QuiCQ 26/11/2024

Rat Race

“The trouble with the rat race is that even if you win, you're still a rat.”

— Lily Tomlin

Finally!

Yesterday got us “por fin” a new ATH for US small cap stocks (Russell 2000, RUT), even though only on an intraday basis. But still, it took the RUT nearly precisely three years to make that achievement, so let’s not small (pun intended) talk it.

With this, we now have all major US market indices having reached new ATHs this cycle:

However, yesterday’s productive session has been a bit jinxed overnight, as incoming US president elect Trump threw around that nasty T-word on his own personal social (an oxymoron?) media network:

Here’s post on China:

The post immediately followed one in which Trump said his first of “many” executive orders on Jan. 20 would impose tariffs of 25% on all products from Mexico and Canada.

Well, …

Equity markets did not appreciate those comments/posts too much, with futures falling overnight, however, they already have largely recovered most of their initial losses about an hour before European equity cash trading begins. Chinese stocks are amusingly enough up on the day …

The largest impact from the Trump comments however have probably be felt on FX markets, where the US Dollar jumped nearly a big figure versus the Euro for example, though also there most of the move has already been unwound again:

Is the market smelling Mr Trump’s bluff?

Last but not least, US 10-year yields dropped to 4.29% yesterday, quickly approaching the key support area at 4.25% we highlighted in our Quotedian report yesterday (click here).

Should 4.25% give, 4% could be easily on the cards.

For today, some interesting earnings reports (e.g. Dell, Crowdstrike, others), but most of them after the US closing bell. Economic data wise it is rather quiet today, with maybe the release of the last FOMC meeting minutes at 20:00 CET of some mild interest.

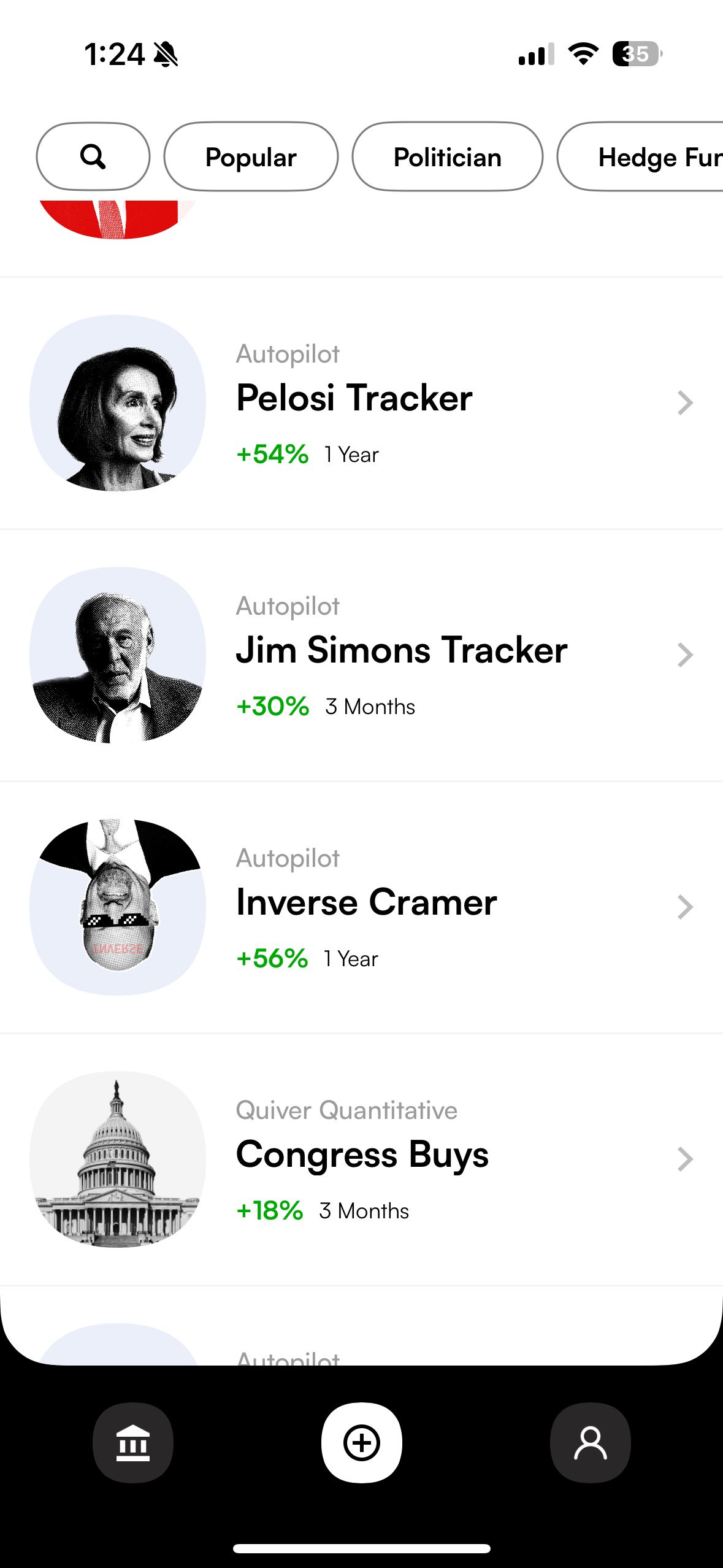

Last week, we compared the performance of sitting congress members from the democratic side of the isle (NANC) to the one of the republicans (KRUZ), noticing that not only did NANC beat KRUZ, but actually also the S&P 500 TR index - quite the feat tbh!

Today, we note that a Pelosi Tracker, with Nancy Pelosi of course being THE democrats super-stock-picker, is being giving a run for her money by none other than the fabulous Inverse Cramer:

And talking of the inverse Cramer, he did it again a few days ago, jinxing Bitcoin with near perfection:

Amazing!