QuiCQ 28/03/2025

A Silver Lining

“Fridays are for closing positions and opening bottles.”

— The QuiCQ (new Friday sign-off leitmotif)

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

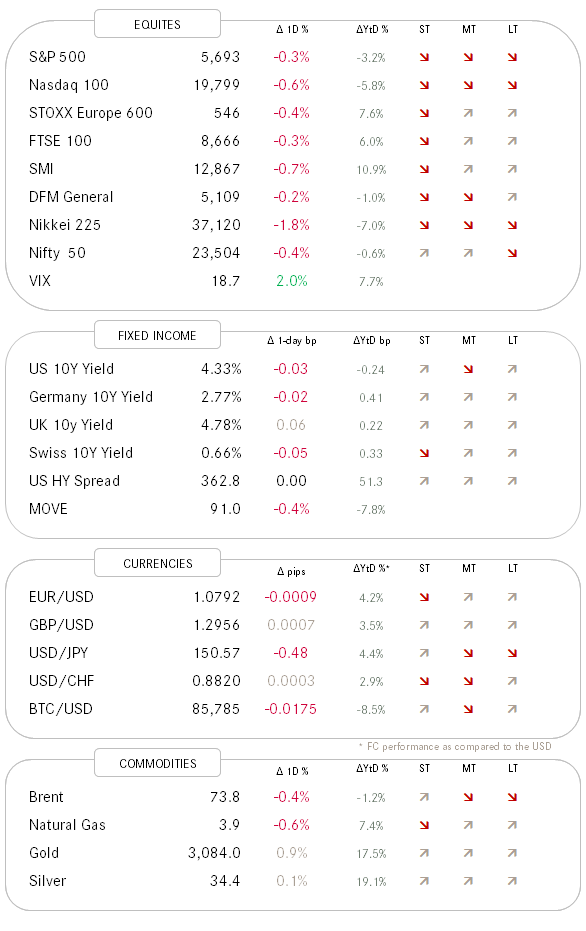

Choppy, non-directional session yesterday, with winning versus losing stocks only slightly tilted towards the latter.

Still, if this was it for the rally in stocks and a new low should emerge over the coming sessions, then that was quiet a weak recovery rally (<5%) in a bear market, indicating a high level of selling pressure in recoveries:

But not all hope is lost for the bulls, of course. Quiet “au contraire”, taking out 5,775 (upper dashed line) which is less than one and a half percent away from current levels, would make the whole picture much more constructive. On the other side, taking out the lower dashed line at around 5,520 would increase the odds for entering a bear market. Don’t we just love those set-ups?

Stand-out in yesterday’s session, apart from the pressure on automakers of course, was the weakness in Semiconductor stocks, with the SOX down 2%:

A breakdown below dashed would again be a bad sign to the overall market, given the economic sensitive of chipmaking stocks and the importance the sector has gained in portfolios “thanks” to AI.

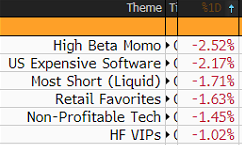

Accordingly, other speculative segments of the market underperformed yesterday too:

Still relative quietness in interest rate markets, with US (grey) and European (red) yields hardly changed in the past few hours, but both seeing their respective yield curves (10y-2y) steepening:

Tokyo inflation (CPI) exceeded expecations this morning,

keeping the BoJ on its rate hike path, nevertheless was the reaction of bond markets to push yields lower, which had probably a bit of “buy the rumour, sell the fact” involved.

The Japanese Yen however seems to react correctly to the higher inflation reading. Here’s the intraday chart versus the US Dollar, y-scale inverted:

And finally, there is, once again, Gold:

Our overweight instigated in February on the back of expecting a blow-off top is paying off handsomely. Stay exposed.

And with this, to our new Friday sign-off:

“Fridays are for closing positions and opening bottles.”

Have a great weekend!

Here’s another Quote of the Day for you - free of charge:

"Silver rewards you relatively infrequently, but when it rewards you, it rewards you dramatically."

- Rick Rule

It Rick’s rule above coming to fruition now?