QuiCQ 23/10/2025

Crude Reality

“Formula for success: rise early, work hard, strike oil.”

— J. Paul Getty

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

This will be a quick QuiCQ 😉

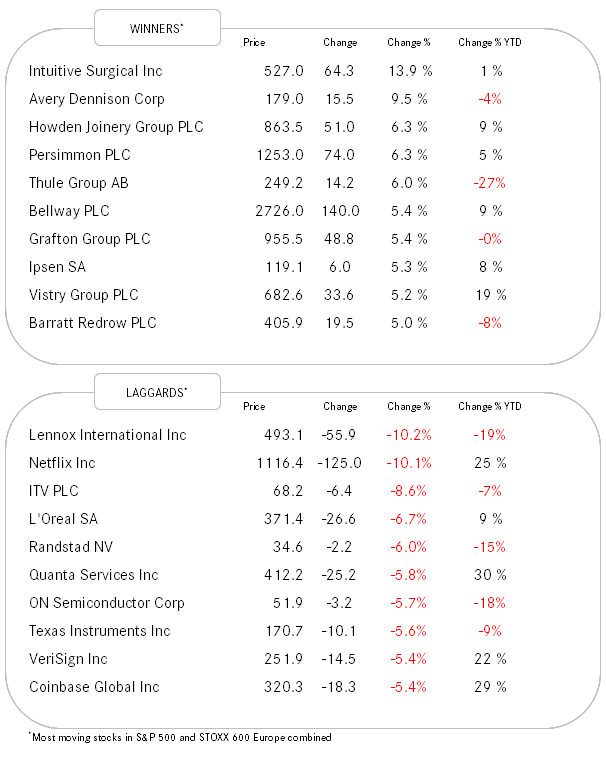

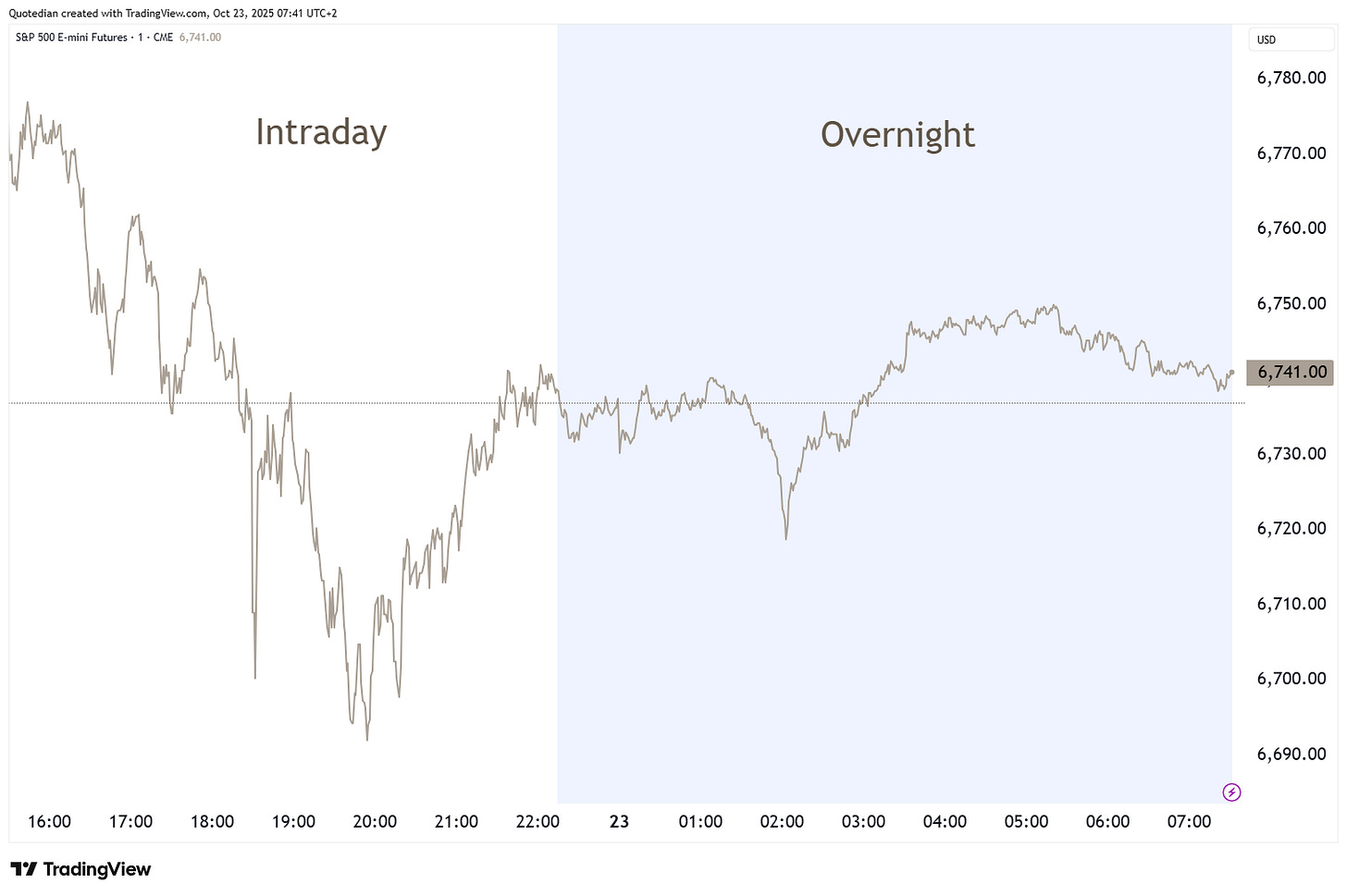

With no other specific narrative than the earnings season one, stocks were in corrective mood yesterday, with the S&P closing down half a percentage point in a dull intraday session, followed by even duller overnight trading:

European markets were mildly down mostly to and this is setting the tone for Asia’s session this Thusday morning too:

Market internals in the US session were not terrible, with the advance-decline ratio at 2:3 and with four out of eleven sectors closing higher, albeit admittedly three of those four (consumer staples, health care and real estate) belong into the “defensive” camp.

The star performing sector was Energy, most likely on the back of the US administration’s decision to sanction the two largest Russian oil companies, Rosneft and Lukoil.

Oil (WTI) jumped over two percent and is up another nearly four percent this morning:

See the COTD below for more crude (pun intended) insight.

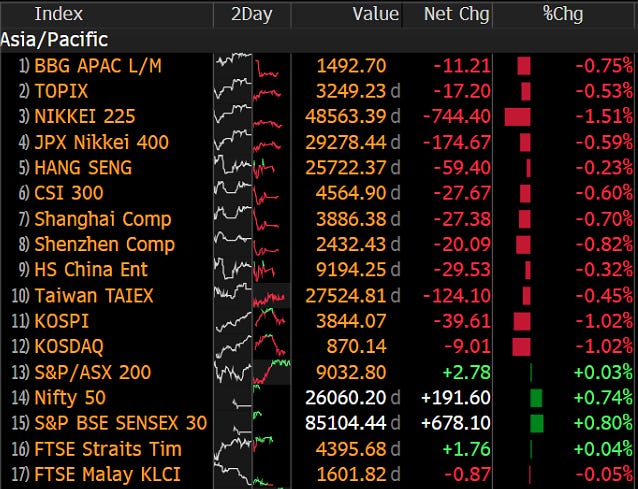

Back to stocks for a moment, where earnings are seeing one of their best beat-rate (85%) since 2021:

In the bond market, worthwhile nothing that UK Gilt yields dropped substantially yesterday,

after UK inflation data (CPI) was not only lower than estimated, but actually also lower than the previous months:

This immediately led to a shift higher from 40% to 75% in expectations for a BoE rate cut by the end of the year:

Finally, as everybody knows meanwhile, Gold (and other precious metals) has come down from its blow-off top. Yesterday, the yellow metal even briefly touched the 4,000 mark. On the chart below, I also overlay a Fibonacci Retracement pattern:

One could argue that with the low yesterday, the 38.2% retracement level has been ‘satisfied’. However, (much) deeper corrections are also possible, without hurting the secular or even cyclical uptrend.

That’s all for today and as I am off tomorrow, “see” you again next week, either here or here or hopefully both!

André

Above we discussed the recent rally in oil, which, small as it is for now, comes at a time of peak bearishness on crude by the investing public.

I have recently been highlighting in different forms and formats, how resilient oil stocks, below proxied via the iShares Global Energy ETF (IXC- grey line) have been in the face of a falling oil price (WTI Futures - red line):

Imagine, just imagine for a moment oil could actually extend its rally on the back of the geopolitical scenario coupled with a re-acceleration in the global economy… stay tuned!