QuiCQ 22/10/2025

Heavy Metal

“The desire of gold is not for gold. It is for the means of freedom and benefit.”

— Ralph Waldo Emerson

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

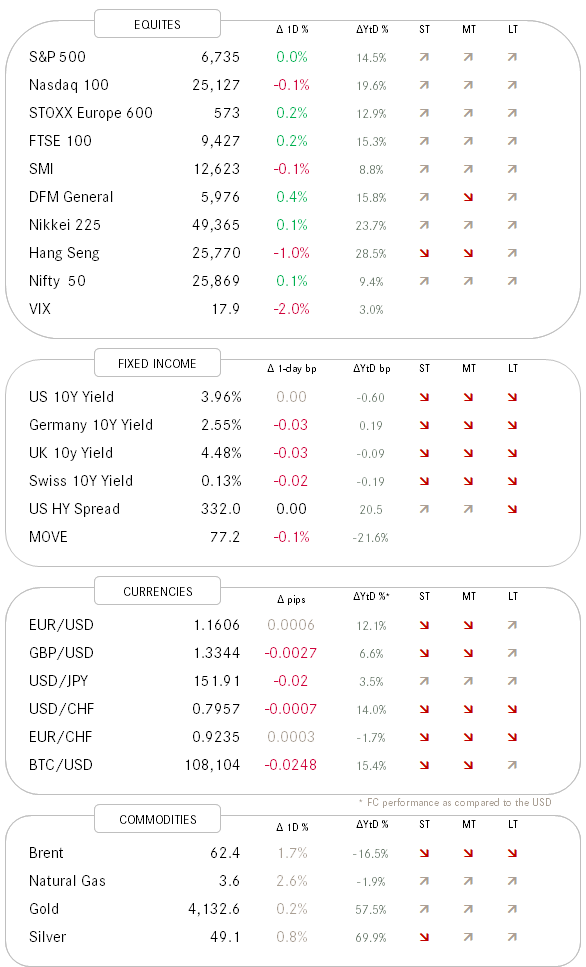

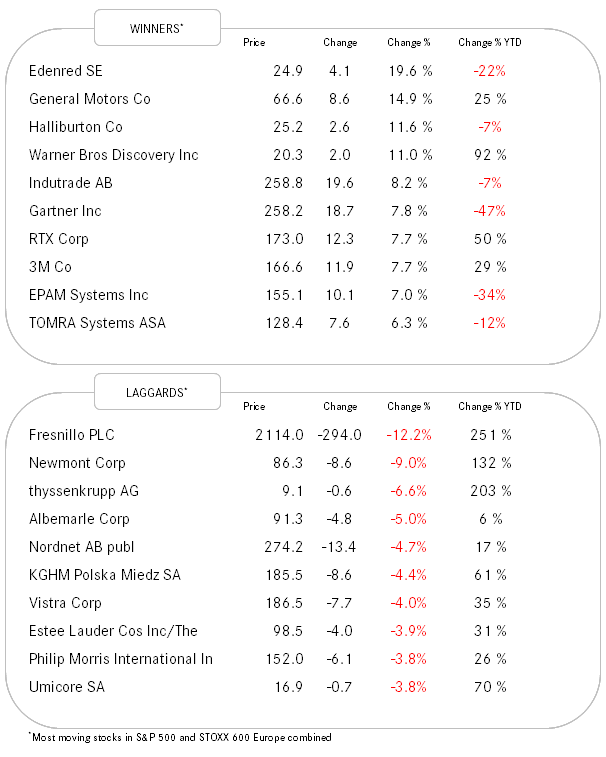

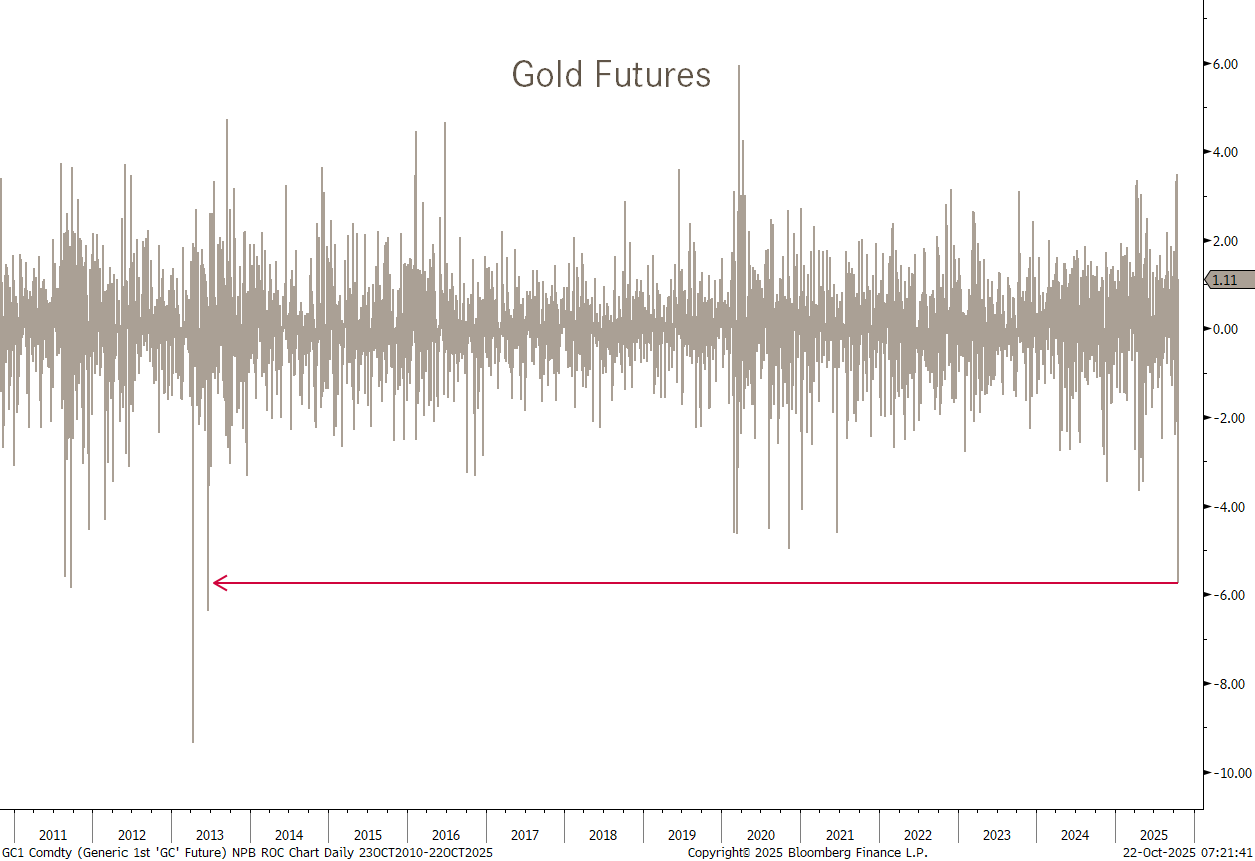

Everybody is talking about Gold’s biggest percentage one-day drop since 2013 - we have the chart!

Hey, wait! We immediately notice that it is actually not true. The worst sell-off was ‘only’ five years ago in August of 2020. So, what happened, when even a financial market hero of mine, the great John Authers, mentions in his morning note that the previous five percent drop was over a decade ago, and then goes on to show this chart (same as above):

Gold indeed had its largest percentage drop since 2013 IF you look through the lens of of the futures market:

So, Ladies and Gentlemen, please concentrate and get your charts right!

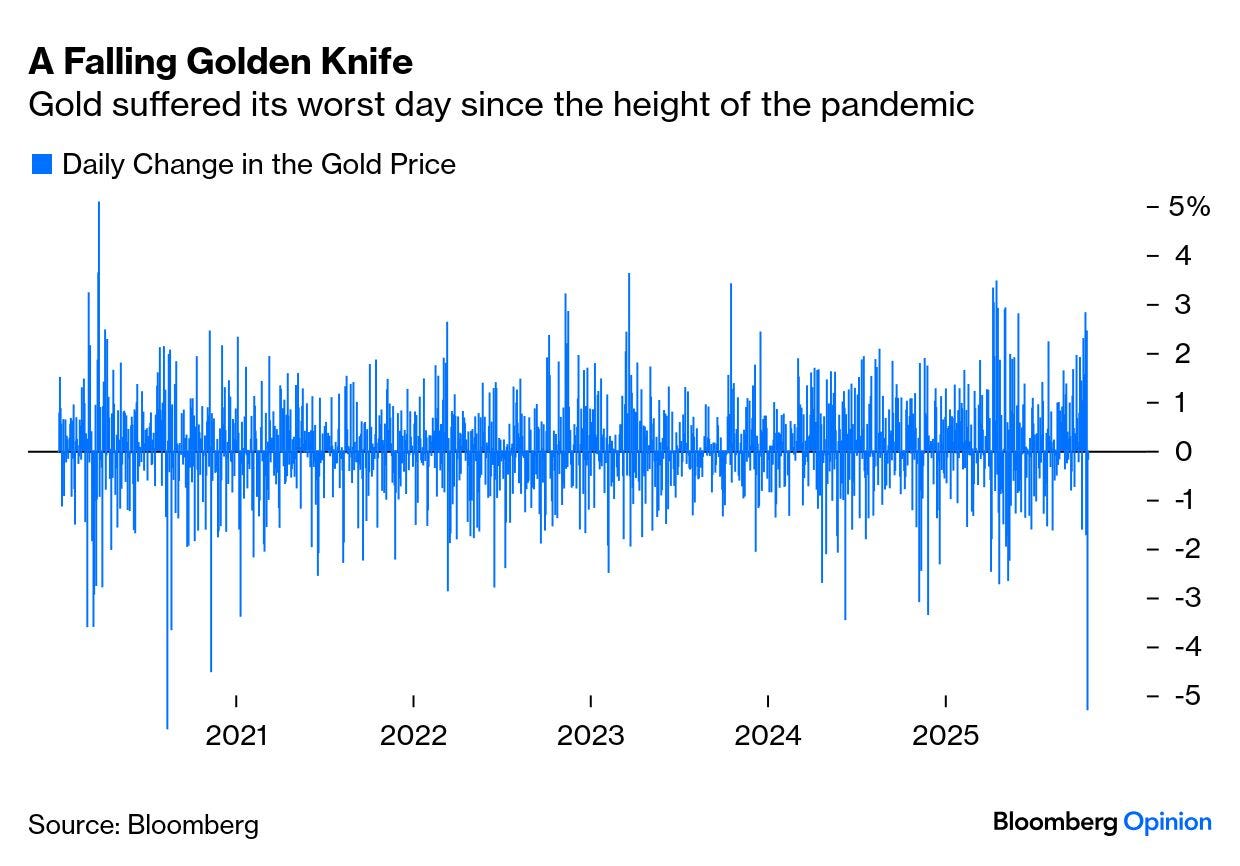

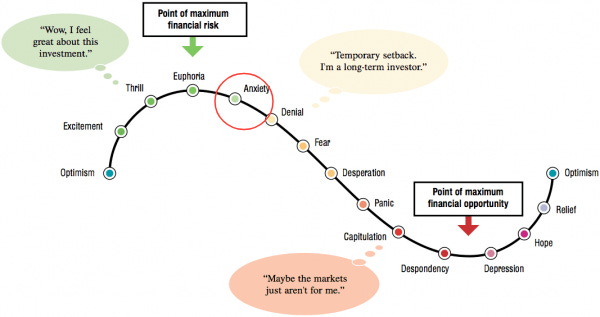

Not to defend the Gold longs and all those who got trapped, because after all we could be here (red circle),

but still, some context is necessary:

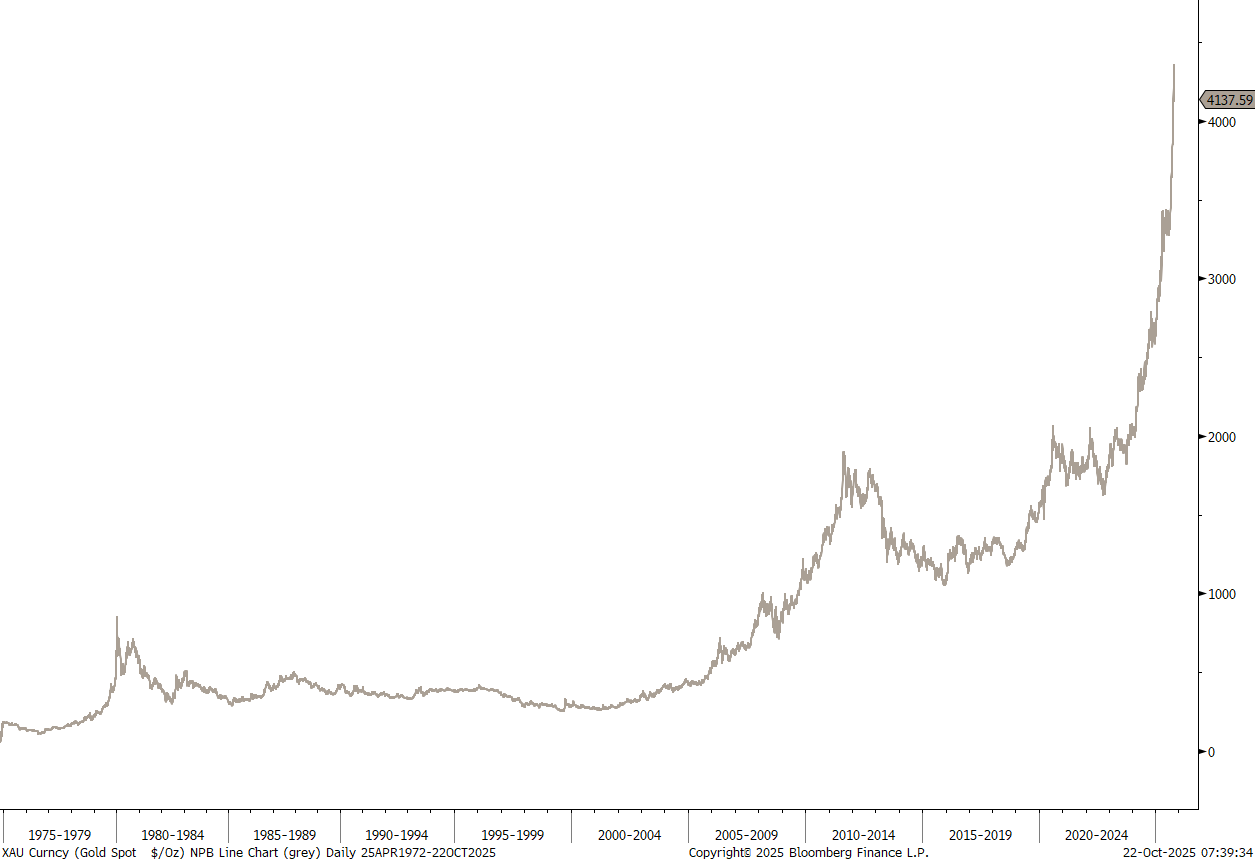

Gold continues to have a great October at +7% MTD:

It is unbeatable on a year-to-date basis:

And please show me that sell-off on the long-term chart:

ANYWAYS …

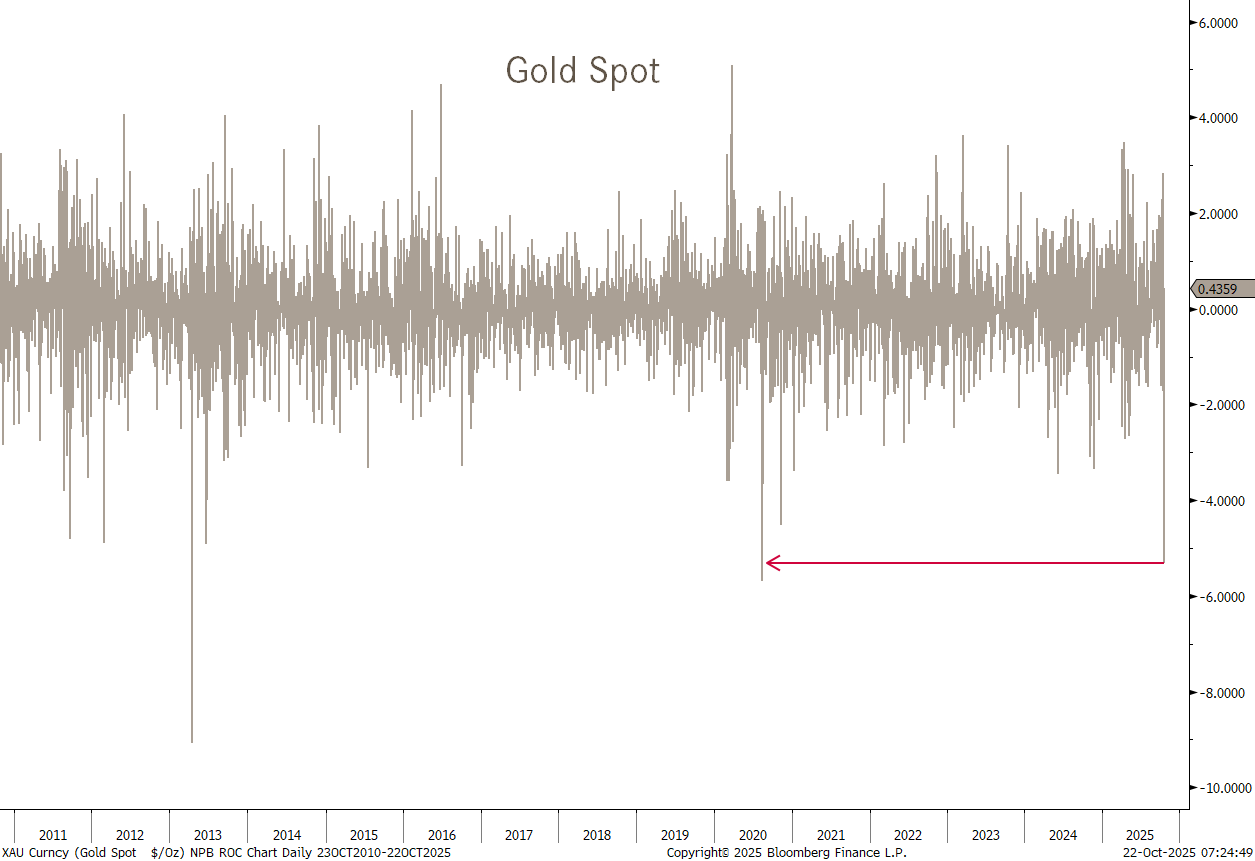

In other markets, equities had a relatively dull, quiet session with a slightly positive tilt yesterday. Biggets ‘event’ was probably that the Dow Jones Industrial index closed at a new ATH:

As I have said many times in the past, a new Papa Dow ATH is not bearish.

At the same time, the Dow Jones Transport index is trying to catch up with his Industrial bro:

A move above 16,400 (+2.5%) would be a good hint with the final confirmation for a DOW THEORY BUY SIGNAL coming above 16,800 (+5.5%).

In Europe, the Euro STOXX 50 index (SX5E) also hit a new ATH, whilst the broader pan-European STOXX Europe 600 index (SXXP) missed that feat by 0.49 index points!

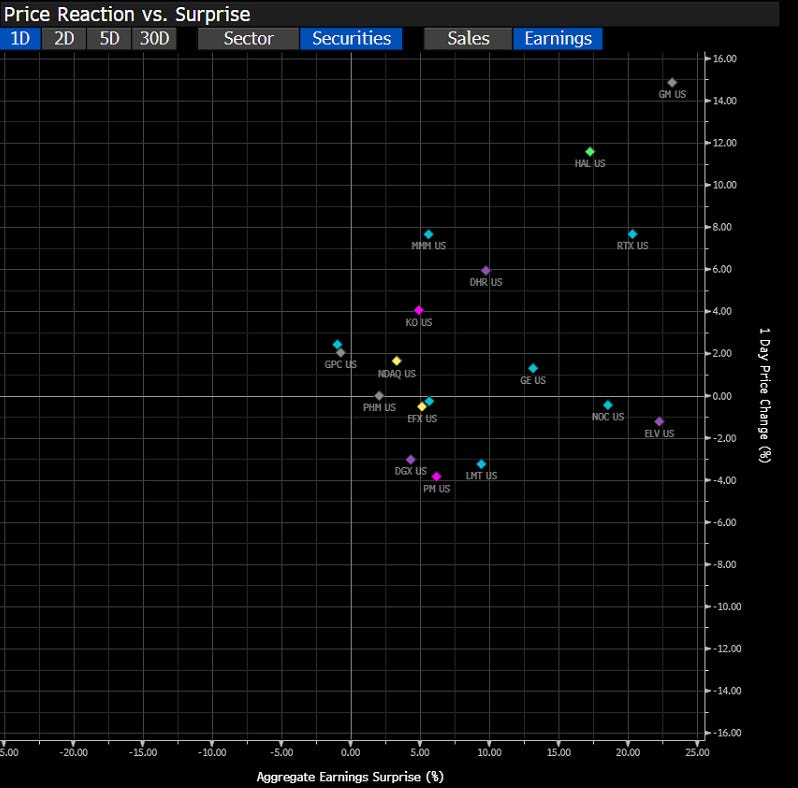

Earnings-wise, Netflix’s EPS miss and subsequent after-market sell-off was widely commented, however, there was a bunch of companies reporting very decent results with positive price reactions (NFLX is not on the scatter plot below due to post-earnings after-hours trading only):

Little to report from the rates or currency side today, hence we’ll cut short here.

Have a great Wednesday!

André -May the trend be with you!

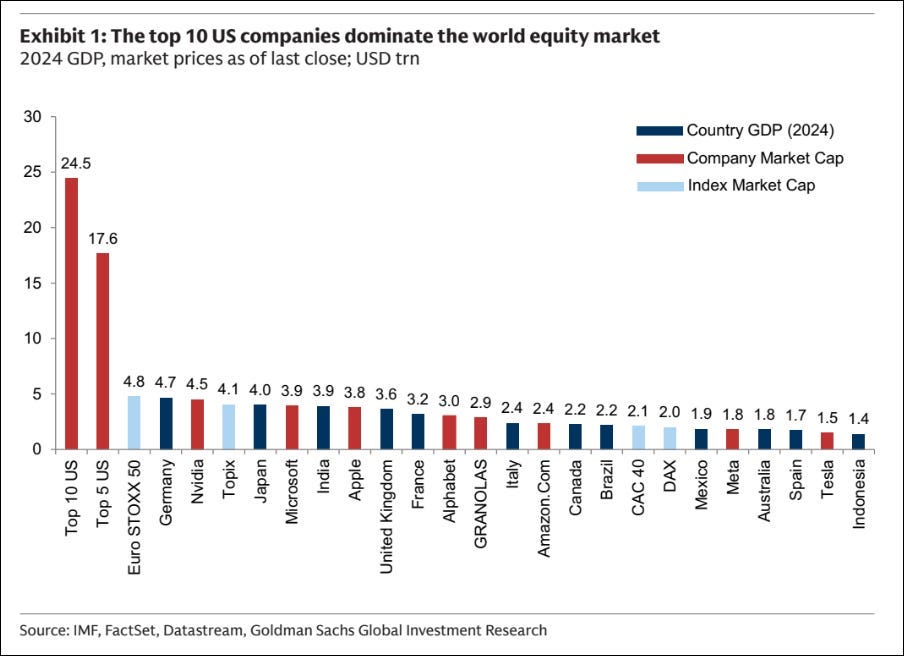

No message, no comment, just fascinating.