QuiCQ 23/08/2024

Revenge of ... the other 493

“Amateurs want to be right. Professionals want to make money.”

- Alan Greenspan

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

Nada. Zip. Zero. Nüt.

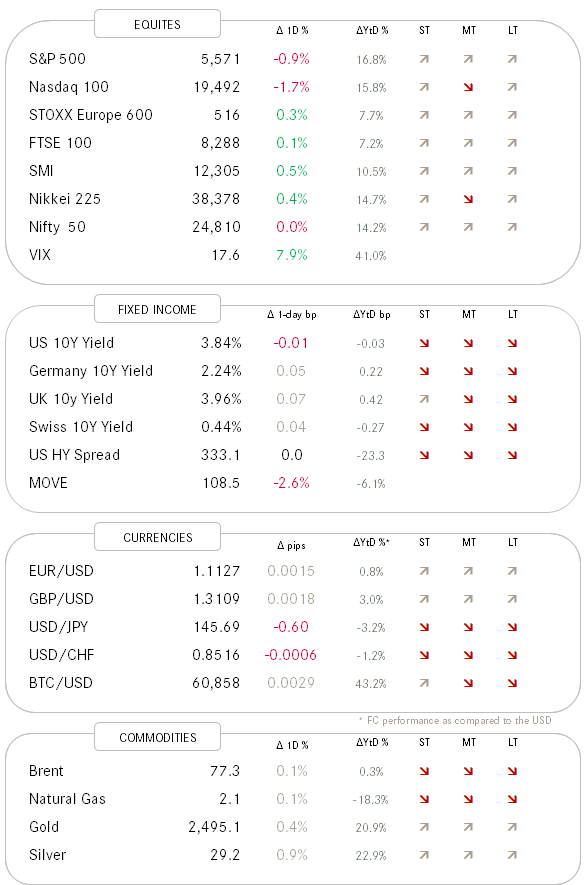

Wall Street closed lower yesterday in what looked like some profit taking after a very decent 10% rally (S&P) over three weeks and ahead of Fed Chair Powell’s comments today (4 p.m. CET) at Jackson Hole.

Only three sectors closed up and the sectors (Consumer discretionary, communications, tech) containing some of the most popular and widely held stocks took the largest hit - another indication of some profits being locked in.

In corporate news, Nestle replaced its CEO of the past eight years and Peloton shares jumped 37% on an improved earnings outlook and hopes for a turnaround.

In currency markets, focus on the Yen this morning, with the USD/JPY dropping nearly a big figure after BoJ’s Ueda commenting that the central bank will still hike rates if the economy meets the CB’s view.

Gold and silver dropped in yesterday’s session, mostly on the back of some USD strength, as the greenback rebounded on some important support levels after the weakness over the previous sessions.

All eyes on the weekend, with only that annoying chap from the Fed standing in our way now!

The stock market observations I read this morning are leaning overwhelmingly to the negative side. That was it for the rally … the market could reach a new high … darlings are dropping again … outside reversal candle … bla bla bla

Consider this … the focus over the past two years or so have been on the Mag 7 and everybody complaining about only those seven stocks rising and the narrowness of the rally etc.

Well, let’s check in on that. As today’s chart of the day below shows, has the “normal” S&P 500 so far indeed failed to produce a new all-time high (ATH). The S&P 500 excluding the Mag 7 (aka ‘The Other 493’) however, has already reached a new ATH and that ex-resistance now acts as support.

Conclusion: we may have short-term wobbles, but medium- to longer-trend the path of least resistance seems higher. Caveat Emptor!