QuiCQ 25/02/2025

Shaky Grounds

“Price is what you pay. Value is what you get.”

— Warren Buffett

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Speedround on a busy Tuesday morning …

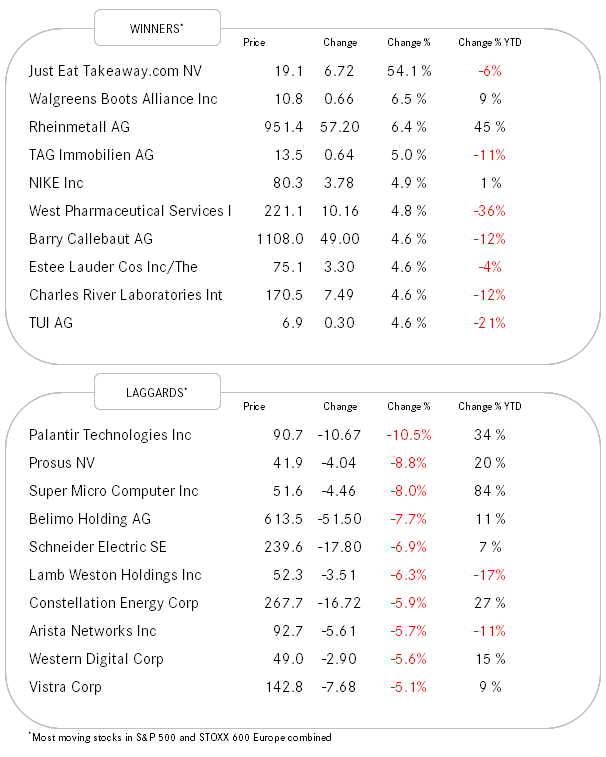

Mixed picture for stocks on Wall Street yesterday, with the Dow up a tad, the S&P 500 down small, the Russell 2000 down a bit more and the Nasdaq down a ‘respectful’ 1.2%.

Maybe more important than the final up or down %-number was the pattern, which was similar for all four fore-mentioned indices: Down, then midday recovery then sell-off into the session lows (and beyond). Here’s the Nasdaq iteration of this:

Previously, stocks in Europe had also shown weakness, albeit only limited so. And German stocks even bucked the trend post elections in that country on Sunday, eking out a gain (Dax +0.6%, MDax +1.5%).

Back to the US briefly, where as a reminder the S&P 500 closed down half a percentage point. However, only half of the sectors were down on the day and the number of stocks rising (288) during the session was higher than the one of falling stocks (214).

This of course means that a) the equal-weight index (RSP) for sure must have outperformed the market-cap weighted index (SPY),

and b) the Magnificent Seven (MAGS) may be in trouble at the current shootdown:

Oh, yes. Deep trouble. Remember in the movie, only three survived (just saying).

All the higher then will be the focus on Nvidia’s Thursday earnings report:

In fixed income markets, duration was bid on both side of the Atlantic, with the US 10-year Treasury first dropping sharply on Friday as stocks went risk off and then saw some additional (yield) downside pressure on Monday over tariff concerns and a strong 2-year Treasury auction.

German Bund unwound the previous week’s election uncertainty fear-trade nearly completely:

The US Dollar has been a bit all over the place since trading resumed in Asia on late (European) Sunday evening, only to be now where it had started. Here’s the chart on the Dollar Index (DXY) to illustrate that point:

Gold closed at yet another new all-time high (2,952) before retreating somewhat this morning:

In case you missed it, NPB’s investment committee decided last week to increase the Gold exposure for its clients from neutral (5%) to a tactical overweight (7.5%). Read about it here (click here).

Finally, as I had already outlined in Sunday’s Quotedian (click here), cryptocurrencies are starting to look like they may be rolling over into a bigger correction. Here’s Bitcoin for example, hanging on in just about:

Last chance to buy above 90k?

Crypto stocks such as MSTR or Coinbase confirm the critical moment for digital money:

That’s all for today - have a great day!

Elon Musk and his DOGE department are trying to slim down the government. Watch out for that pick-up in jobless claims around the Washington DC area: