QuiCQ 28/08/2024

"The secret of change is to focus all of your energy not on fighting the old, but on building the new."

- Socrates

Prefer to read today’s QuiCQ in PDF?

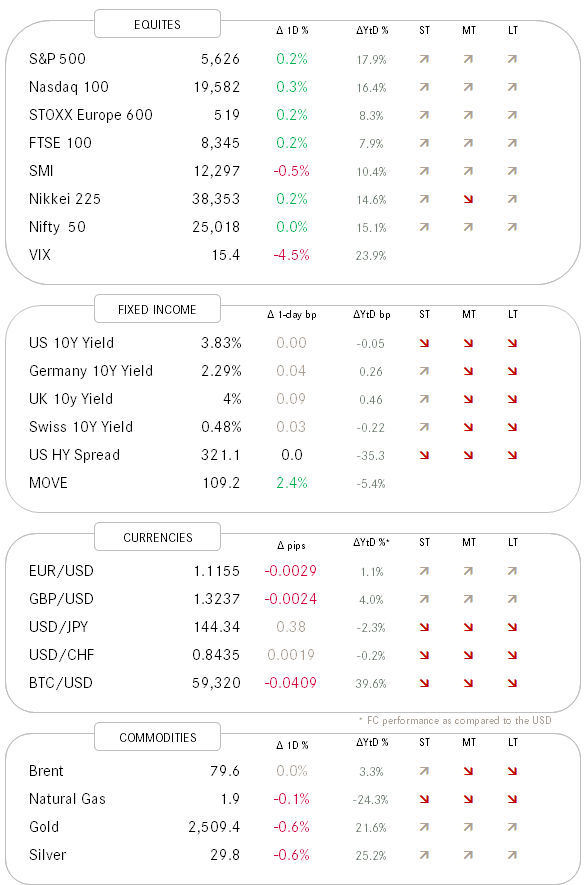

As equity indices section in ‘The Quotes’ table above would give away, yesterday was a pretty eventless session for European and US markets, as the whole world seems to be waiting for “The One Earnings Report to Rule Them All” (click here).

In the US, seven out of eleven sectors closed higher, with technology (+0.61%) leading and energy (-0.93%) lagging. On both sides of the Atlantic, new 52-week highs by far outpaced new 52-week lows, hinting to continued underlying strength. As yesterday’s QuiCQ (click here) showed, NVDA’s earnings and subsequent performance can indeed have a short-term impact on the overall market, but given the positive breadth observed it is difficult to imagine for a negative report to influence beyond a few sessions.

Asian equity markets are sputtering a bit this early Wednesday morning, with especially the wide Chinese equity complex suffering. Apparently that weakness comes on the back of disappointing earning results - all the better than that two of our portfolio companies (aka Focus List), Trip.com and PetroChina were both up strongly yesterday after their respective earnings update.

Nothing whatsoever to report back from the interest rate front, where the US 10-year Treasury yield seems to have fallen into slumber mode at 3.82%. The Bund (yield) is creeping a tad higher, but I would not expect much to happen in terms of yields on either side of the Atlantic until Friday’s release of CPI in Germany and PCE in the US.

The US Dollar (DXY) for now is holding above key support at 100.50 and could well continue to do so as short-term the Greenback is technically very oversold.

Interesting graph from the team at JPM Asset Management (via "The Daily Shot”), showing spending and source of financing allocation within the 2024 US Federal Budget.