QuiCQ 28/01/2025

DeepTrouble?

“Only the game, can teach you the game.”

— Jesse Livermore

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

OUCH! That hurt! Even though many “experts” have now come out to say that they saw DeepSeek coming, that was quite THE curveball for markets in general and AI-related stock in particular yesterday. It was also for a curveball for me writing the weekly Quotedian, having to start from scratch twice over and applying a sheer uncountable number of edits, leaving a pretty subpar letter as outcome in the end. But, oh well…

As we noted in our 2025 outlook published earlier this month, this year is to take down the sails, take out the oars and start rowing these “Wild Waters” ahead.

Anyway, this is your short, daily market update so apologies for digressing.

As you already know by now, a Chinese hedge fund firm started fiddling around with a couple of Nvidia Chipsets and managed to create a pretty decent LLM, dubbed ‘DeepSeek’. The app was released over the weekend and quickly become the most downloaded app on Apple’s store:

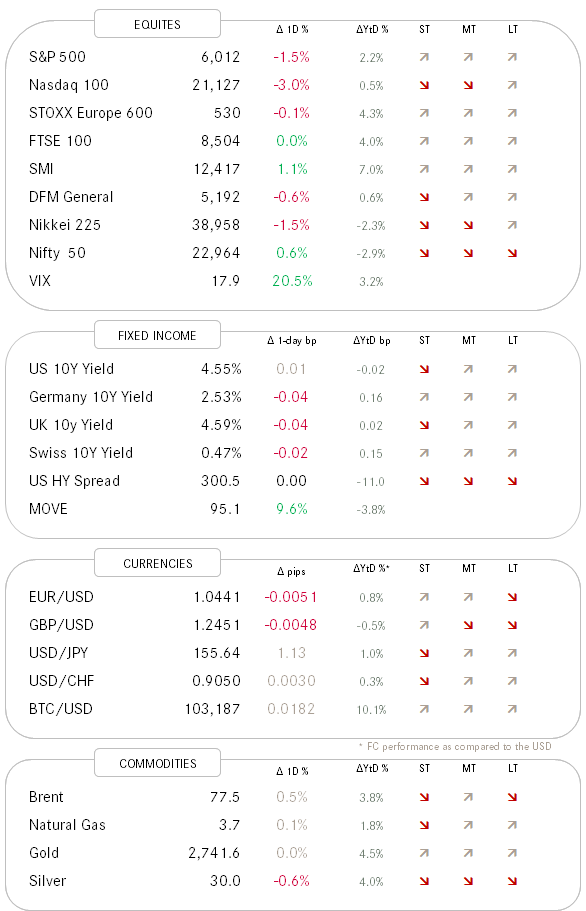

The gist of the story is that they produced an absolutely fine acceptable at a fraction of the cost of its competitors (ChatGPT et al.). A fraction of the cost means thanks to less chips needed —> less engineers needed —> less power needed —> less data centres needed. Now, with that knowledge, go back up to the ‘Movers’ section and check the Laggards. Eh, voila!

Most of the pain hence was in the Nasdaq 100, which dropped three percent on the day. However, believe it or not, less than half of the stocks in the index closed lower on the day, showing how mega-cap focused the whole “hiccup” was/is.

The mighty S&P 500 itself was down roughly one and a half percent on the day, but actually saw more than twice as many stocks rising (351) than falling (152), leaving the daily heatmap with plenty of green:

Papa Dow, aka the Dow Jones Industrial index, even closed up on the day!

Bond markets rallied due to the general risk-off move on the equity side. However, given how narrow the equity sell-off seems to be, I wonder if that rally has a lot of legs …

Here’s yesterday’s intraday movement of the US 10-year treasury yield, showing that indeed yields already bounced of loss (or bond prices dropped back from highs) in the second half of the (US) session:

The US Dollar has strengthened against most other major currencies over the past few hours, which is probably less due to “safe haven” buying, but rather increased sabre-rattling again from Trump, who vowed ‘Much Bigger’ tariffs ahead:

Gold sold off USD30 (=1%) yesterday, as price got rejected at last November’s all-time high:

Asian equities are having a mixed Tuesday, with the overall regional index lower, but some green prints out of Taiwan, Korea or India for example.

Western equity index futures are similarly mixed, but it seems like we could get a positive start to the European cash trading session.

Nvidia, giving its mega market cap, has produced some stunning one-day market cap drawdowns in the past, but yesterday dwarfed everything:

BUT…

in reality all that happened, on the chart at least, is that the stock is now trading at its 200-day moving average for a first time in a long time:

Stay tuned!