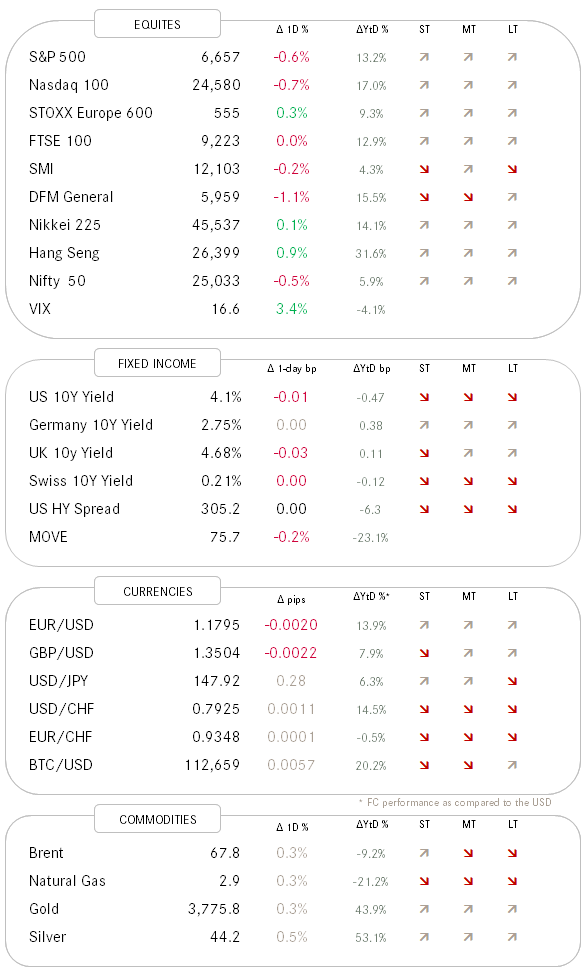

QuiCQ 24/09/2025

Irrational Exuberance

"But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions ...?"

— Alan Greenspan, December 5th 1995

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

During a speech yesterday, Fed Chair Jerome Powell was asked whether he and his colleagues give any weight to the impact of their monetary policies on financial markets. He responded: "We do look at overall financial conditions, and we ask ourselves whether our policies are affecting financial conditions in a way that is what we're trying to achieve.”

Then he opined that "by many measures, for example, equity prices are fairly highly valued."

Was that Powell’s equivalent to Greenspan’s famous irrational exuberance speech, which by the way then subsequently was used by Professor Robert Shiller as a title for an in the investment world famous book (click here)?

By all means, he then quickly added that this is "not a time of elevated financial stability risks.", which I am not sure should sooth us or trigger all our spidey contrarian senses? To be seen …

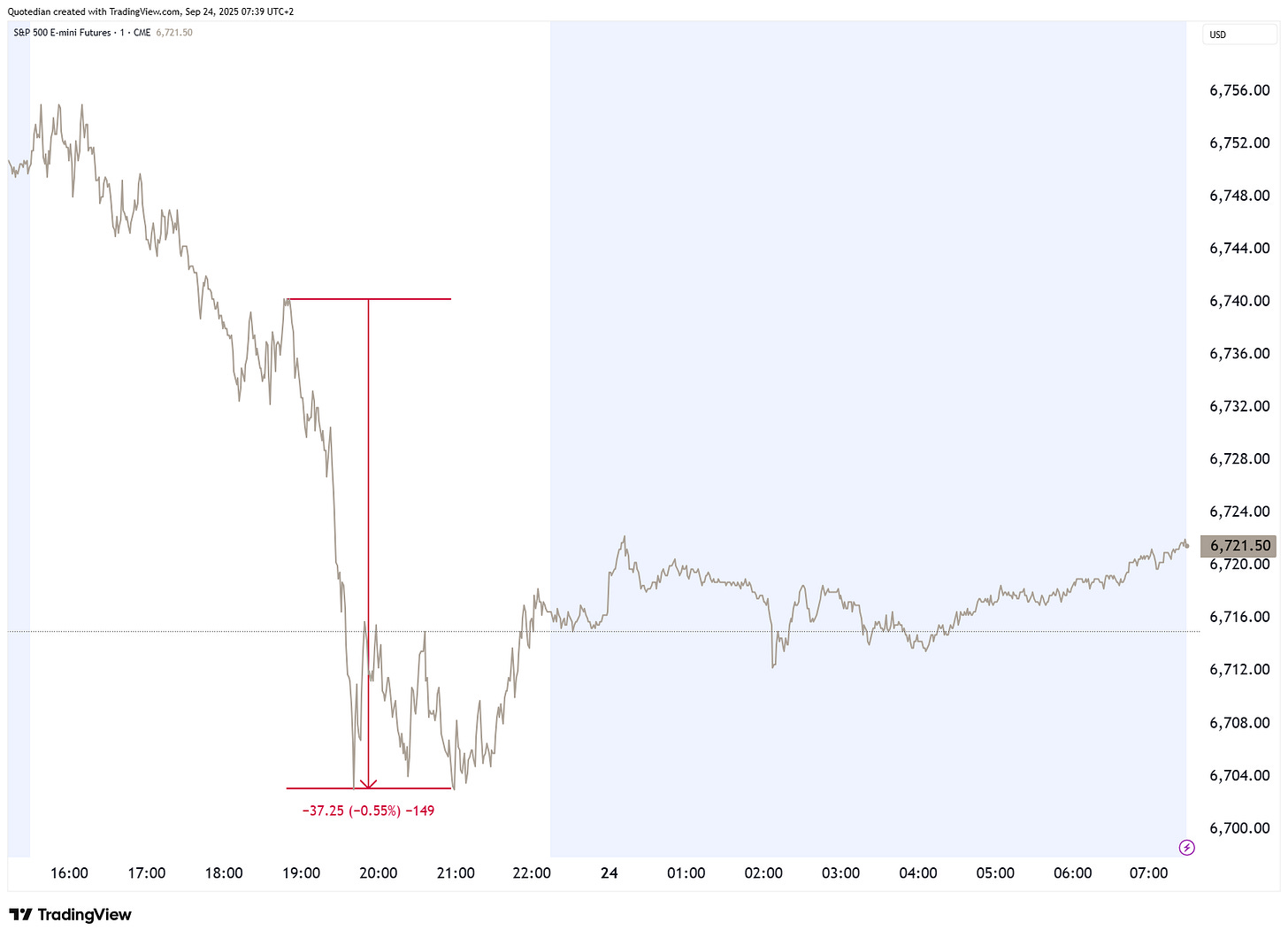

Back in 1996, stocks dropped about three percent intraday after Greenspan’s remark - in the 2025 version the S&P 500 gave back about half a percentage point before starting to climb again:

So, stocks are oblivious to nearly anything at the moment, especially valuations. But let’s hold that thought and discuss it deeper in the next Quotedian.

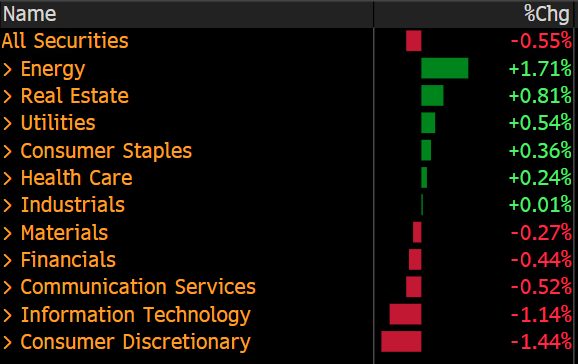

But back to markets … the fact that more stocks were up than down on a down-session day, already hints to the largest caps having underperformed yesterday:

And interestingly enough we also observed a (one day) trend reversal to sector performance:

That is pretty much the mirror image to year-to-date sector performance which we had briefly discussed in Monday’s Quotedian (click here).

Bonds were bid around the globe yesterday, but the truth is, that since the Fed cut last week, the uptrend in YIELDS has reignited. Here’s the US 10-year treasury as proxy for the rest:

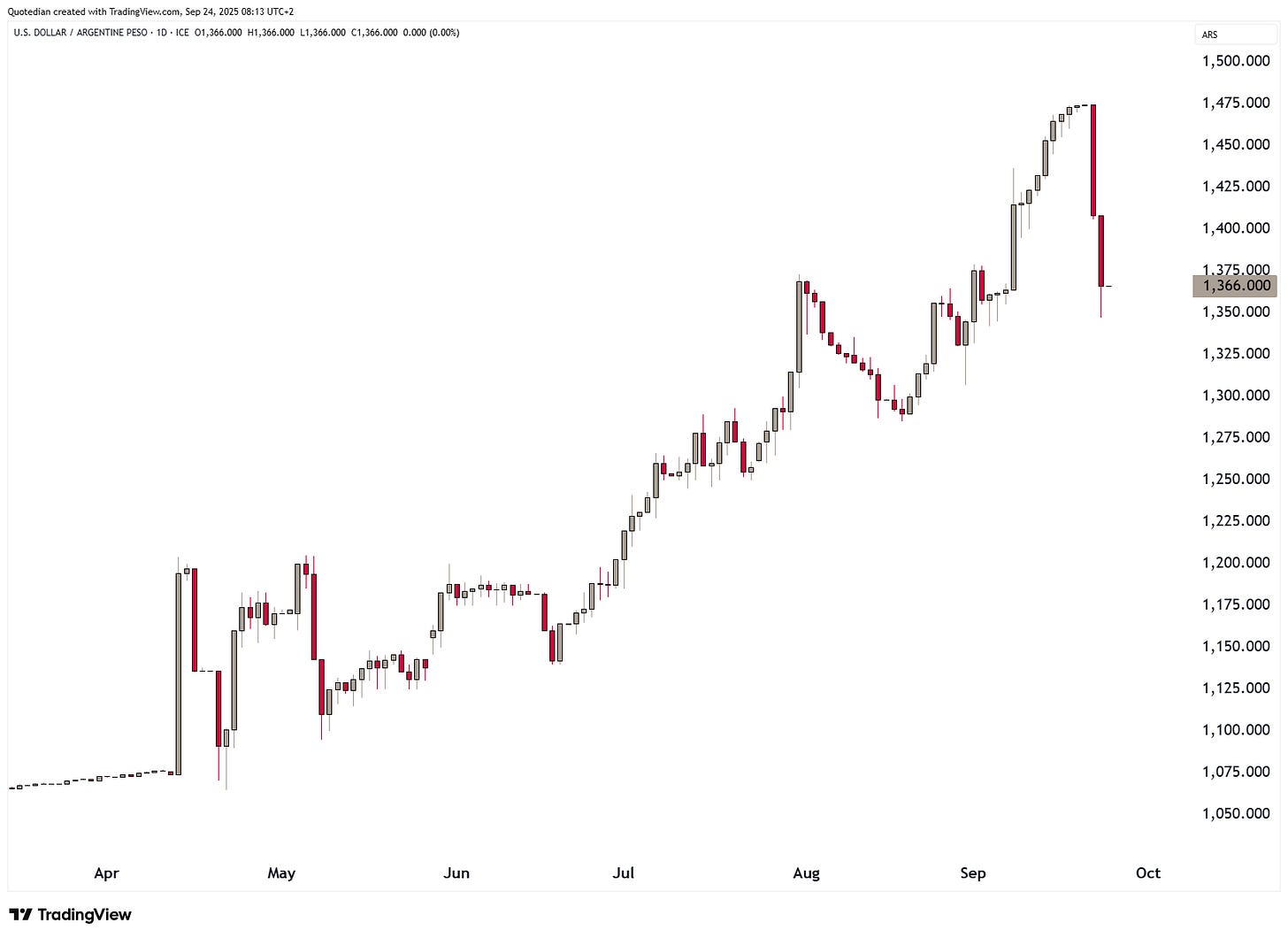

Little to report from the currency realm, maybe with the exception of the Argentine Peso, which is living through a partial recovery as Milei is waiting for a bailout in Washington:

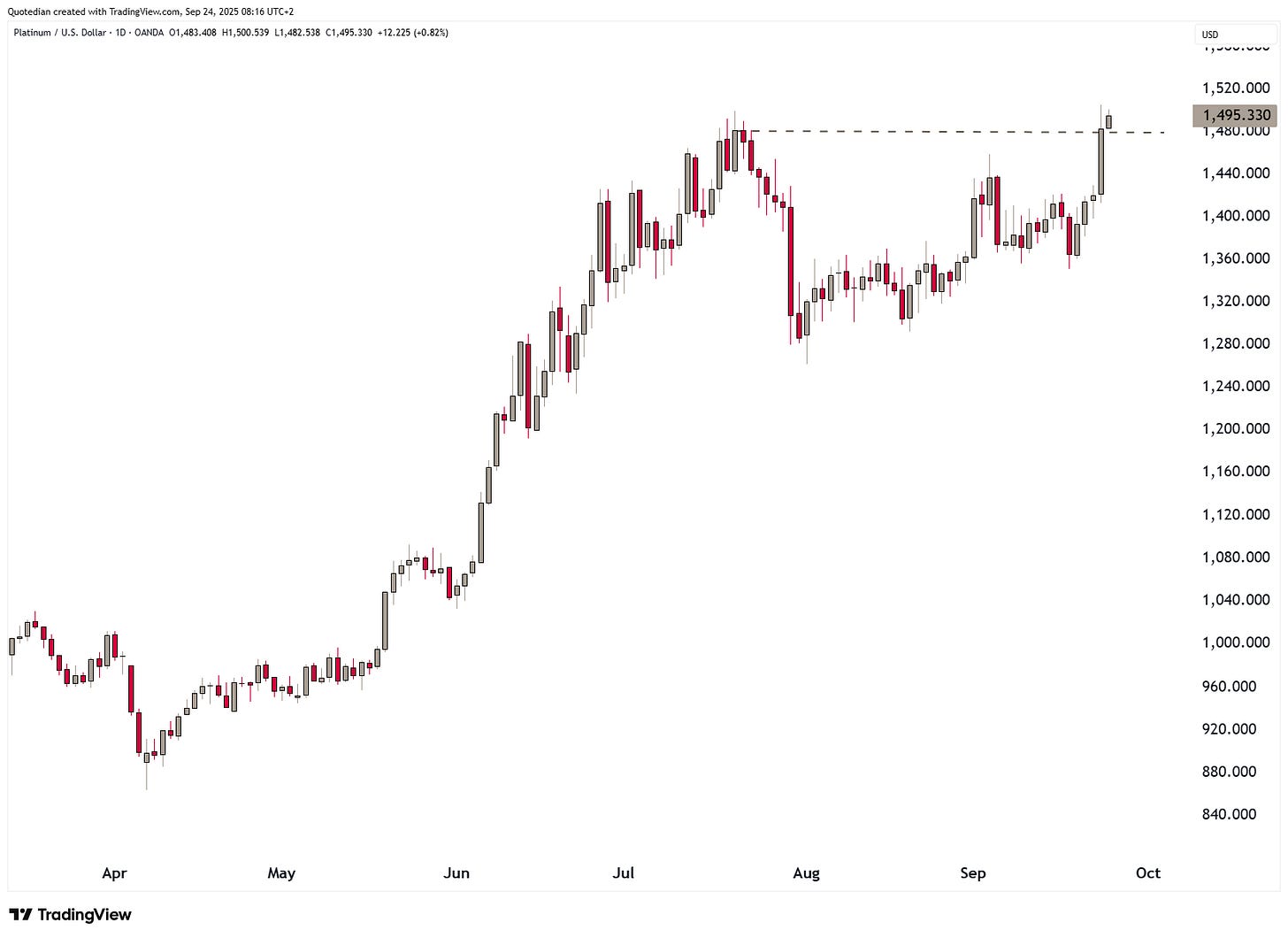

And finally, Platinum, the best performing precious metal year-to-date, seems to have started its next leg higher, as prices just broke above the July highs:

Time's up, more tomorrow - May the trend be with you!

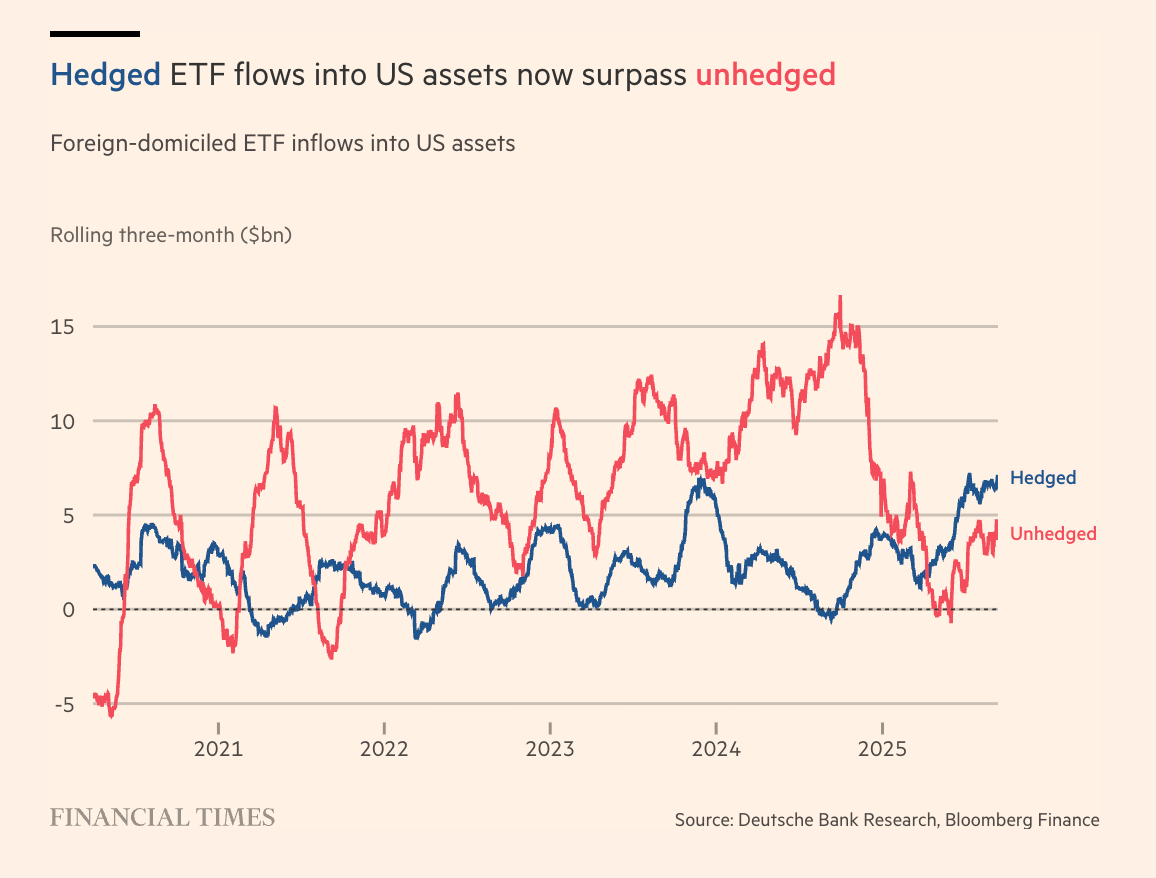

In NPB Q3 Outlook (click here) we discussed how we expect that the US Dollar has fallen into a secular bear market and as such we expect further weakness for the greenback over the coming months and years.

The chart below suggests that other foreign (i.e. non-USD) investors are agreeing with us.

Stay tuned!

It's interesting to see how the market's reaction to similar Fed comments has changed over time.