“If you don't read the newspaper, you're uninformed. If you read the newspaper, you're mis-informed.”

— Mark Twain

What a headline! Though, indeed did stocks drop for a second consecutive session yesterday (it must be the end of the world) in a mixture of profit taking, higher bond yields, earnings results and _____________ (fill in your favourite reason to the left). However, given that the S&P for example is down less than 15 points in those two sessions and a new all-time high was set just last Friday, the panic seems muted.

The S&P 500’s heatmap is evidence of a very fragmented session,

But there were still three times a many stocks (17) hitting a new 52-week than those (5) hitting a new 52-week low.

After the closing bell we got news that the CDC was investigating an E.Coli outbreak with McDondald’s quarter-pounder hamburger at the epicentre. The stock dropped initially 10% and is now still down close to 6% and will likely weigh heavily on the Dow Jones Industrial performance today. Well, if that is no fodder for the tinfoil heads:

Yields on both sides of the Atlantic continue to stampede higher - it is likely just a question of time until we get the “higher bond yields send stocks lower” headline.

As yields are continuing to raise faster in the US than in Europe, the US Dollar is continuing to exhibit interest rate differential related backwind. Especially versus the Japanese Yen has the Greenback now extended gains to over 8% since mid-September.

Asian equity markets are largely printing green this morning, with the notable exception of Japanese stocks. And this despite that Japan’s largest IPO in six years (Tokyo Metro) showed a 40% on debut and can be considered a major success for the country’s capital market.

Some housing data in the US on the economic data today, but more focus likely to be on corporate earnings.

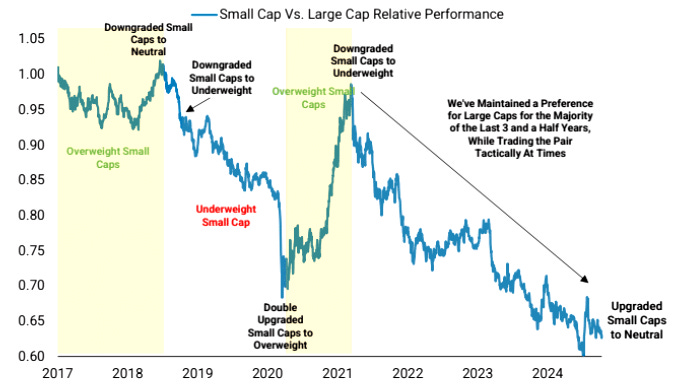

Here’s some chicken soup for small cap investors: Morgan Stanley just upgraded small cap stocks versus large cap stocks from underweight to neutral. Given their track record (not verified by The QuiCQ), that could be a telling sign (or better, signal):

However, the currently rising bond yields could at least short-term be a headwind for small cap stocks (higher borrowing costs on generally more indebted companies).

Hence, CAVEAT EMPTOR