QuiCQ 27/06/2025

Close but not cigar

"There is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success, than to take the lead in the introduction of a new order of things."

— Niccolò Machiavelli, The Prince

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

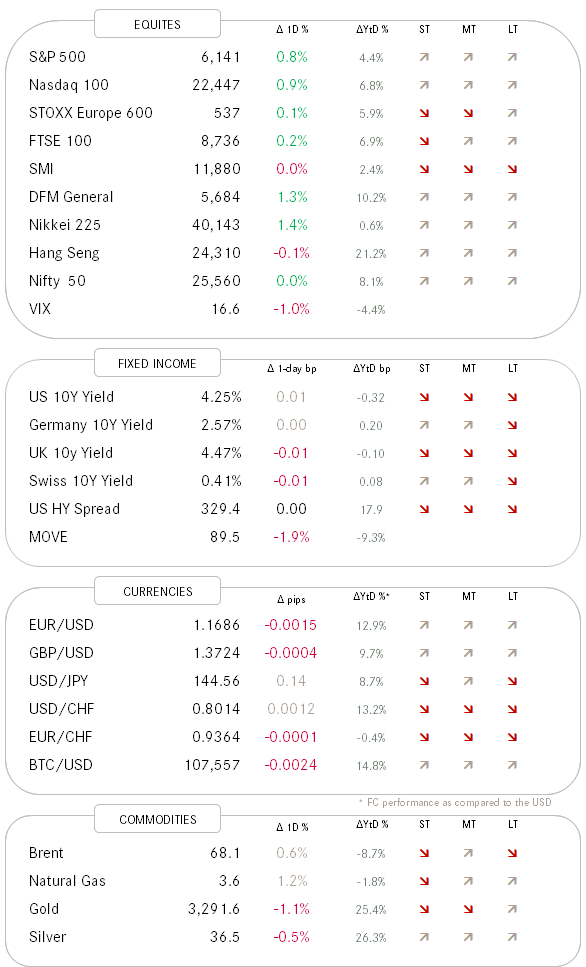

Last night the S&P 500 closed at 6,141.02, missing the set a new all-time high (ATH) by full 3.13 points or 0.05% - close, but NO cigar! But also NO doubt that the previous ATH set on February 19th this year will be taken out in one of the upcoming sessions - maybe as soon as this Friday.

Why no doubt? Given the markets’ strong breadth during “up” sessions over the past week(s), it is clear that the path of least resistance is to the north (i.e. up). Yesterday, winners outpaced losers once again at a ratio of three-to-one and only two out of eleven sectors were small down on the day:

Plus, index futures (S&P 500 minis) are already trading at new ATH:

Plus, as previously discussed in a Quotedian (click here), the cumulative advance-decline ratio, i.e. the number of stocks that go up and down on any given day, has long broken out to new ATHs:

(Interest) Rates continued to soften yesterday, i.e. duration was bid again, with the US 10-year Treasury yield falling to its lowest level (4.25%) since early May:

This, as investors are increasingly ‘betting’ on two to three rate cuts again by the end of the year:

This is also translating into a weaker US Dollar, with the Dollar/Swissie for example clearly breaking down,

or the EUR/USD trading at its highest since 2021!

Gold is trading below the $3,300 level and challenging the lower end of its ascending triangle again:

Quite contrary to Platinum, which has been steaming higher:

Last but not least, Copper is also joining the metals rally now:

Putting completely at odds its usual correlation to the 10-year treasury yield:

Asian equity markets are mixed this morning, with strong gains (1%-plus) registered in Japan, but the Chinese complex (Mainland, HK) lower. European and US futures are firmly up, improving the odds further for that new ATH on the S&P today.

Ok, that’s all for today and this week.

Enjoy your weekend and make sure to remain hydrated! ;-)

One of the best performing market segments yesterday were small cap stocks (Russell 2000 +1.7%), where the chart starts looking really constructive now: