QuiCQ 22/07/2025

Too Complacent?

“The fastest way to end a winning streak is to trade like you deserve one".”

— Trading lore

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

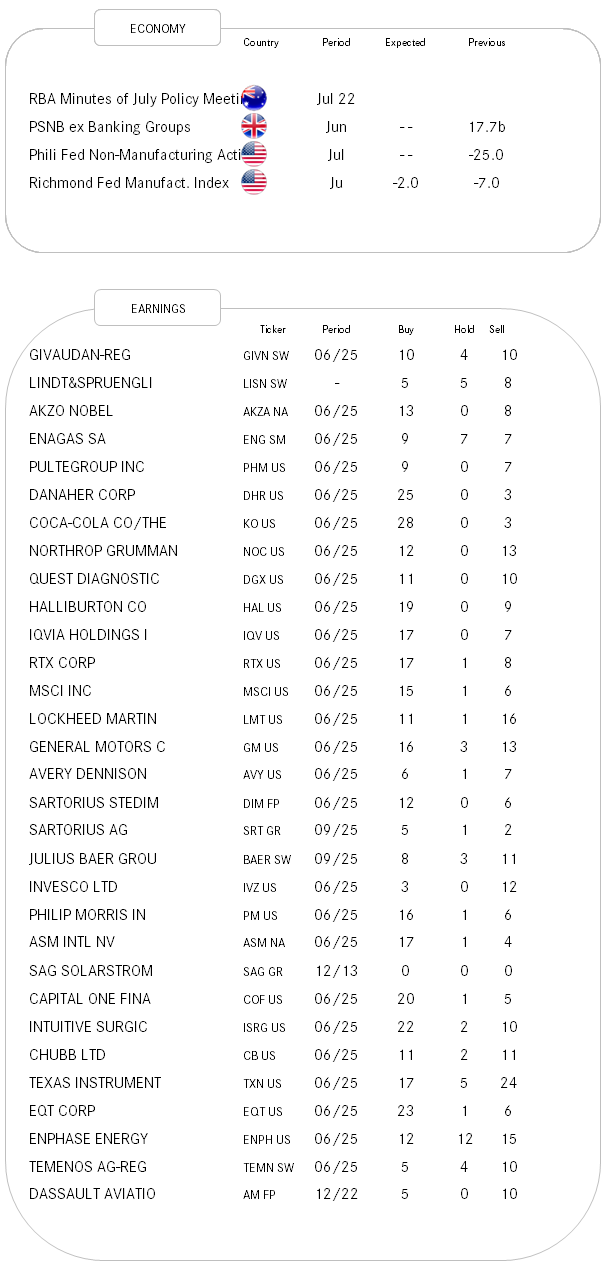

The stock market shrugged off a collection of negative narratives today and managed another, albeit brief, new all-time high in the S&P and NDX. Pressure on Powell to cut rates has become a constant presence in the world of tweets and news. Rand Paul wants to audit the Fed. Bessent was on TV this morning, asking, “What are the PhDs doing over there?” And House Rep Luna sent a criminal referral to the DOJ to prosecute Powell for perjury.

The entertainment value of the current US administration remains high …

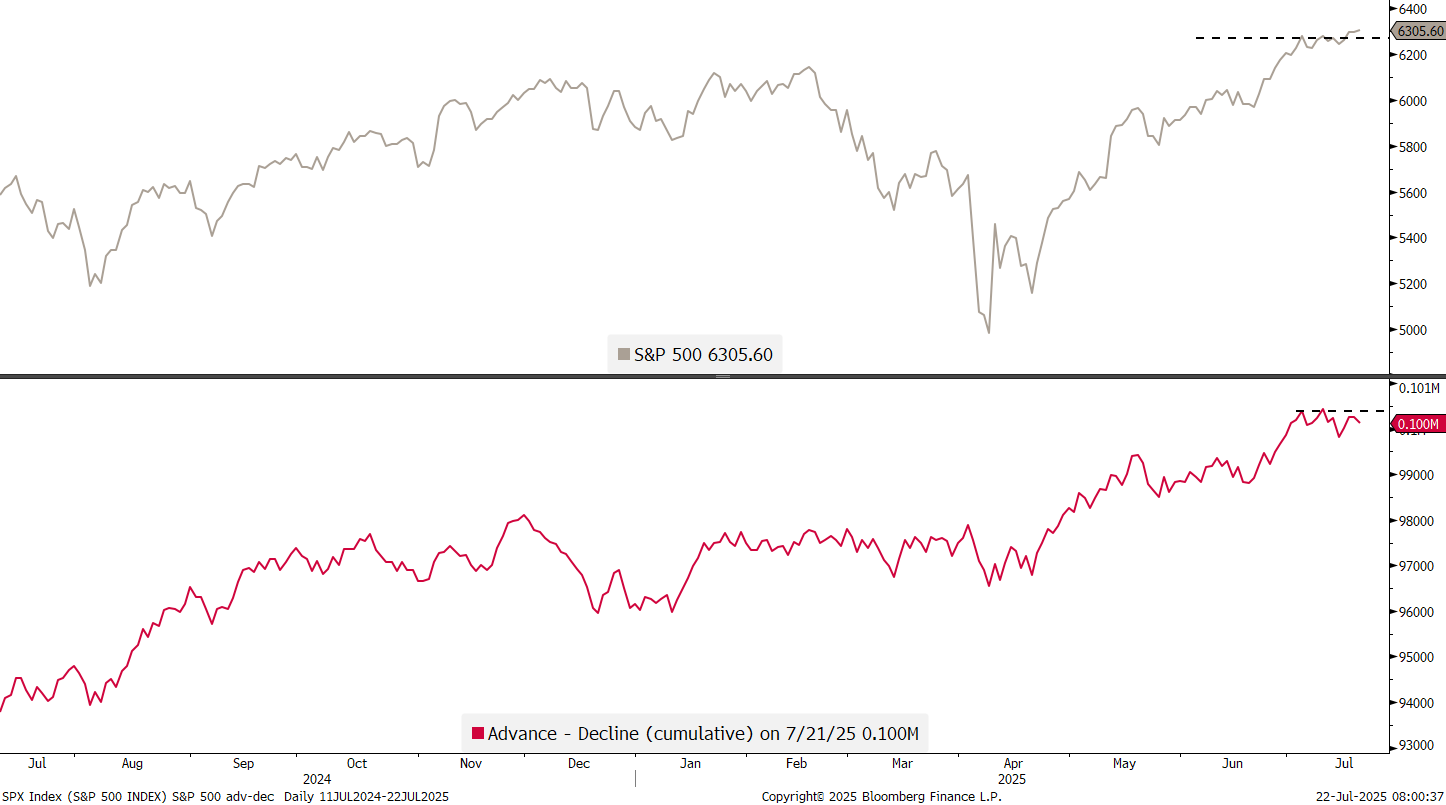

As aforementioned, after reaching a new ATH the S&P 500 rally especially started fizzling, and continued to do so in after-hours trading:

Market breadth was supportive of the second half of the trading session, i.e. was pretty weak with roughly two stocks down for every stock up in the S&P 500. As we highlighted in yesterday’s Quotedian “This is the End (again)” (click here), one breadth measure, the cumulative advance-decline line (lower clip) has so far failed to confirm the series of new ATHs in the S&P 500:

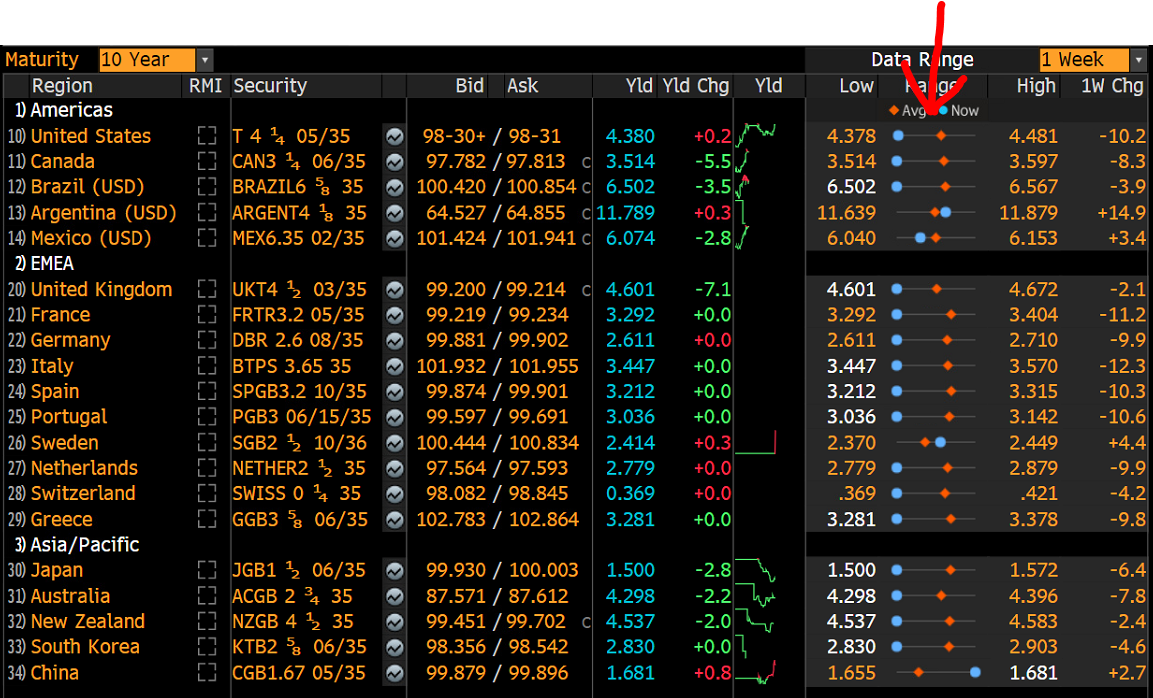

In bond markets, duration was somewhat bid yesterday, as global bond yields all headed lower. The table below shows that (nearly) all major market bond yields are trading at their lowest over the past week (red arrow):

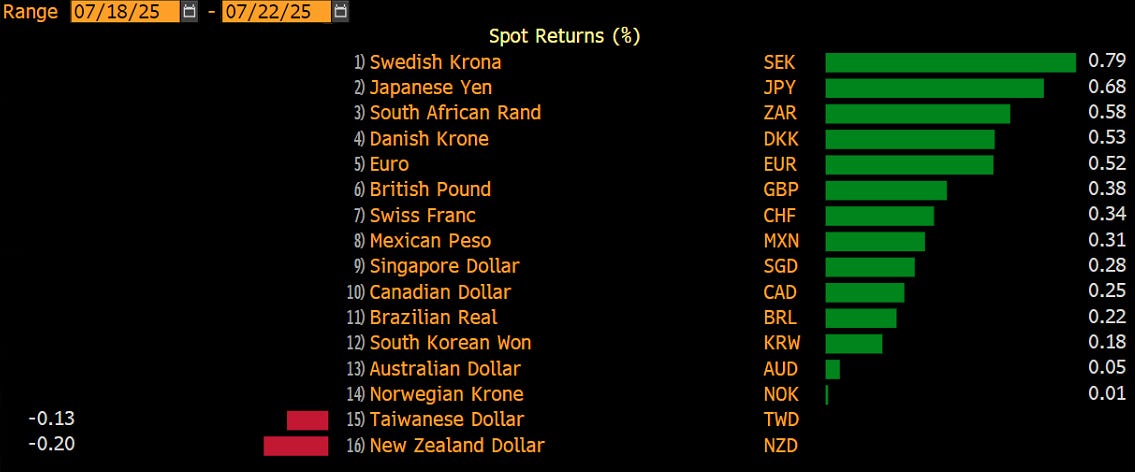

The US Dollar is trading lower against most majors since last Friday:

The 50-day moving average has been the “hangman” of the US Dollar in this cyclical downturn:

The weaker Dollar probably partially explains the renewed Gold strength, which briefly traded above $3,400 yesterday:

Investors look complacent and I am the first to say “never short a dull market”. HOWEVER, summer months are also famous for bouts of volatility, hence stay vigilant. Geopolitics, the Fed Chair hot seat (pun intended), Fed Day (30/7) followed by Liberation Day II (1/8) are all fuses already lit. Plus Rumsfeld’s unknown unknowns … be careful out there.

Time's up, more tomorrow - May the trend be with you!

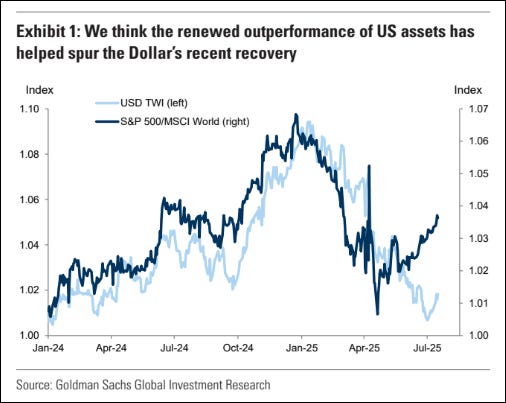

In our Q3 outlook titled “exoUSD” (click here) we advocated for a structurally longer Dollar. Not an outright collapse, but months to years of weakness. Of course, we would not be proper market ‘seers’ without hedging that view with a disclaimer that a rally from oversold levels should happen first. We got this rally, however weak it was, and as the chart below from Deutsche Bank argues, this rally may have been thanks to a strong US stock market again. What will happen to the Greenback should this turn lower again (e.g. 1st August)??

Stay tuned…