QuiCQ 23/01/2025

“I'd be a bum on the street with a tin cup if the markets were efficient.”

— Warren Buffet

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Aaand …

the equity market closed at yet another new all-time high (ATH), but

noooo …

not the S&P 500 this time, which did hit intraday a new ATH, but closed about 3 points below the highest close reached on December 6th last year, but much rather … drumroll please … the FTSE Eurofirst 300, a European S&P 500 comparable:

The narrower, large-cap and Eurozone-only focused EuroSTOXX 50 closed up for a seventh consecutive day, which is a feat in itself, at the highest level in 25 years and is now less than five percent away from a new ATH.

Is this “Trump say Dank”, as investors are betting on a European wake-up call, delivered by the incoming US adminstration?

No, argues the following chart from the formidable John Authers in his daily “Point of Return” column. Much rather could valuation differentials be the driver for a cath-up intent by European stocks:

Even though, this stand in direct contrast to an excellent quip I heard this morning from StoneX’s equally fromidable Vincent Deluard:

“Value does not make price, flows (liquidity) make price”

In any case, we will keep track of this European "new found hope” via our weekly newsletter, The Quotedian:

But I digress, back to yesterday.

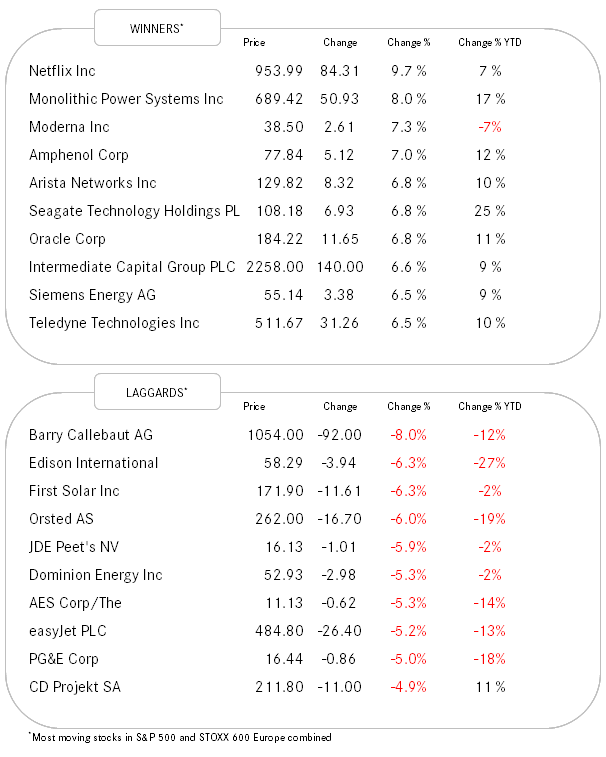

The S&P, advancing 0.6%, showed its first negative breadth day in a while with about twice as many stocks declining than advancing. Nevertheless. nothing to worry about, as breathing in and breathing out is also a thing on financial markets. Only three two sectors, tech and communications, eked out a gain on the day, with all other nine sectors down. We would then expect the market map to reveal that only the mega-cap corner is printing green:

Bingo!

Very little to report from the interest rate/fixed income front, where global yields drifted a tad higher.

A similar eerie quietness on currency markets, with maybe only crypto worth a mentioning. Bitcoin for example seems to be in a kind of emotional pre-/post-inauguration rollercoaster, with the cryptocurrency currently deflating again, as it is “Waiting for Godot Trump”:

This morning, Asian equity markets are printing mostly green, though strong early gains have been partially given back. Especially Chinese stocks (CSI300) stand out, where an early close to two percent jump after government reinsurance over further market support has nearly completely deflated:

European and US index futures are currently printing small red.

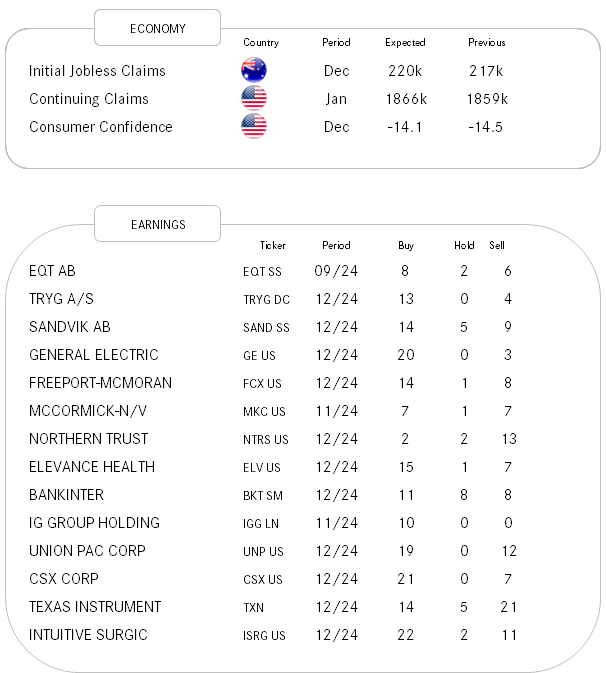

Still absent anything of increased interest on the economic agenda, the highlight of the day seems to be President Trump key note speech in Davos at 5 pm CET today.

Have a great day!

André

No party (rally) is complete without the semiconductor stocks. After a six month hangover period, they seem to be ready to join the party again: