QuiCQ 23/09/2025

Déjà vu

"It's déjà vu all over again"

— Yogi Berra

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

No, with today’s title and “Quote of the Day” I am not referring to Jimmy Kimmel returning to his late night show - even though this is probably one of the more encouraging news items over the past days weeks months this year.

No, with déjà vu I meant that flashback I had when reading following headline last night:

It took me all the way back to the year 2000 (yeah, I’m getting fossil old …) where high-flying equipment manufacturers were giving credit to customers to buy their products.

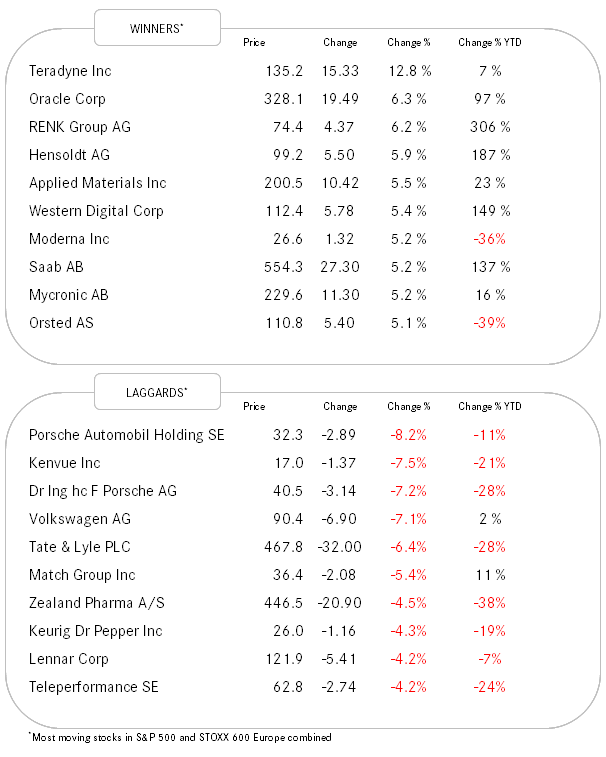

For those of you who are too young to remember (or too old to recall), Cisco is now slowly getting back to the level of its 2000 highs:

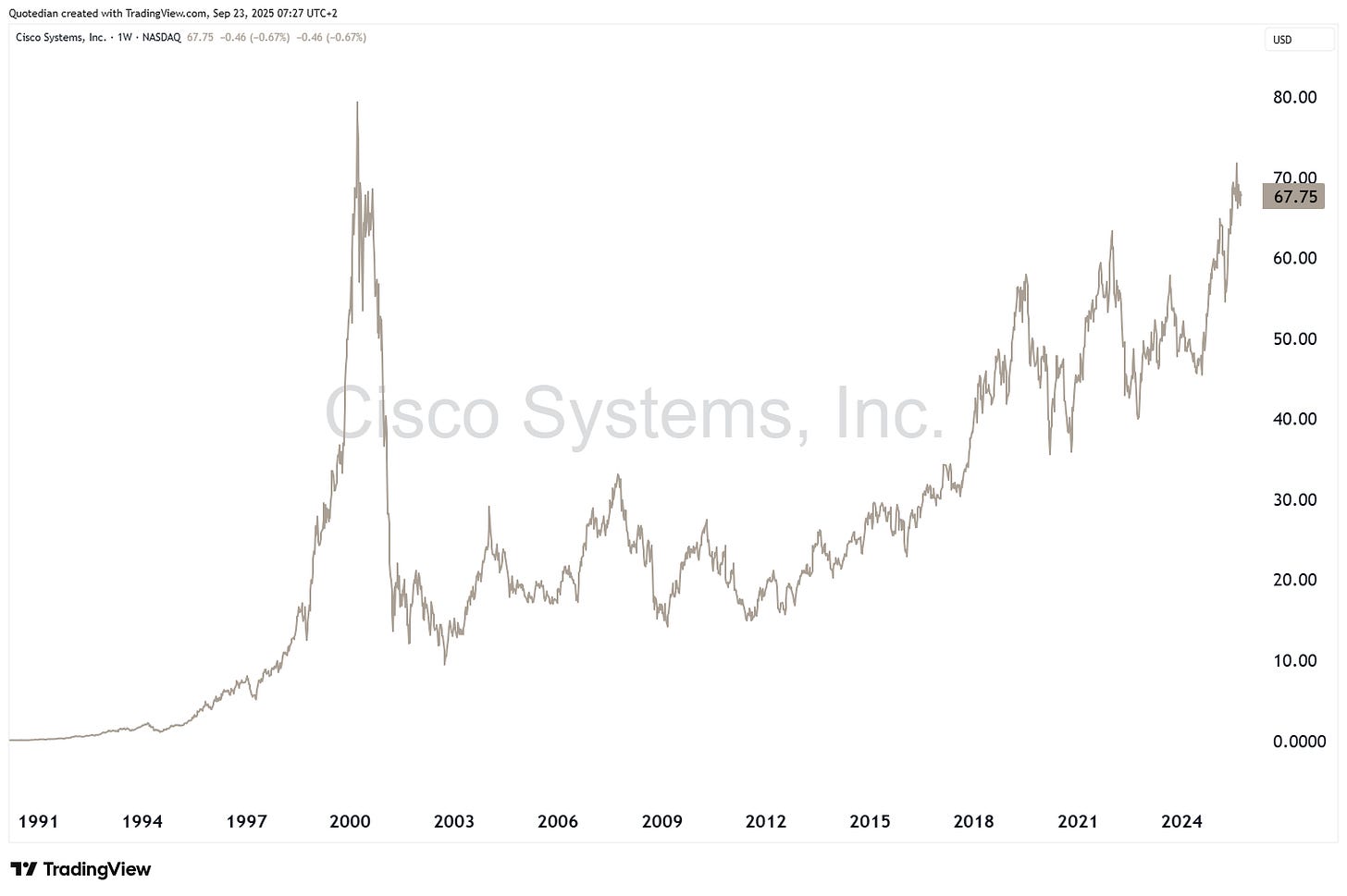

Nortel …. well, Nortel, RIP:

Of course, the numbers for vendor financing were smaller back then, which doesn’t make the case better for the participants in the current mania.

In any case, as usual, such anecdotal evidence is not great for market timing and yesterday the market decided to agree with me on that statement, pushing up NVDA’s share price nearly four percent, registering yet another new all-time high:

Clearly, NVDA (and AAPL) were largely responsible for the rallies in the S&P 500 and the Nasdaq 100, as actually the numbers of decliners slightly outweighed the number of advancers on the day:

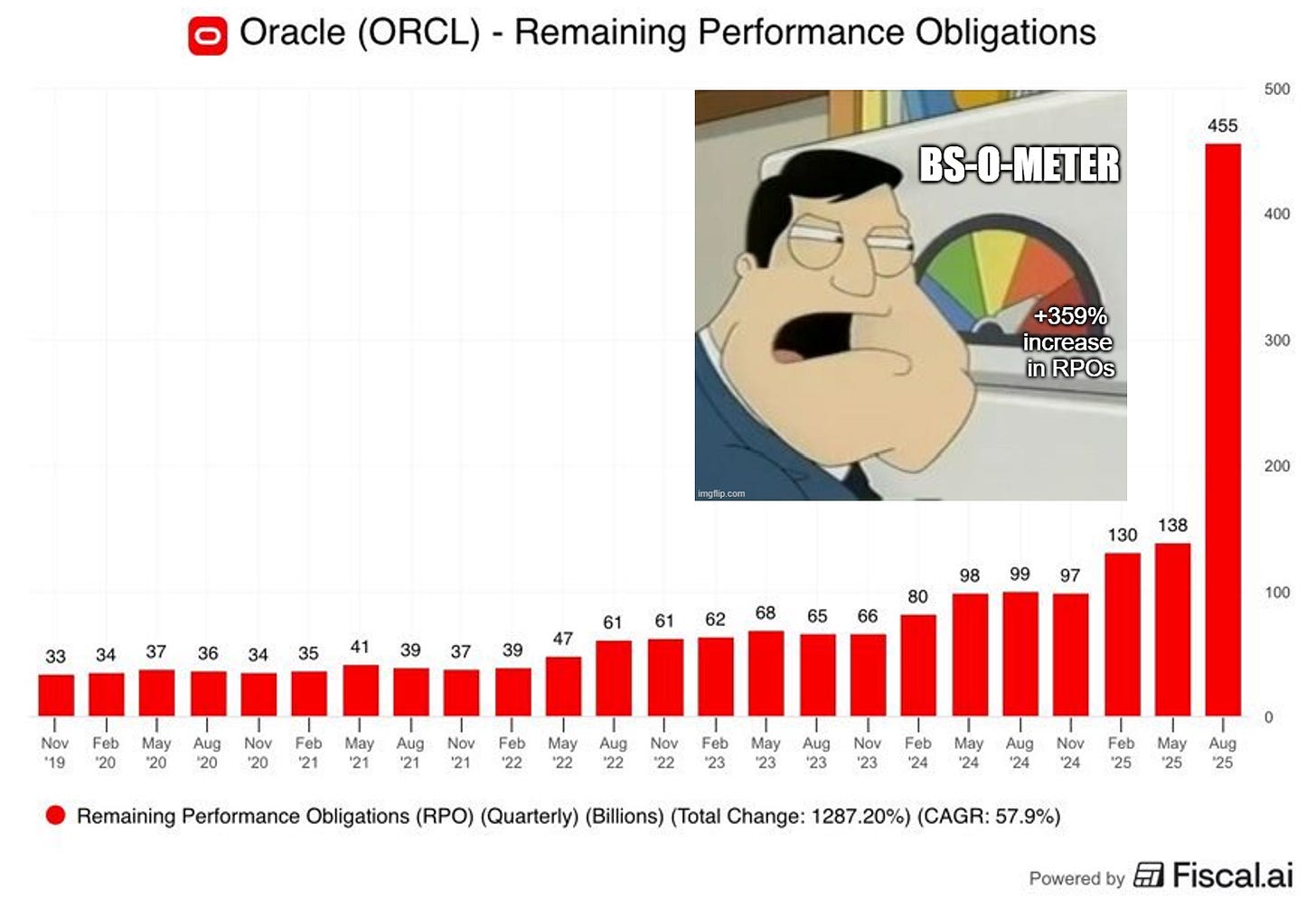

Oracle, a company that was around for the 2000 Dotcom bubble too, recently had a slew of ‘positive’ news coming its way. Last week already they reported a big jump in future earnings, which smells a tad suspicious to me (I allow myself to take a chart from fellow substacker ‘Le Shrub’, who at the same time I highly recommend to follow):

Another news item making the rounds this weekend was the Trump’s administration small hike in the H-1B visum, a visum for skilled (mostly tech) workers, from around USD2,000 to USD100,000 … not sure the exact reason given, but I hope it was not due to inflationary pressures …

In any case, the IT services sector gave thanks to that decision with a three percent drop yesterday and some follow-through today:

And finally, we need to talk Argentina.

After a painfully lost local election in Buenos Aires two weeks ago, the country is suddenly in front of an abyss … AGAIN!

President Milei’s goodwill has suddenly run out, enough to make him run to Uncle Don and Uncle Scottie later today. Good old Uncle Scottie has already soothed his favourite nephew (via X of course):

Argentina is a systemically important US ally in Latin America, and the US Treasury stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table. These options may include, but are not limited to, swap lines, direct currency purchases, and purchases of US dollar-denominated government debt from Treasury’s Exchange Stabilization Fund. Opportunities for private investment remain expansive, and Argentina will be Great Again.

Enough ranting for one day, see you back tomorrow!

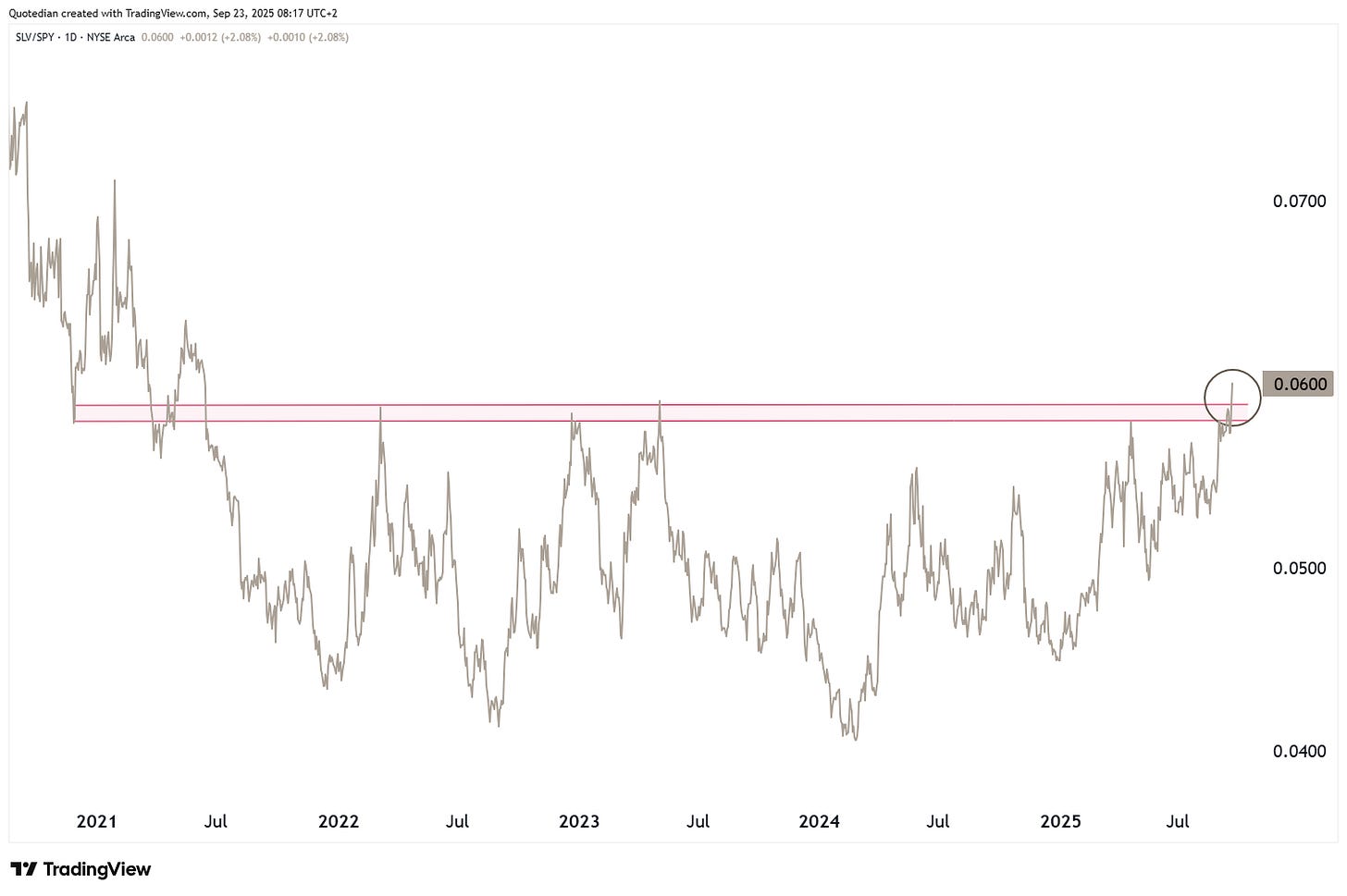

After a base of nearly four years, the ratio of Silver (SLV) over stocks (SPY) has started to break higher:

It’s Rocks over Stocks for the foreseeable future!

Rocks over stocks ! 👏🏻👏🏻