 4.58% level. Especially UK yields (10-year version below) softened further, probably very much to the delight of the country’s (current…) government:

The US Dollar softened against nearly every other major currency on the day, with two notable but not surprising exceptions …

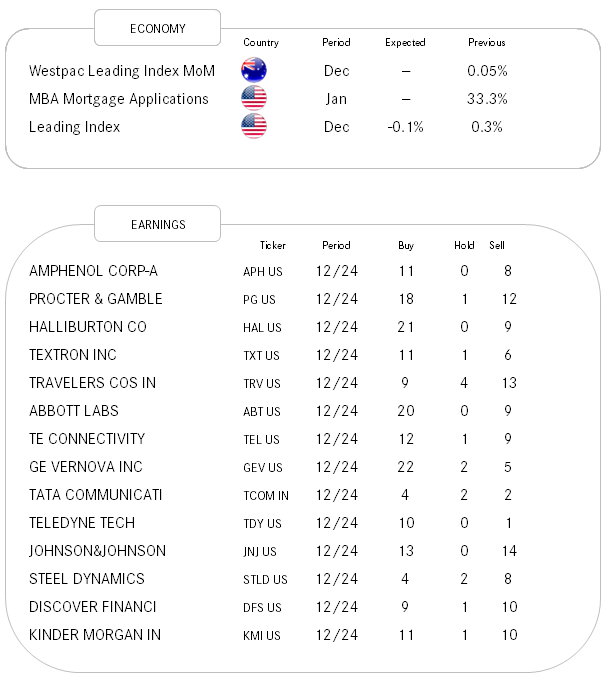

For today, again an economic-light and earnings-heavy agenda, so stock pickers’ paradise should continue for now…

Have a great day!!

For today’s Chart-of-the-Day I leave you with following observation from Jason Goepfert at the SentimenTrader: