QuiCQ 27/11/2025

So long and thank you for all the fish

“Do it or don’t do it. You will regret both.”

— Søren Kierkegaard

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

First QuiCQ this week - let’s give thanks to the responsible: “Thank you, audit!”

In Monday’s Quotedian called “Bear Sightings” (click here) we asked whether the recently volatility in equities were just same near-term shake-out of the more frothy parts or the beginning of a new bear market.

Benefit of hindsight, and at the danger of providing some too early foresight, it seems your friendly neighbourhood bear just came to same goodbye before going into hibernation this week:

The big question now then is whether this cuddly fellow will go into his usual hibernation until early spring, or may he be awoken early by a bad dream in early January?

Time will tell…

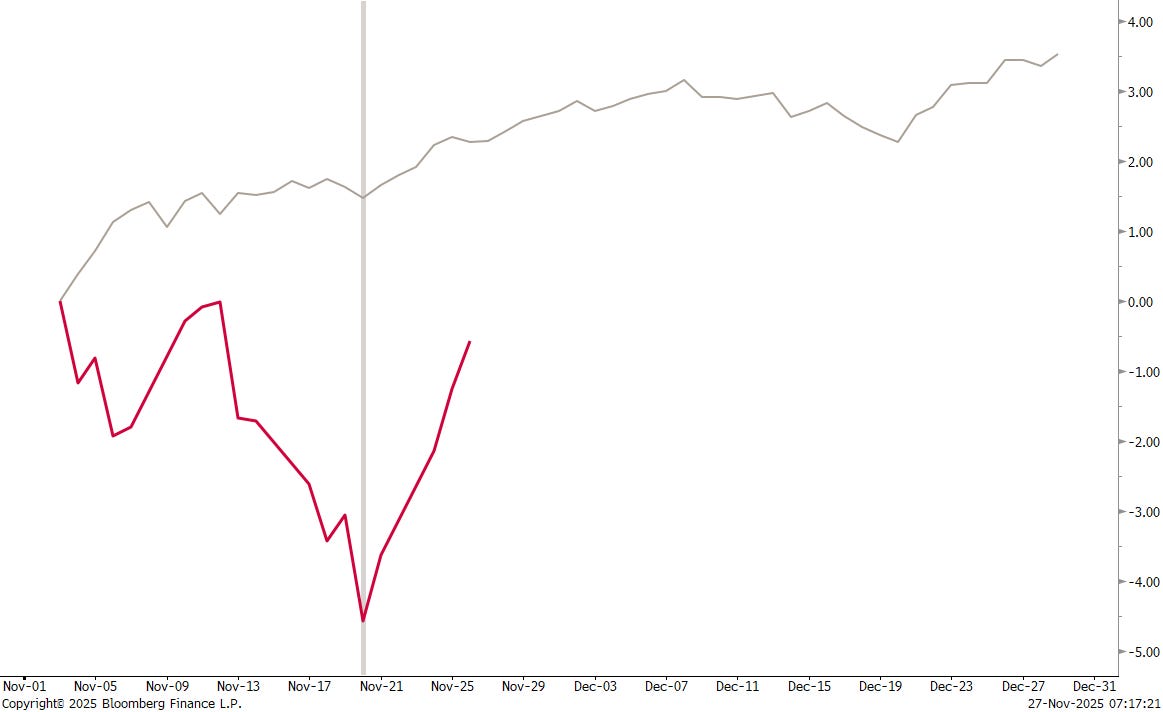

For now, we know that stocks (S&P 500 - red) have swung higher, a possibility we had highlighted in this week’s Quotedian, right in-line and on-time with the seasonal pattern of the past 30 years (grey):

If stocks are to continue this roadmap, we should be fin until shortly after St. Nicholas and then face some weakness until the Santa Clause rally starts shortly before x-mas eve.

In an unusual plot twist, stocks have been stair-stepping lower in November, but took the elevator up over the past four sessions, bringing the S&P 500 to only about one percent below the previous all-time high:

Small cap stocks (Russell 2000) had an especially good, eight percent run and are close to the ATHs too, but must importantly, especially to Dow Theory enthusiast, has the Dow Jones Transport Index finally also hit a new cycle high:

In a nutshell, this is important in terms of trend confirmation and continuation.

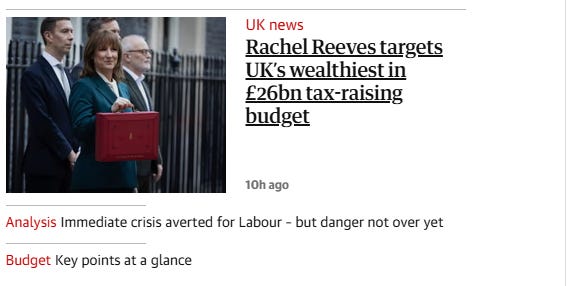

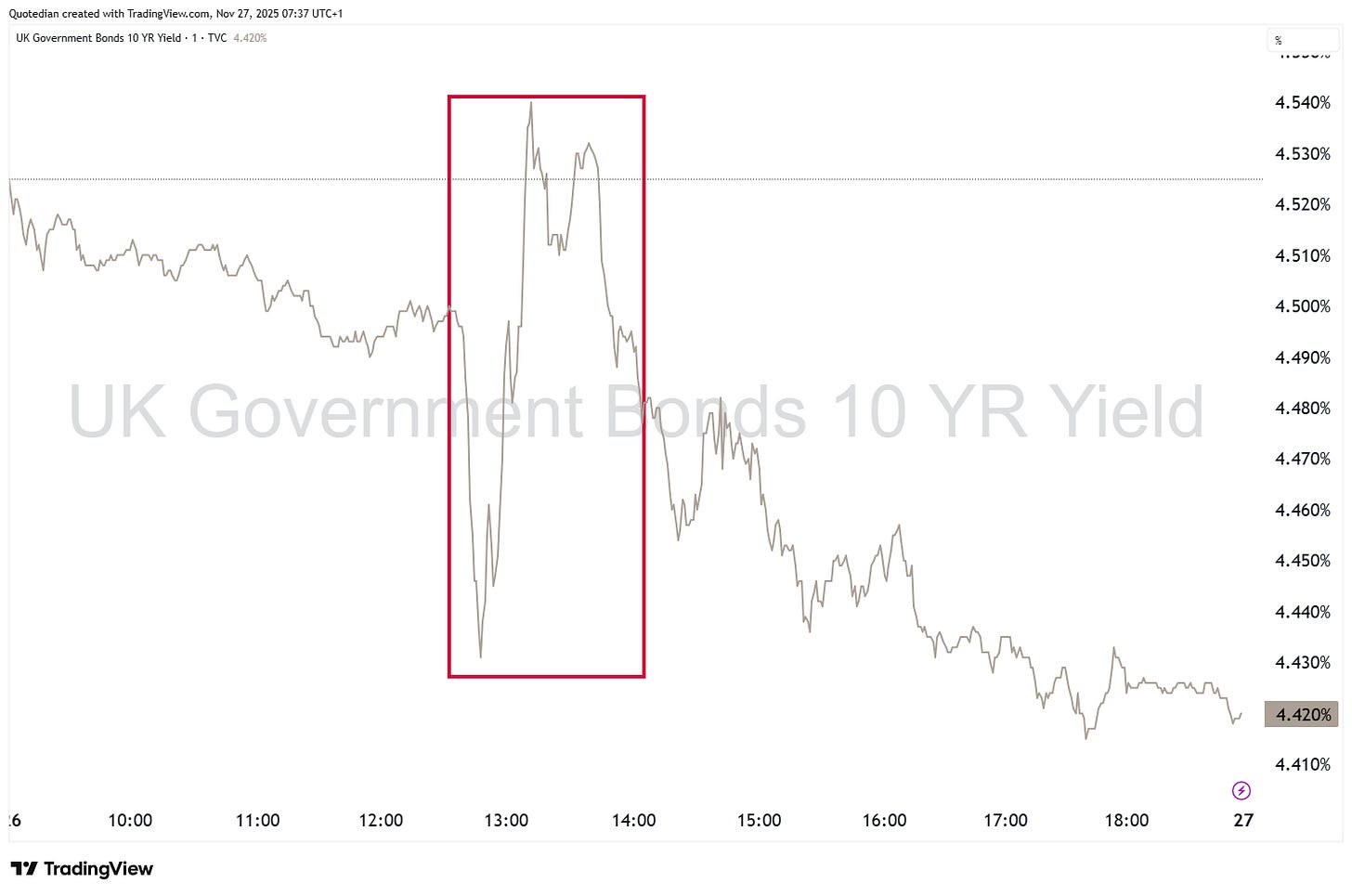

In rates markets, the US 10-year treasury yield has dropped below 4% again on the back of the strong equity market, but the biggest focus was on UK Gilts yesterday, as the country’s chancellor Rachel Reeves (finally) presented her budget. Comments by the press were manifold:

The Telegraph:

The Guardian:

And the FT:

But the only verdict that really counts is the one from the bond vigilantes, which, poor them, were first thrown into a volatile upheaval, as the OBR (Office for Budget Responsibility) in an act of complete Unresponsability released the budget details to early to the public:

However, eventually things settled in and a 10 basis points open-to-close drop in yields can for now be interpreted as the budget has been accepted by the bond market:

Though it all feels a bit like this other FT headline:

The FTSE 100 closed up by nearly one percent and the GBP continued its rally versus the US Dollar,

and most other G10 currencies:

The US Dollar Index itself has again been rejected at the ‘line in the sand’, but we’ll take a closer look at that in the next Quotedian:

Gold is heading higher too still, but I find the Silver (XAG) chart one of the most intriguing right now:

That blow-off to $100 is still on my books (or at least in my fantasy).

That’s all for today - remember to give thanks and remember that US equity and bond markets are closed today and quiet tomorrow.

André

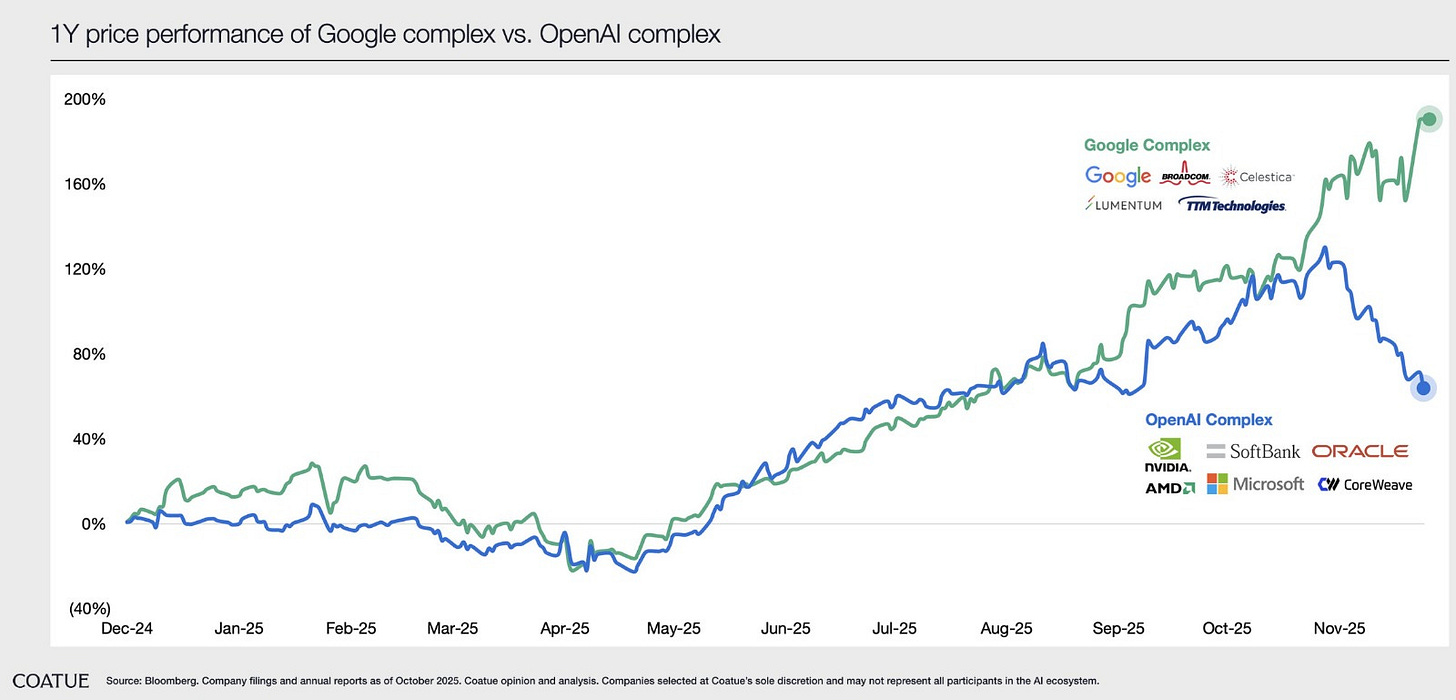

David vs. Goliath

VHS vs. Beta

Federer vs. Nadal

Coke vs. Pepsi

Batman vs. Joker

and now …

Google complex* vs. OpenAI** complex!