QuiCQ 28/05/2025

Wall of Worry

"Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria."

— Sir John Templeton

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

So, what shall we argue?

a) that stocks (S&P 500) are up 19% since the early April panic lows?

b) or that they have gone nowhere over the past six or seven months?

Glass half full or half empty?

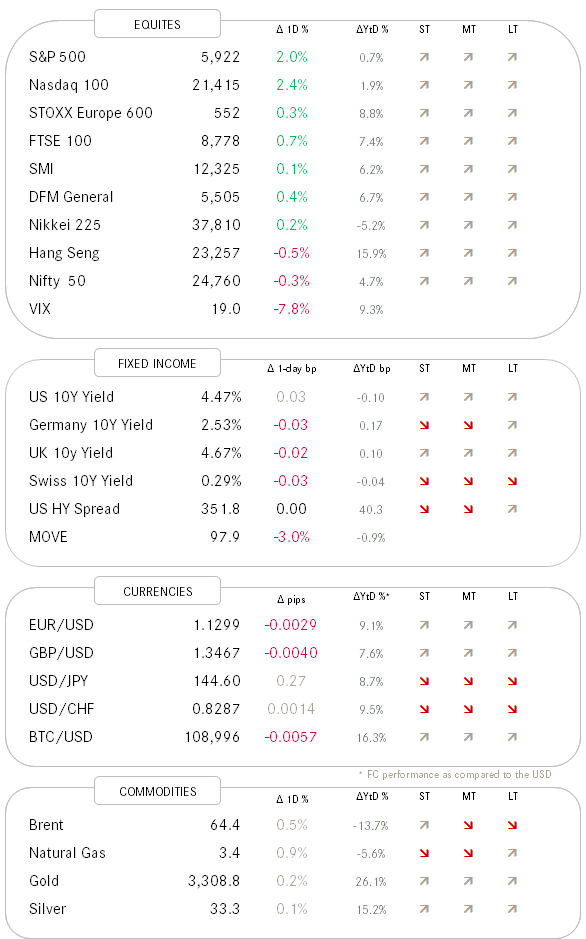

Anyway, onwards with yesterday’s session, which turned out to be quite the firework for stocks.

Not only were two of they most observed benchmark indices (S&P 500 and Nasdaq 100) up in excess of two percent, but participation in the rally was also very broad. Point in case, in the S&P 500 well over 90% (470) of the constituents ended the session higher leaving the market map seeming a sea of green:

Equally bullish was the sectorial picture, with all eleven economic sectors higher on the day and the more defensive ones (e.g. utilities, consumer staples, health care) lagging:

Even small cap stocks (Russell 2000) had their day in the sun and are quickly approaching major resistance (dashed line) again:

And all this positiveness obviously resulting from US President Trump’s “Little Britain” moment regarding taxes on the Eurozone:

Well, maybe a strong pick-up in consumer confidence - one of the strongest in recent history - also helped stocks in yesterday’s session:

However, not only stocks were bid yesterday, but so was duration (bonds) too, on the back of the Ministry of Finance (MoF) in Japan implicitly suggesting reduction in issuance of long dated bonds. This pushed the yield on the 40-year JGB down 26 basis points from Monday’s close to the intraday session low yesterday:

This led to a rally in global bonds (i.e. a yield sell-off), helping amongst others the TLT (iShares 20+ year Treasury Bond ETF) to recover from the support line we had discussed in this week’s Quotedian (click here):

However, some of the bond bullishness is being unwound this morning and again is Japan the culprit. A demand-wise very poor 40-year government bond auction pushed yield up 9 basis points to 3.375% and is exerting some upside pressure on global yields this early Wednesday.

Another asset group that is seeing upside pressure since the beginning of the year are Asian currencies, in what seems to be another hint to exodUS™

Looking at the Bloomberg Asia Dollar Index from a longer-term perspective then, we note that it is rapidly approaching what could be an important resistance point:

Today, we get the minutes from the last FOMC meeting, but probably more important, after-close earnings reports from HP, Salesforce and the almighty NVIDIA! The graph below shows the expected revenue from Chip sales by NVDA into Q4 of 2026:

Time's up, more tomorrow - May the trend be with you!

Here’s an intersting chart-of-the-day by macrocharts.com. It shows that ETF investors are selling into the current rally - This is a classic 'wall of worry' behaviour!

As per macrocharts.com: “If history is a guide, the market should grind higher over time, leaving sellers behind.”