QuiCQ 29/01/2025

Turnaround Tuesday

"It's OK to be wrong; it's unforgivable to stay wrong."

— Marty Zweig

Enjoying The QuiCQ but not yet signed up for The Quotedian? What are you waiting for?!!

Turnaround Tuesday lived up to its reputation, providing a decent recovery rally from Monday losses. The Nasdaq 100, one of the harder hit indices on Monday, recovered more than one and a half percent yesterday, and when looking at the futures version of the index, we note that the already two thirds of the slump have been recovered:

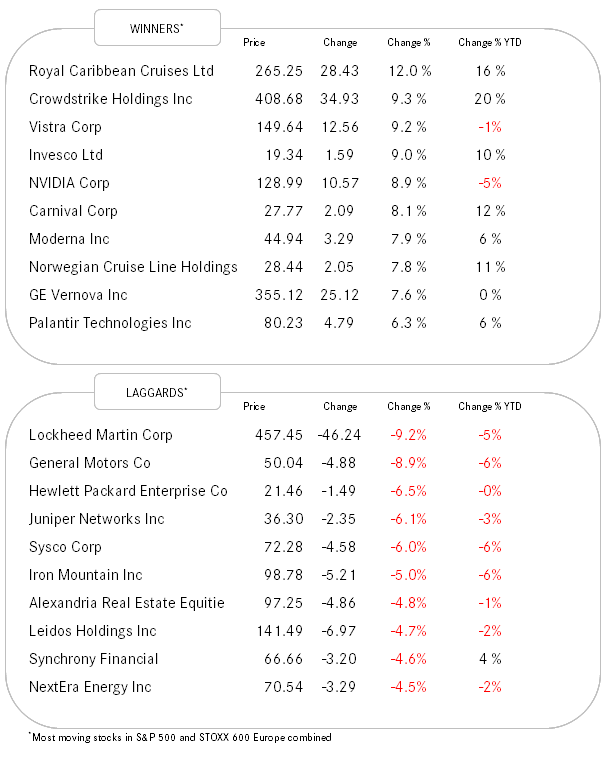

The almighty S&P 500 closed up just shy of one percentage point, but this time with inverted breadth figures (151 stocks up versus 349 down). Only three out of eleven sectors closed in the green, in a sign that yesterday’s rally was indeed focused on the rebound of Monday’s losers:

Nothing specific to write home about on the (bond) yield front of matters, where the US 10-year Treasury bonds saw a small advance, pushing yields on the Tens from 4.57 to 4.52%, where they still hover now.

But if you are looking for THE definition of eerie quietness, look no further than the currency market, where nothing has been moving in meaningful fashion over the past few hours.

The quiet before the storm?

Asian equity markets are tending to the friendly side (if you are not a short seller that is) this morning, with decent one percent advances in Japan, Korea and Taiwan, whilst China Mainland and Hong Kong are printing a small red. European equity futures hint to a very decent start to today’s session.

And talking of storm a moment ago, some mega cap names (TSLA, MSFT, META) are reporting today amongst many others - most of them after market close. Couple that with the Fed announcing their key policy rate decision (none) and the ensuing press conference (aka presser) by Jerome Powell, it may well be that ‘Wild Wednesday’ follows ‘Turnaround Tuesday’.

The Fed ends its two day FOMC meeting today with no rate cut (or hike!) announcement expect. Even though the presser could be the start to a High Noon-like showdown between Mr Powell and Mr Trump.

The chart below shows the markets expectation of rate cuts into year-end for the Fed (grey) and by October for the ECB (red).

The ECB is expected to cut twice as much as the Fed, i.e. four times versus only twice, which of course would further increase the rate differential. Stay tuned …