QuiCQ 24/04/2025

The Art of Caving In

"Those are my principles, and if you don't like them... well, I have others."

— Groucho Marx

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

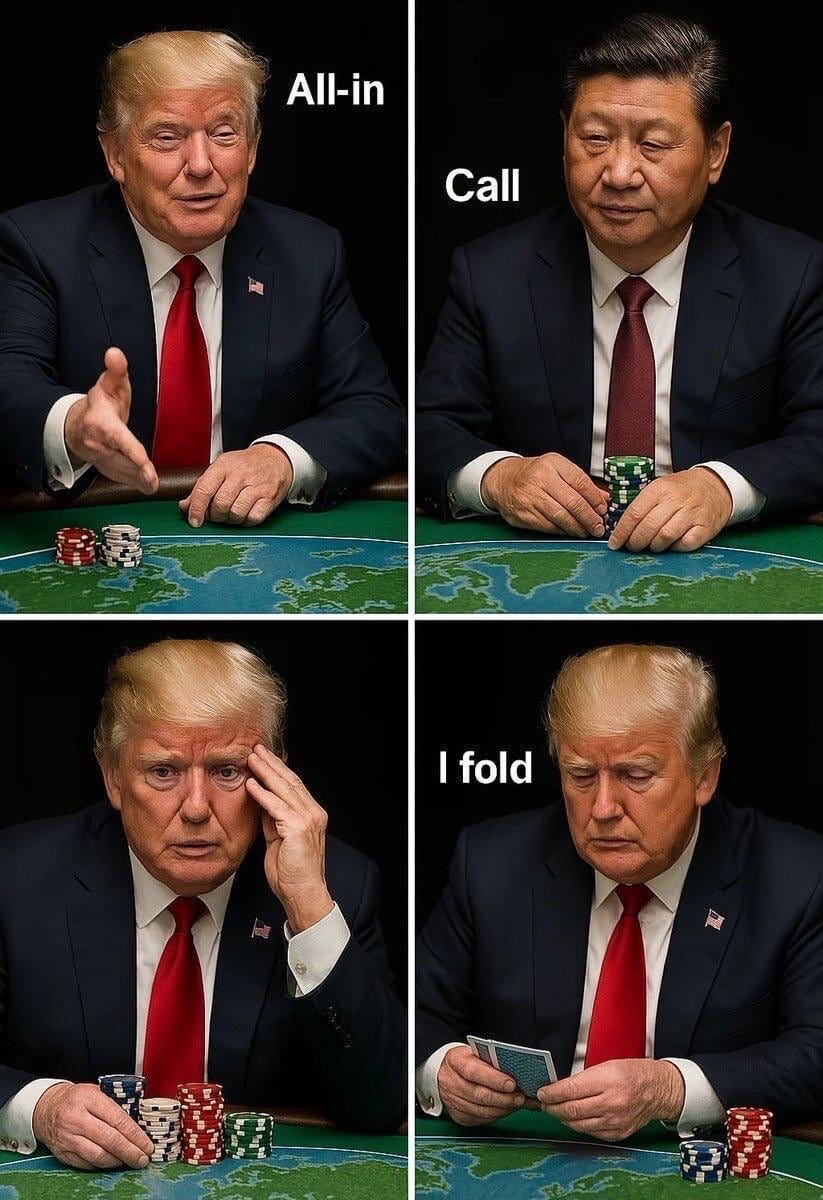

In our most recent Quotedian "Bluff Called” (click here) we ‘accused’ Trump of having blinked in his trade war stand off with China (and the rest of the world). The blinking seems to have turned into a frantic fluttering this week. The number of memes is increasing accordingly:

Onward with our daily observations though …

In the end, a potential Wonderful Wednesday turned into a Whimper Wednesday for stocks by the time the closing bell rang. Mind you, up over one and a half percent on the S&P 500 is still a very decent advance for just one day, but given that the index was up more than double that shortly after market opening, left kind of a stale taste:

Participation in the rally was weaker than on Tuesday massive upwards thrust day, but still honorable at a win-to-lose ratio of nearly 3:1 (just not enough for the Zweig Breadth Thrust signal many were hoping for).

Still, nine out of the eleven economic sectors printed green on the day and some of the more frothy (aka speculative) corners of the market performed well:

Bond yields (UST 10y) ended the day more or less where they had begun it after a wild down-up sequence:

Despite the improving outlook regarding a possible tariff-induced recession did oil sell-off heavily yesterday, partially on the back of record US oil production numbers,

but mainly on OPEC+ calls for a production increase yesterday. This could keep longer-term US interest rates in checkers and actually play well into a further risk-on scenario for the coming weeks to months as highlighted yesterday.

The US Dollar meanwhile was able to gain some further ground versus its G-10 colleagues, increasing the odds for a deeper retracement of recent losses:

But one of the most interesting aspect of macro moves this week is … see below “Chart of the Today”.

Time's up, more tomorrow - May the trend be with you!

Gold!

We proxy Gold via the SPDR Gold Trust ETF below, as it has volume data. The chart argues for the first prolonged consolidation pattern ahead in Gold as,

A key reversal took place,

with follow through yesterday,

on highest volume in three years.

Odds are in favour of a deeper correction now.