QuiCQ 22/05/2025

AU!ction

"Bonds are the sentries of the economy. They see the enemy before anyone else does."

— James Grant

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

It seemed only yesterday (actually it was yesterday - click here), that I asked you to “stay tuned” regarding a badly gone JGB auction in Japan, pushing the 30-year bond to levels not seen in … well … over 30-years.

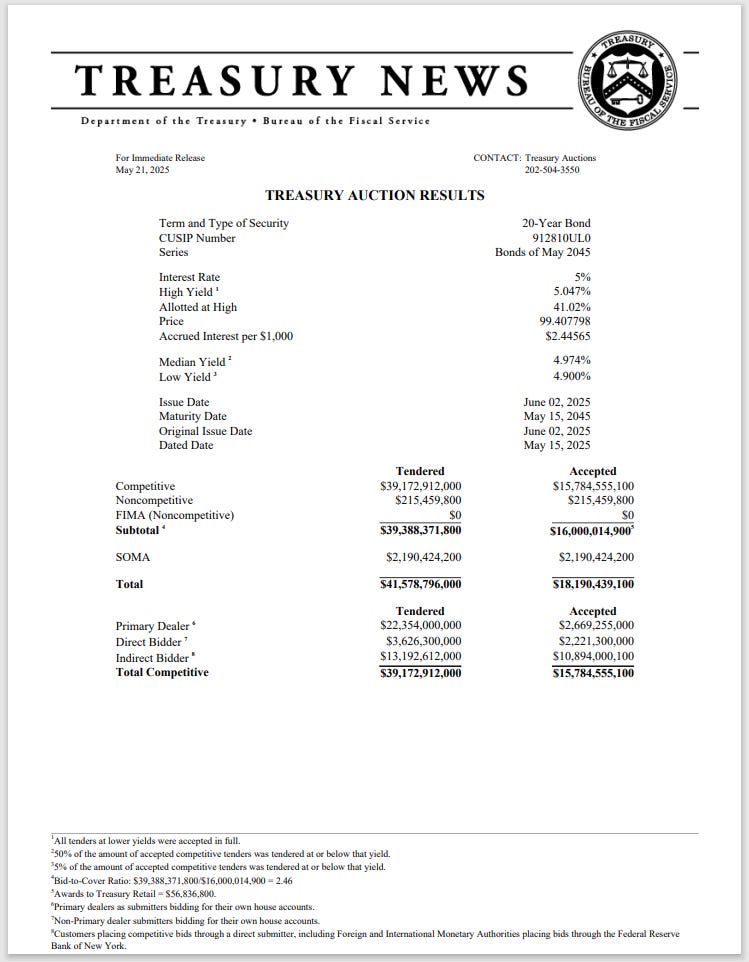

Yesterday, later European afternoon, this silly, apparently boring US government paper showed that a 20-year treasury bond auction had attracted little interested, meaning a higher yield had to be admitted to by the Treasury Department:

Barrons had a good recap:

The auction saw investors accept a yield of 5.047% on the 20-year note, compared with the past six auctions’ average of 4.613%. It was also 0.011 percentage points higher than the yield seen before the bidding deadline. This was the first time the Treasury sold a 20-year note with a rate over 5% since October 2023. Back in the pandemic, it could sell its 20-year debt at 1.22%. Higher rates signal that demand is weak, as the Treasury has to entice investors with higher yields to buy U.S. debt.

Joining the upwards drift in Japanese and US Treasury where other international bond markets too, not least the UK Treasury yield, after a higher than expected inflation reading earlier in the day:

Here’s the corresponding “something’s afoul” chart to go along:

Back to the US market, where the US 10-year yield trading AND closing(!) above the level where Trump and Bessent panicked a few weeks ago, led to a pretty broad sell-off in the stock market.

At a -1.6% move on the day, the S&P 500 saw its biggest drop in over a month:

But a 2.1% retreat on the S&P 500 Equal-Weight index would give away that the sell-off was broad:

Actually only 18 stocks out of the 503 in the index closed higher on the day …

But it were the more speculative corners of the market that were sold off most:

With the sell-off taking place mostly after the European closing, markets in our geographical zone had closed flattish on Wednesday, but futures are unsurprisingly ‘deeply’ negative this early Thursday. Asian markets have also sold off, with Japanese and Hong Kong stocks down to the tune of about one percent.

Other asset classes affected by the bond yield rally?

The Dollar trades softer of course, as worries over the governments finances expressed in yesterday’s bond auction outweigh any positive impact from a larger interest rate differential:

The break of the short-term recovery for the Greenback is now confirmed, at the Dollar Index is likely to retest the previous low just below 99.00 in due course:

This is what it looks like translated onto the EUR/USD cross chart:

As I highlighted also yesterday in the Chart-of-the-Day section, in terms of valuation, the USD has potentially much more downside ahead.

Last but not least, another two asset classes affected, in this case positively by the bond market turmoil, are Gold,

and Bitcoin,

with the latter exceeding the previous all-time high (dashed line) and then some!

Time's up, more tomorrow - May the trend be with you!

Not to scare the living daylights out of anyone, but this chart from TS Lombard shows how interest payments in the US is taking a larger portion of the US deficit:

Ladies and Gentlemen, avoid bonds.