“Follow the trend lines, not the headlines,”

— Bill Clinton

Much of yesterday’s market action seems a continuation of the “Trump Trade (TT)”, i.e. betting on assets that should do well under a Trump win and a possible Republican sweep. For more detailed comments on this, refer to past and upcoming issues of The Quotedian (www.thequotedian.com), the big brother publication of The QuiCQ.

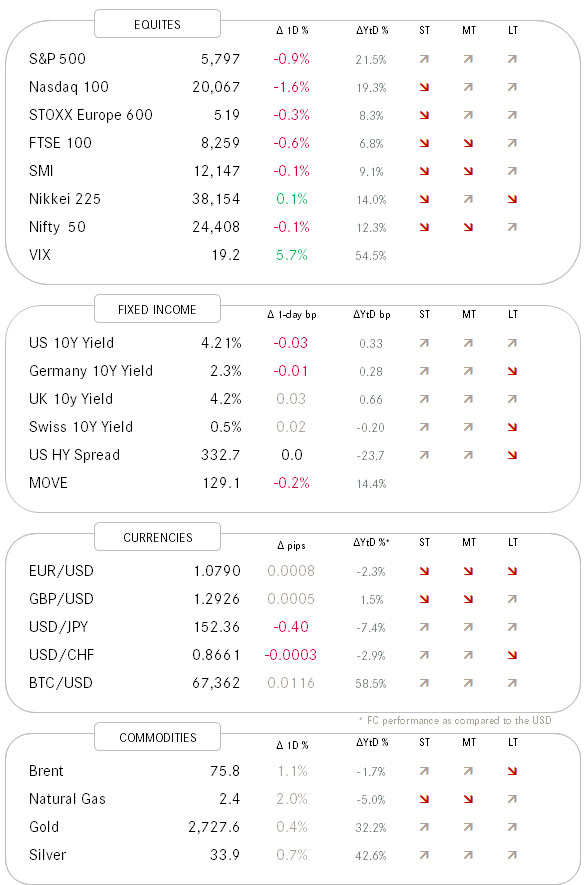

Two such trades belonging to the TT are higher bond yields and a higher Dollar - often they go hand in hand and yesterday was no exception as the US 10-year Treasury yield briefly hitting an intraday high of 4.26%, up well over 50 basis points since the beginning of the month. Such move in bonds are considered ‘massive', especially over such a short time period, and are prone to upset one or the other stress-testing model.

Ergo, the Dollar pushed the EUR/USD rate to as low as 1.0760, and maybe even more meaningful the USD/JPY rate briefly above 153.00.

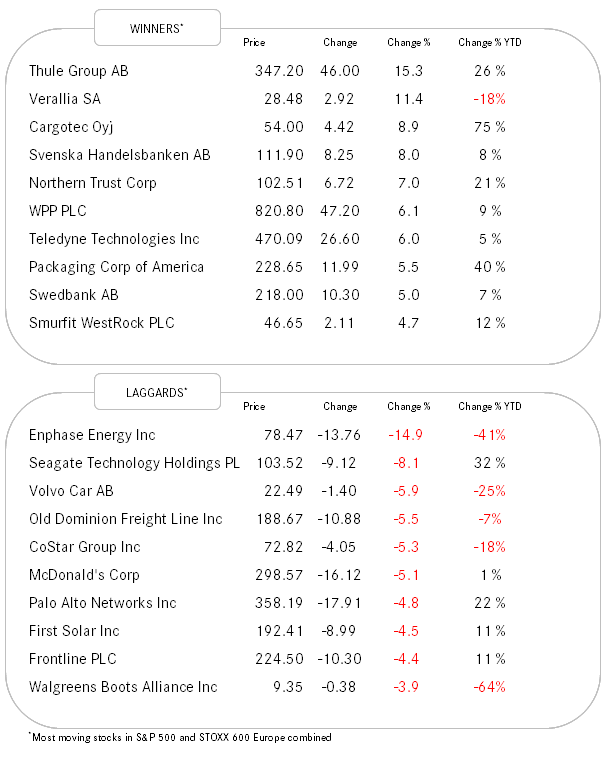

Stocks were under pressure for a third day yesterday, mainly because of the above just described, but also negative earnings surprises outweighing positives ones yesterday.

Having advocated that a Trump win may be clearer than expected since about a month, the market seems now to have come to that conclusion too and I would argue that such an outcome could be fully priced in. Maybe time to consider some USD-puts and TLT-calls for a “buy the rumour, sell the fact” trade? Or heaven forbid, Mr T actually does not win …

Anyway, Asian markets are reflecting Wall Streets sombreness, with only the Japanese equity market showing a little ray of (green) light.

Having said that, European and US equity futures are in positive territory about one hour before our cash markets open here, maybe helped a tad by good results from Tesla after hours?

In investing, the temptation to fit the narrative and chart interpretations to fit your views is huge, and, sadly also quite easy. Just ignore the ones that don’t fit and pick the ones that do …

With that out of the way, the chart of the USD Index (DXY) below, shows an exhausted momentum indicator (MACD - middle clip) and a price (top clip) that is approaching some key pivot levels. In combination with a second DeMark Sequential 9 signal (read more here and here) and our view expressed above, a tactical short Dollar may be of interest.

Now, before you do anything, please scroll down and read the disclaimer, especially points one through four :-)