QuiCQ 24/07/2025

Melt-Up or Blow-Off?

“More money has been lost trying to anticipate and protect from corrections than actually in the corrections themselves.”

— Peter L. Bernstein

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

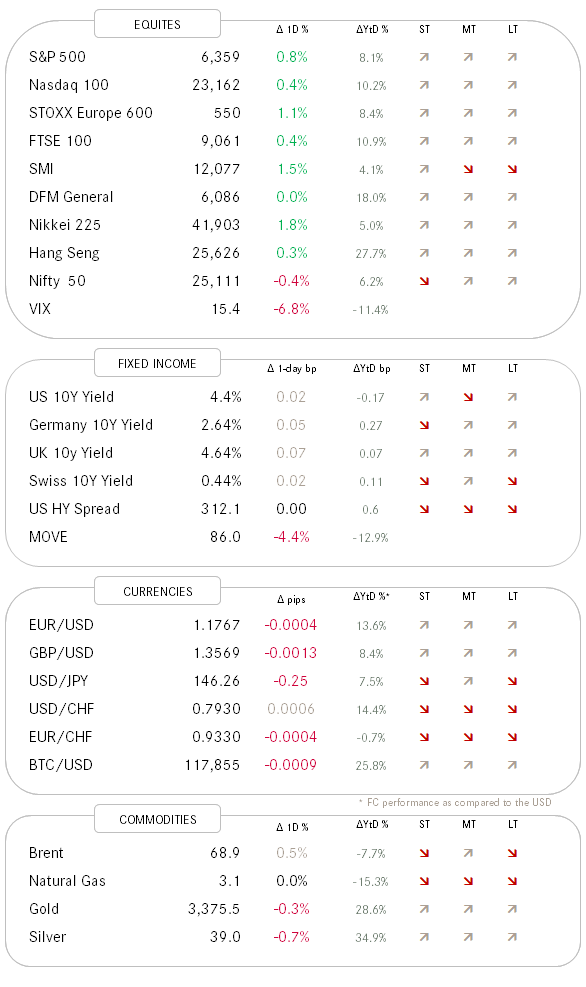

The slow grind higher on stocks continues, though yesterday at an increased speed and on broader breadth. Is the melt-up turning into a blow-off?

We need to remember an old market wisdom, reminded to me in a recent note by one market observer:

The rate of change matters more to markets than absolute levels. I.e., whether “things are getting better or worse” can be more important than whether “things are good or bad.”

Japan’s 15% tariff agreement is a point-in-case on the above. Markets are hopeful now, that “things will also get better” in tariff negotiations between the EU and the US - the deadline is exactly on week away …

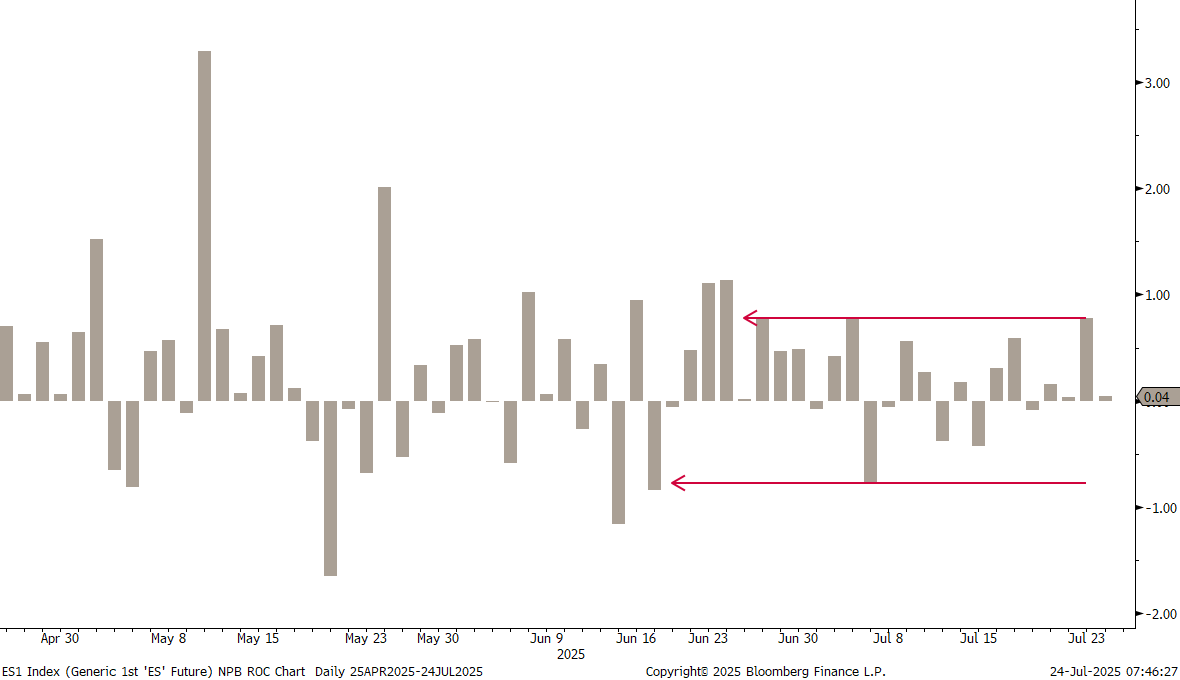

Yesterday then, post the Japan announcement, the S&P 500 (futures ES1) had not quite a one percent day move, but still its largest up (or down) day in nearly a month:

As aforementioned, breadth expanded also, with two stocks up for every stock down in the S&P 500, but maybe more importantly, 10% of the stocks in this same index, reached a new 52-week high. Not bearish …

The Japanese stock markets itself, saw today a 1.7% follow-through to yesterday’s 3%-plus rally (TOPIX) not only exceeding the cycle highs from quite precisely a year ago …

… but also reaching a new all-time high - some 36 years later!!!!!!!!

Now, that’s what I call a base!

And if you think I sound very euphoric … at least I am not alone, as the Barclays Equity Euphoria Indicator, which uses options data to quantify investors’ giddiness, shows as it jumped to its highest level since late December.

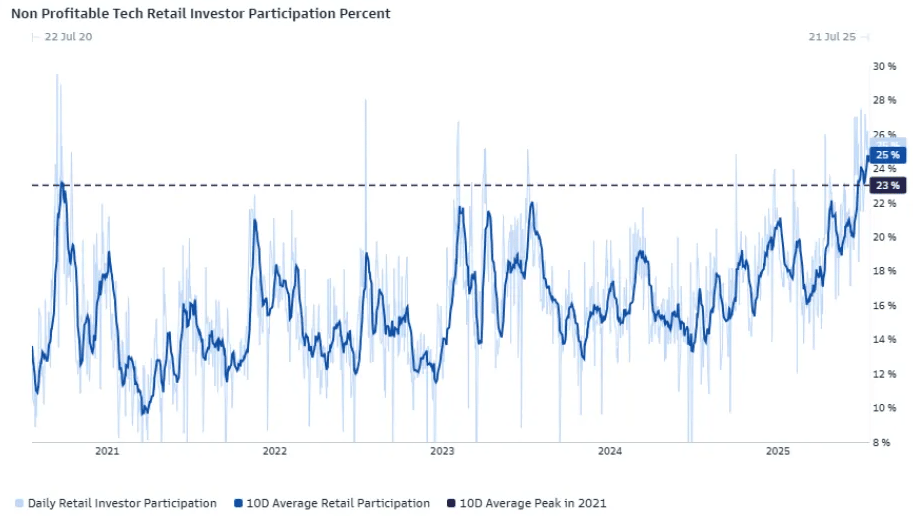

Also, the 10-day average of retail participation in non-profitable technology companies reached 23% — the highest level since a Goldman Sachs trading desk began tracking it — and rose to 25% this week."

Now, before you get too bearish, first scroll back up and read today’s Quote-of-the-Day again and then scroll all the way down and check out The-Chart-of-the-Day.

Global bond yields (prices) have traded higher (lower) over the past day or two, less as a function of economic data or news, but rather due to the risk-on rally in equities.

Here’s an unsolicited and unrelated yet still interesting chart on government bond maturity profiles:

The USD continues to soften, with the EUR/USD cross closing in on the July 1st closing highs rapidly:

Time's up, more tomorrow - ah, no!! One more:

May the trend be with you!

“Be bullish” was a Merrill Lynch slogan for several decades, until the mother of all bears (GFC) ate that bull. Nevertheless, in the same vein as “Triump of the Optimists”, “Be Bullish” has served investors well over the past sixteen years or so. Today’s Chart-of-the-Day gives you more fodder to “Be bullish”:

Stay tuned … and bullish!