QuiCQ 28/02/2025

Snowballing

“"A single snowflake never feels responsible for the avalanche."

— Voltaire

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Nasty session yesterday, with US stocks accelerating on the downside into the closing bell. My friend, the Indomitable Paul Fraynt at Franklin Templeton, points out that CTA sell orders got triggered about two hours before market close, leading to further sales from systematic strategies.

Aaahh, that snowball effect …

In any case, the S&P 500 closed down 1.6%, right at the session lows:

For a first time this week, there were indeed more falling than advancing stocks, and only four sectors were able to print green on the day, leaving us with a sea of red:

The trained eye will immediately notice that the biggest stocks were amongst the biggest losers in yesterday session, confirming that snowballs get bigger on the way up but also on the way down …

Indeed, a >3% drop on the Magnificient 7 is a sign of where the sell-off is focused. Here’s the Mag 7 ETF (MAGS):

We have to draw a pretty think line to argue that the Mags are still holding on support…

Europe did not have a happy session either, but by falling “only” half a percent (SXXP), respectively one percent (SX5E) it managed to relatively outperform its US cousin yet another day.

The best thing to point out about yesterday’s session is probably that sentiment is hitting rock bottom levels. Here’s the weekly bull-bear ratio of retail investors via the AAII (American Association of Individual Investors):

And here’s CNN Greed and Fear indicator,

which is at its lowest level since last August’s Japanese scare:

All this sell-off in equities surely led to a bid on duration assets in the bond market, right?

Right! As the 10-year US treasury yield, now at 4.22 and close to its January lows demonstrates.

Remarkably, or not, have expectations for further Fed rate cuts increased from one to over two and a half in only two weeks:

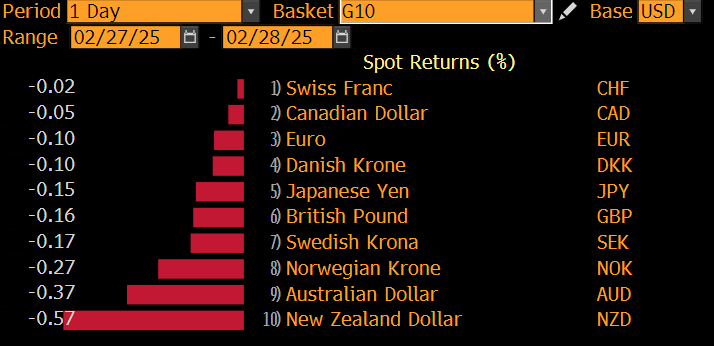

Another asset that finds a bid during risk-off moments if of course the US Dollar:

The greenback has been up against all other G10 currencies over the past 24 hours.

Our best call over the past two weeks has been for a lower Bitcoin:

Definitely don’t try to catch that falling knife (or snowball iceball) yet …

Our less good call has been for a tactical increase of Gold just over two weeks ago:Our

Our confidence on the call remains very elevated, unfortunately given the recent strong rise in the yellow metal, the price could fall all the way back to ~$2,800 before hitting a first important retracement (read: support) level.

That’s all for today - have a good day, and above all, have a great weekend!

We were probably bit harsh on our self-assessment regarding the tactically overweight gold call above.

After all, Gold is outperforming nearly everything, not least the stock market. As the chart below shows, the Gold (GLD) to S&P 500 (SPY) ratio is just breaking higher out of a multi-year base, and is probably good for a multi-month rally: