QuiCQ 23/07/2025

What a difference a day makes - Issue 204/2025

“I would rather suffer with coffee than be senseless.”

— Napoleon Bonaparte

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Focus of the past 24-hours has been two-fold. First, renewed attacks by US Treasury Secretary on Fed Chair Jerome Powell, this time focusing on the non-operational spending (i.e. a $2.5 bn project to renew parts of the Fed building in Washington), gave market participants suspicion to the current administration looking for a back-door (aka excuse) to fire Powell.

Even though Polymarket bets on Powell to be removed in 2025 did not nudge,

Gold, in this case considered a hedge against inflation AND fiat currency ‘accidents’ did, rallying nearly a hundred bucks since Monday:

As did the US Dollar, a fiat currency 😉, by weakening versus all other major currencies over the past hours:

The second area of focus has been the trade agreement reached between the US and its ally Japan, a win-win for both sides. Trump got another trade deal in his pocket, and Japan’s PM Shigeru Ishiba, since Sunday’s election defeat strongly beleaguered, got a highly welcomed distraction.

The Japanese stock market (Topix) is up 3.5% as I type, scrapping at key resistance:

Amongst the largest winners, many carmakers:

This experience also shows how skewed the reactions are to trade negotiations and agreements. Positive impact after agreements seems substantially larger than the negativity during the uncertainty period …

Take Germany’s DAX for example … on the verge of breaking down to 23,000 only yesterday, futures are trading one percent up this morning on the Japan (i.e. Japan, not Europe trade deal), throwing the index nearly back into its uptrend channel:

Other Asian markets are also up in sympathy with Japanese equities this morning, as are index futures on both sides of the Atlantic.

Later today, all eyes on Alphabet (Google) earnings after the market close.

Time's up, more tomorrow - May the trend be with you!

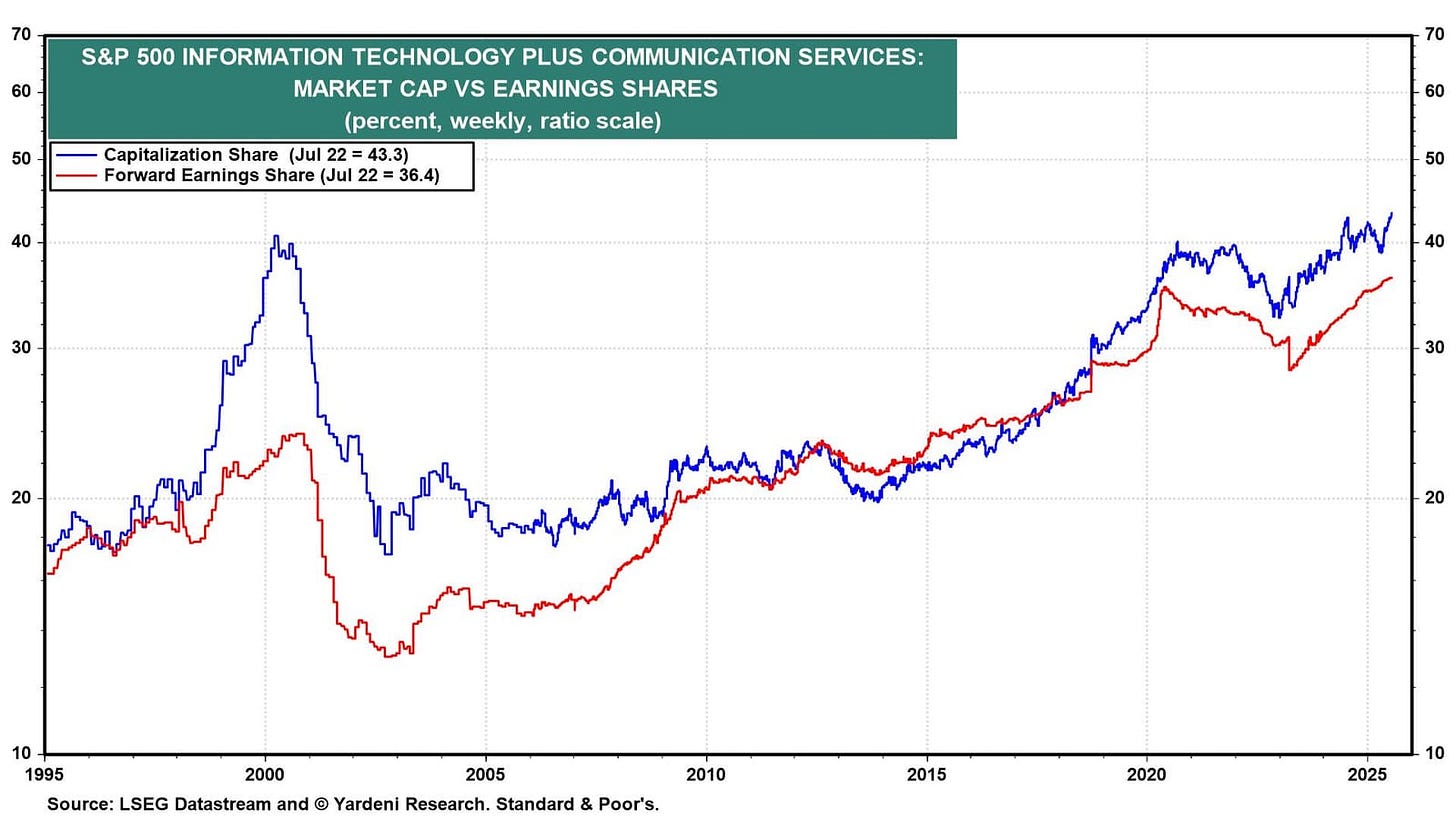

An interesting chart, somewhat contradicting our argument of an expensive US market in this week’s Quotedian (click here), from the very fine folks at Yardeni Research.

The blue line shows the combined market capitalization share of the communication services and the technology sector in the S&P 500. At 43.3%, it now exceeds the top (41%) during the late 1990s Tech bubble.

However, the earnings share of these two sectors (red line), currently at 36.4% is well above the peak the preceded the Tech wreck.

Caveat Emptor (and stay tuned, of course)!