QuiCQ 27/08/2024

Waiting for Godot (aka NVDA)

“Take care of your employees and they’ll take care of your customers”

— John W. Marriott

Prefer to read today’s QuiCQ in PDF? No prob, download it here, but don’t you dare complain about the formatting!

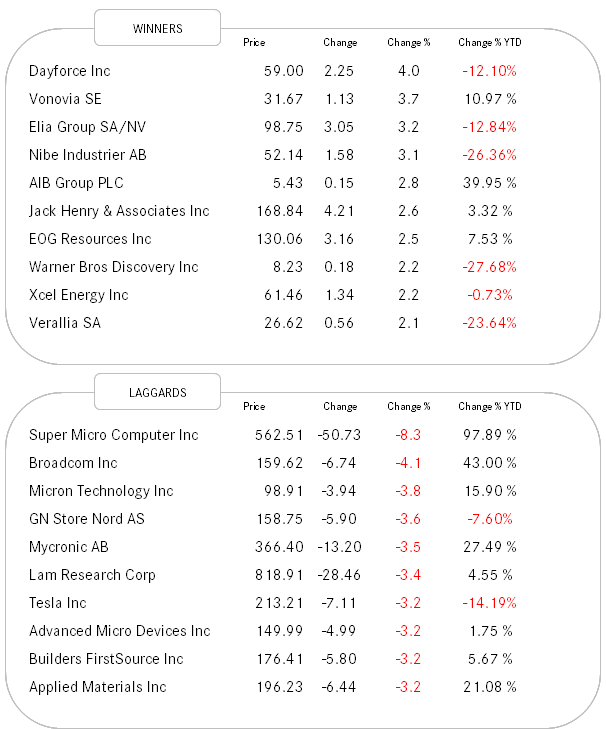

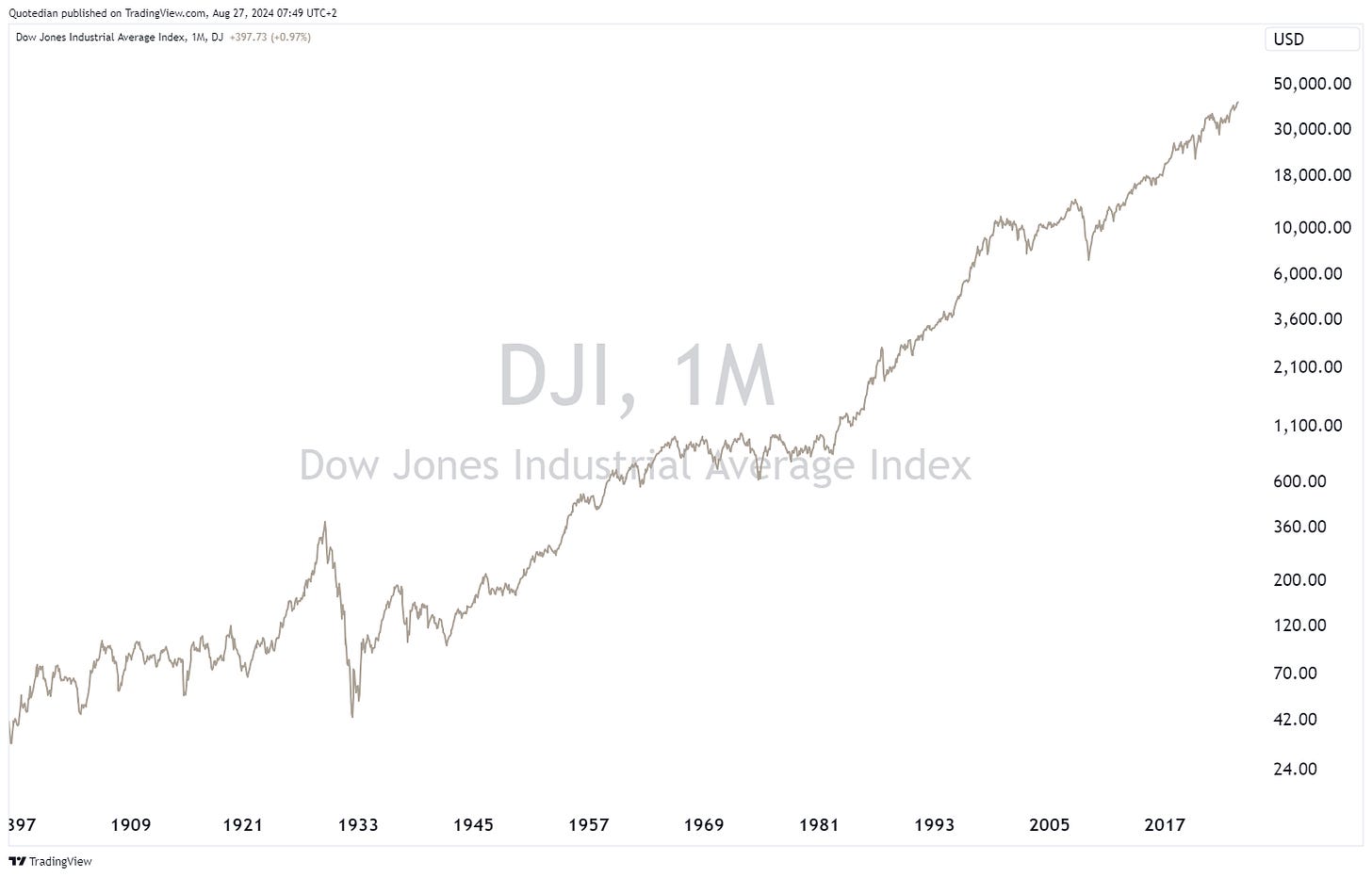

To understand yesterday’s (equity) session, look no further than the ‘Losers’ table in the Movers section above. Sprinkled with semiconductor jobs it is easy to deduce that investors were taking some chips of the table (pun fully intended) ahead of NVDA’s earnings release tomorrow after market close (please also refer to today’s COTD below). But to see what is really going on, a quick glance under the hood is necessary. With the S&P 500 down 0.3% yesterday more stocks rose (264) than fell (237) and 79 stocks hit a new 52-week high versus zero a new 52-week low. Aaaand, Papa Dow closed at a new all-time high, which is worth a little ‘hommage’ via two charts on the Dow’s history. Here’s the normal y-axis version:

And here the same using a log-scale:

Bond yields, as measured by the 10-year US Treasury, rebounded from crucial support (3.80ish), with little news to write home about.

Two commodities to keep a close (geopolitical) eye on continue to be Gold and Oil. The yellow metal closed at yet a new all-time high yesterday, though has since then retreated a little. Crude is up over 7% in just three sessions, not only because of production shut down in Eastern Libya, but also due increased kinetic fighting between Russia/Ukraine and Israel/Hezbollah, coupled with increased ‘manoeuvres’ by China close to Taiwan.

Little excitement on the economic calendar today.

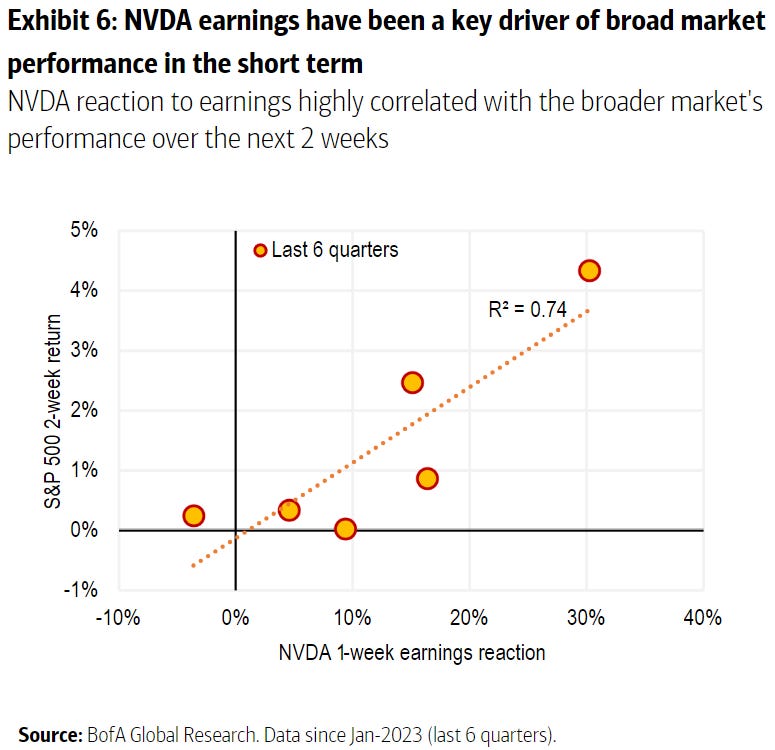

One stock to rule them all? Well, nearly.

Correlation does not prove causation, but the following chart from BofA (via John Authers) illustrates Nvidia’s importance on the overall market by comparing its stock performance in the week after an earnings announcement on one axis, and the S&P 500’s performance over the following two weeks on the other.

A correlation of nearly 86% (R-squared 0.74) is hard to ignore - spurious or not…