QuiCQ 22/04/2025

Financial Reckoning

“In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could”

— Rudiger Dornbusch

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Quite a disastrous start to week in US markets as most of Europe was still closed and mourning the loss of Pope Francis on Easter Monday.

Stocks tanked, the US Dollar tanked, yields rose but above all, Gold is hitting one new all-time high (ATH) after the other.

Let’s take it turns though, starting with the likely culprit for yesterday’s messy market. Apparently it was this despotic presidential Tweet that set fire under investors’ collective bum again (typos not mine):

US equity investors immediately voted this supposed attack on the independence Federal Reserve Bank with their feet. Here’s t intraday chart of the S&P 500, which was pretty one way until some very late bargain hunters appeared on the plain:

Selling was broad with the best performing sectors (consumer staples) still down nearly one and a half percentage point on the day and less than 10% of stocks in the S&P able to print green:

The US yield curve (10y-2y)steepened materially,

in a combination of lower short-term yields as a tariff-induced (increased uncertainty) recession is likely to bring lower central bank policy rates eventually,

and higher yields at the long-end,

as response what impact such rate cuts could have on future inflation (higher).

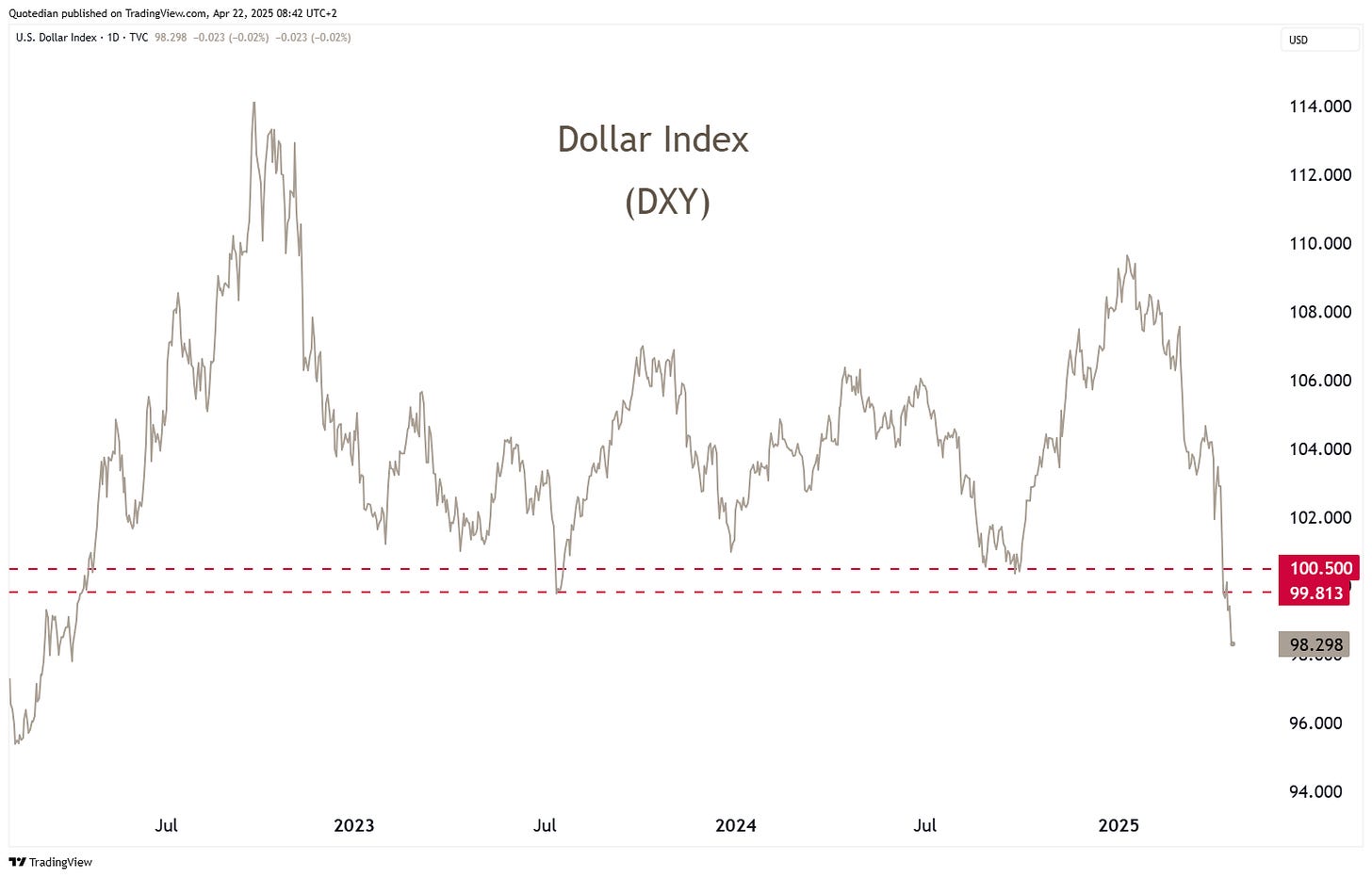

But the true victim continues to be the US Dollar, with the USD Index (DXY) now clearly having undercut long-term support:

Here’s the EUR/USD cross, if that is a more ‘comfortable’ read to you:

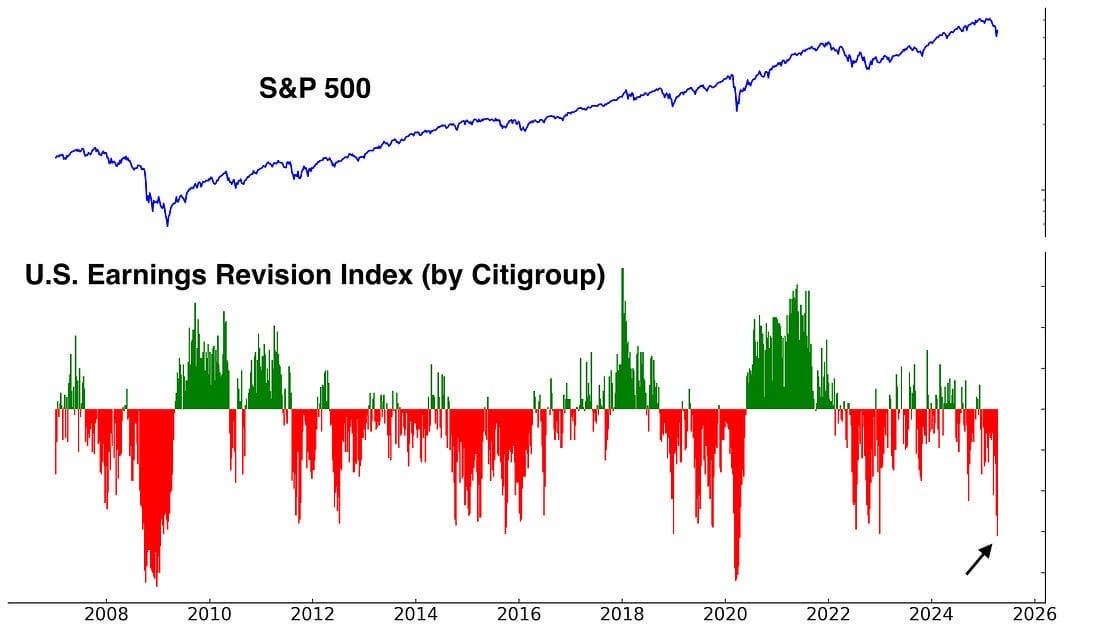

This week the economic agenda is on the ‘milder’ side, but earnings season is in full swing. Keep in mind that it is NOT the actual earnings which are reported that matter, as they are fully excluded from any ‘Obliteration Day’ impact, but rather the forward guidance given by CEOs and CFOs. And that, we expect to be EXTREMLY cautious. And so do financial analysts apparently, according to the following charts:

Earnings downward revision is the largest since COVID 19 in early 2020.

All in all, this is not about trade wars anymore, maybe not even capital wars, but rather a complete reframing of the global financial system, with all the dangers attached.

Be careful out there and may the trend be with you!

Talking of COVID-19, measure in Gold, the S&P 500 is now back below to those COVID lows: