QuiCQ 23/01/2026

Never on a Friday!

“Life is long if you know how to use it.”

— Seneca

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

“Never on a Friday” is the subtitle to today’s QuiCQ and an old “Wall Street” adage I was taught early in my career when sitting on the FX Nostro-desk of a large US banks.

This old saying seems to contain more wisdom than ever nowadays and especially this year. Consider the three weekends we had so far in 2026:

Weekend #1: Trump removes Maduro in Venezuela

Weekend #2: Trump attempts to remove Powell out of Fed via a subpoena

Weekend #3: Trump threatens to remove Europe out of Greenland

Maybe it’s just me, but I see a pattern there …

Anyhow, “Never on a Friday” is the lessons to not go into the weekend with too many risky positions, OR, only very deliberately so!

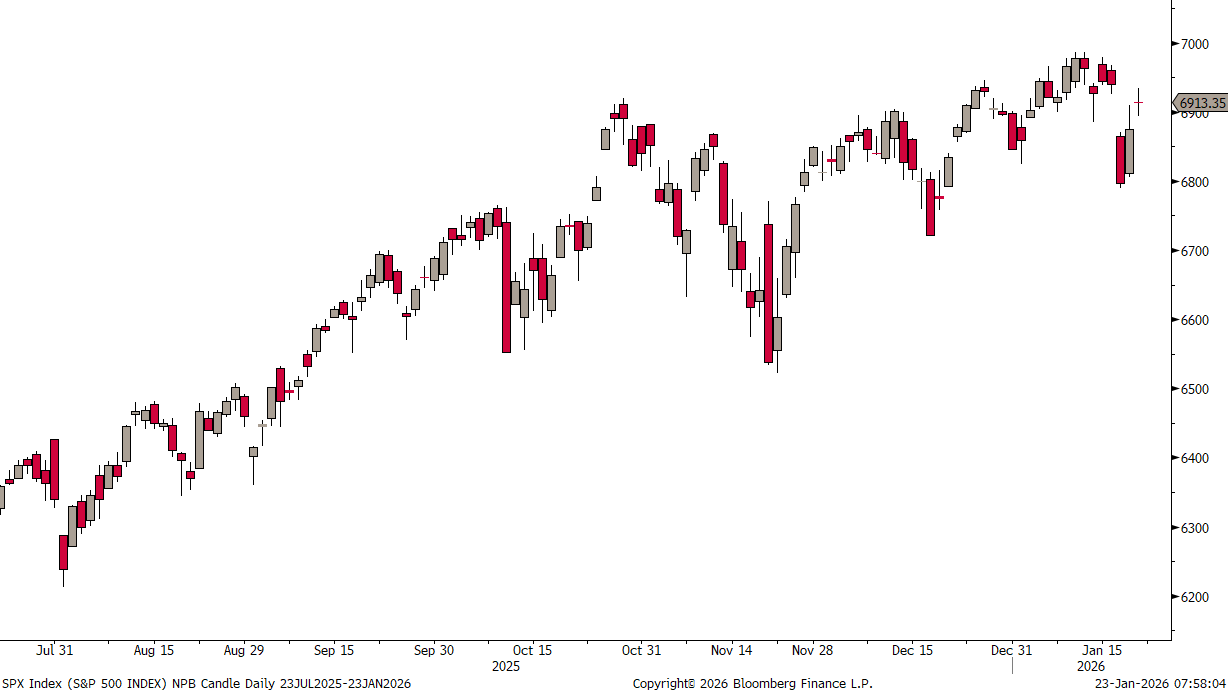

Meanwhile, stocks are rebounding from the “piece of ice”-slump, with the S&P 500 only about a percent away from a new ATH:

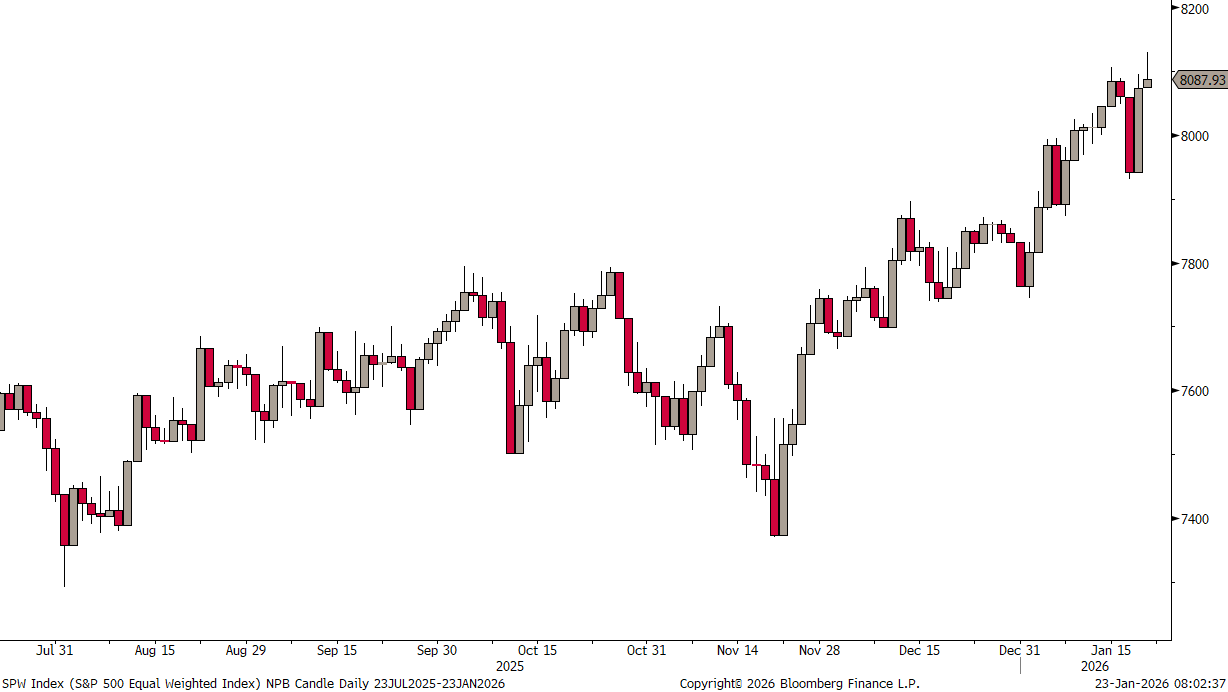

The equal-weight version of the same index already achieved that feat:

US small cap stocks never really worried too much about Greenland (or anything else for that matter). Here’s the Russell 2000:

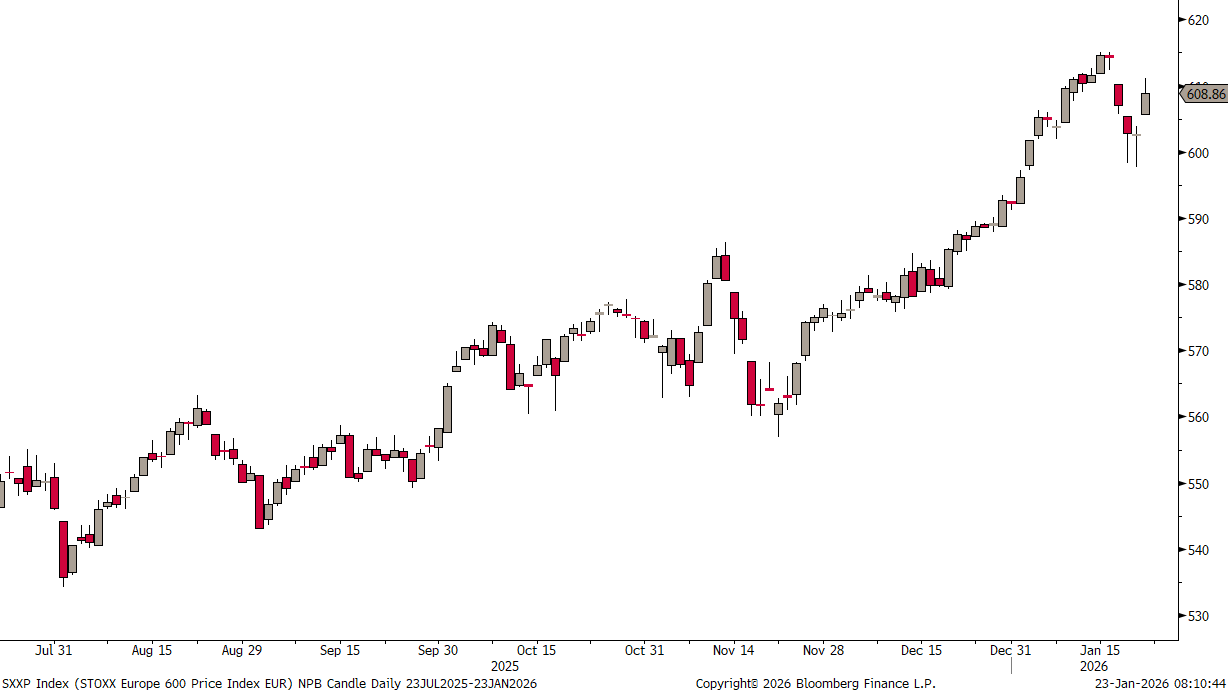

European stocks (SXXP) are also quickly recovering:

(US) Bond yields have relaxed the past three sessions, but clearly broke out of their nearly six-months trading range at the back-end of last week (see an possible explanation for the higher yields in the Chart of the day section below):

But, of course, the talk of the town continue to be precious metals, especially Gold,

and Silver,

both to hit very important milestones ($5,000 and $100 respectively) within the next few moments …

That’s all for this week, have a great weekend!

André

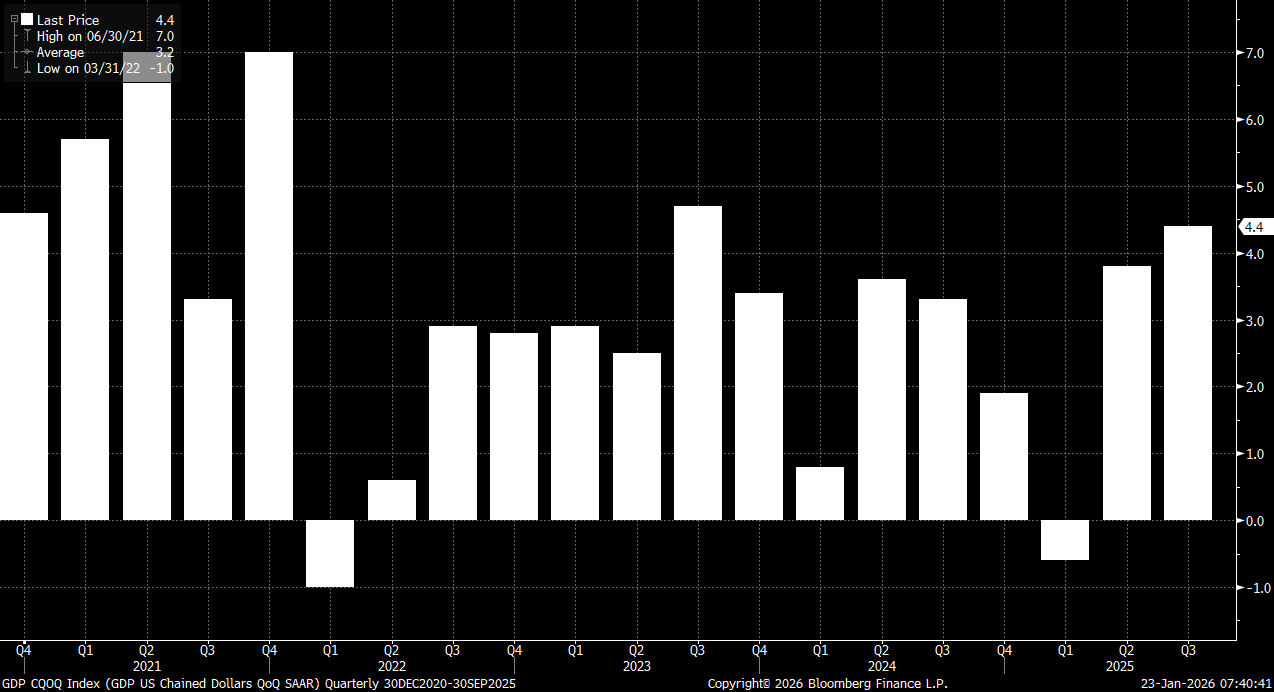

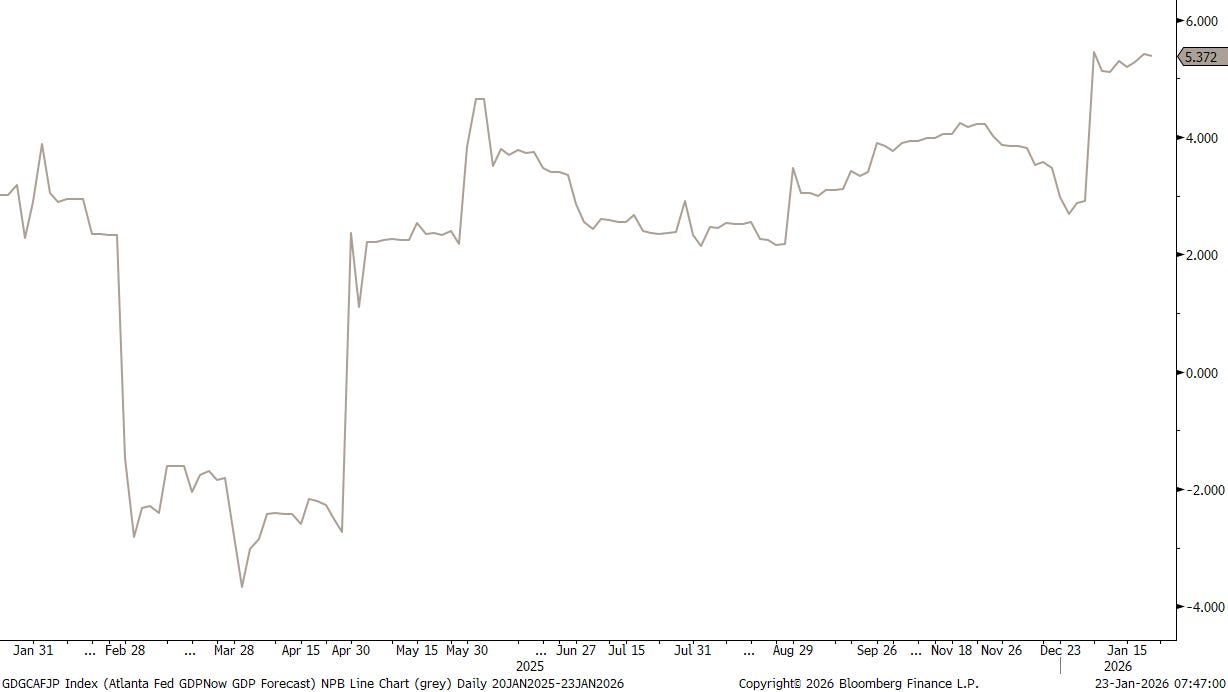

In our 2026 CIO Outlook called “Age of Empires” (see the full document here and the video executive summary here) we noted that the US economy is likely to surprise to the upside, which at first will be a positive for risky asset classes.

A recent upwards revision of US GDP Q3/2025 to 4.4% (from 4.3%) shows that we had the strongest growth in the US economy since mid-2023 and one of the strongest quarters since the COVID-stimulus induced rebound in 2022.

The Atlanta’s Fed GDPNow GDP Forecast is indicating that the US economy is running at above 5%:

I’d say, stay tuned …