QuiCQ 23/04/2025

Turnaround Tuesday

“If the IMF forecasts rain, bring sunscreen.”

— Anonymous

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

‘Turnaround Tuesday’ lived up to its name yesterday, as not only global equity markets but just about any major asset class reversed the nasty trends from ‘Manic Monday’.

The S&P 500 and the Nasdaq both closed up around two and a half percent, completely retracing the previous day’s losses. Here’s the S&P intraday example:

But not only did the indices fully recover losses, upside participation was even better than downside participation in the previous session, with the S&P 500 seeing 98% of its constituents trading higher:

The previous session best performing sector, consumer staples, was the worst yesterday, but still up a respectable 1.6%:

Reason for all this renewed found happiness? Probably the absence of any further ‘bad news’, such as anti-Powell/Fed tweets by Trump and soothing China-comments by Treasury secretary Bessent helped a lot.

But the true icing on the cake was probably the global growth slowdown forecast by the IMF:

Given the IMF’s non-existential forecasting track record in combination with elevated investors’ bearishness … bring risk on!

And the even better really good news (I know that sentence is wrong)? The really good even better news came after the market close:

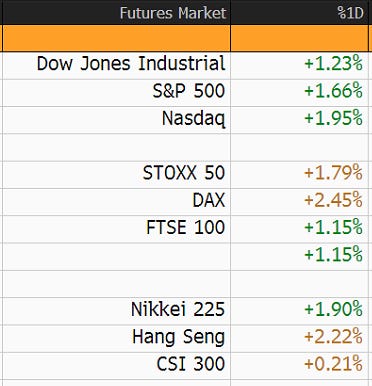

This should help equity markets also on Wednesday to a good start and indeed Asian and Western index futures pointing upwards:

Bond markets also saw a reversal from Monday, with the yield on the Tens stalling above 4.40 and trading at 4.36% this early Wednesday. Also did the curve steepening (10y-2y) from the previous day completely reverse:

Good here thing too that the flattening happened via reversing Monday’s moves, i.e. yields at the short-end of the curve increased whilst longer-dated yields traded softer.

The US Dollar finally found a footing (kind of at least),

but maybe even more important, Gold has its first serious reversal pattern in a while, indicating a certain relaxation regarding the end to fiat money as we know it …

There’s much more, but time’s up - May the trend be with you!

Without wanting to appear overly bullish, there’s a case to be made for some more equity upside over the coming weeks. First of all, breadth as measured by the cumulative line of advancing-declining stocks (lower clip) held up pretty well in the S&P 500 (upper clip), given the brutality of the index’s sell-off:

And from a shorter-term perspective, the crypto guys are telling us to go long the Nasdaq:

But now, let me repeat the ultimate risk warning I have repeated over and over again: Nothing ever good happens below the 200-day moving average, which means nothing else than manage your position size and adhere to your stop losses.